hist78

Well-known member

I'm honestly curious. What do you think the process to make this feasible looks like?

I’d like to hear what @MKWVentures thinks since he was there.

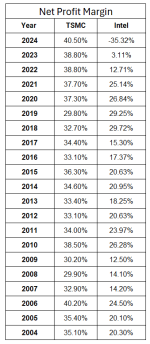

From my perspective as an outsider, I believe Intel could have implemented many cost cutting and productivity improvement initiatives long ago, similar to the measures Lip-Bu Tan is executing today. As an IDM, Intel should, in theory, enjoy a higher net profit margin than a pure play foundry like TSMC, because Intel can capture the added value from the final products. However, Intel’s overall costs have remained very high for a long time, especially compared with TSMC. This was true even when TSMC wasn't as dominant as it is today.

TSMC vs. Intel annual net profit margins (2004–2024)