- The US government has signed a nonbinding letter of intent to invest up to $150 million in a chip startup.

- xLight is chaired by Pat Gelsinger, who ran Intel until his resignation late last year.

- The deal signals Washington's effort to regain leadership in chipmaking.

- The US government is poised to become a shareholder in a semiconductor startup chaired by Pat Gelsinger, who ran Intel until his resignation last year.

The Commerce Department said on Monday that the Trump administration signed a nonbinding letter of intent to invest up to $150 million in xLight, a startup trying to build a more advanced and cost-effective way to manufacture chips.

The investment would come from the CHIPS and Science Act and would be structured as equity, giving the federal government direct ownership in the company.

Pat Gelsinger

The deal — a first from the Trump administration's CHIPS Research and Development Office — signals Washington's effort to regain leadership in chipmaking. Most advanced semiconductors are manufactured outside the US, led by TSMC in Taiwan and Samsung in South Korea — areas where China's influence looms large.

Intel warned in July that it may halt development of its next-generation chip, 14A, due to financial reasons. If Intel gives up on 14A, this could be a death blow to US chip manufacturing, Business Insider's Alistair Barr wrote in a July report.

"For far too long, America ceded the frontier of advanced lithography to others. Under President Trump, those days are over," said Commerce Secretary Howard Lutnick in Monday's press release.

"This partnership would back a technology that can fundamentally rewrite the limits of chipmaking. Best of all, we would be doing it here at home," Lutnick added.

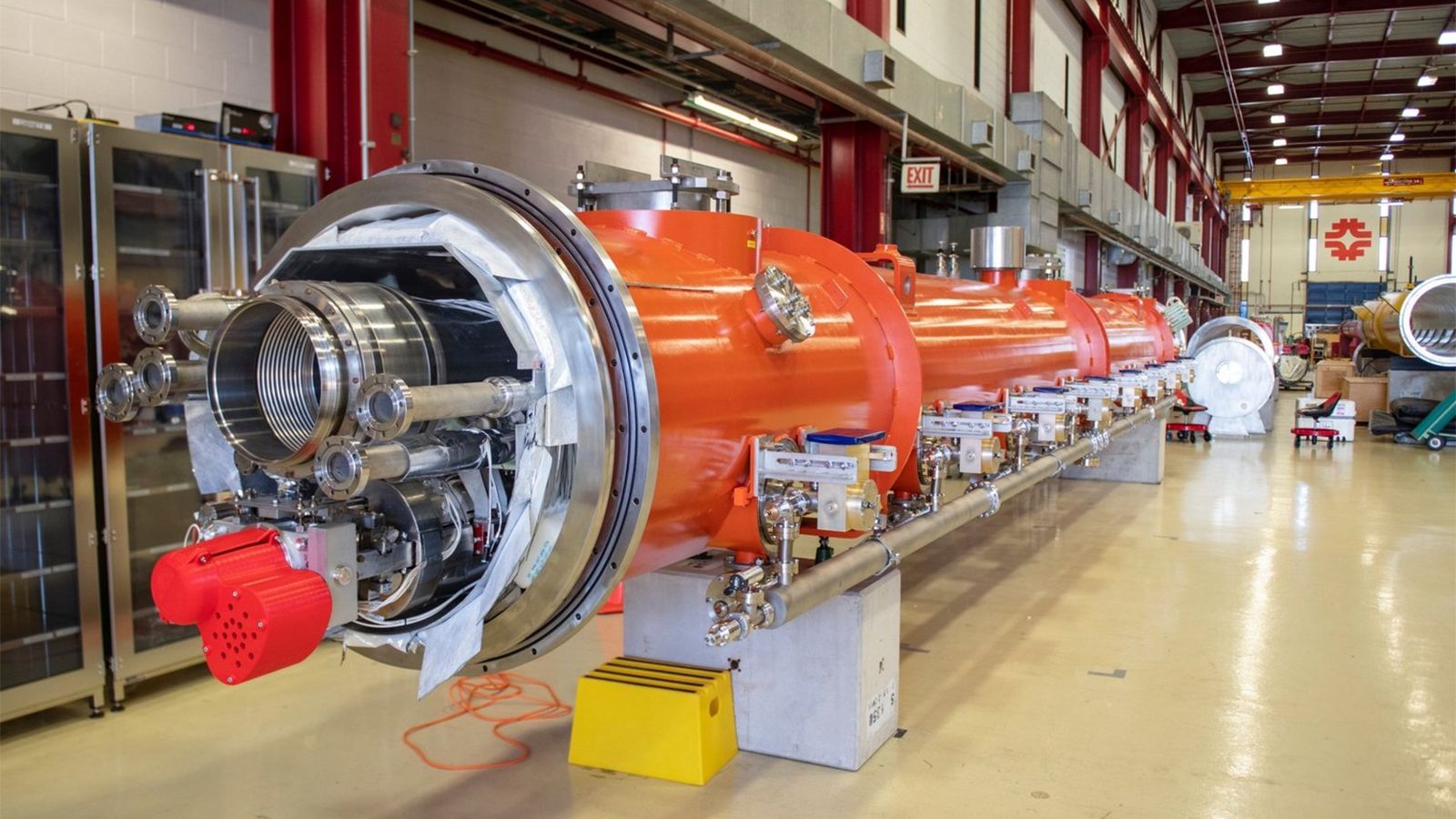

The Palo Alto-based startup, founded in 2021, is developing free-electron laser technology, "an alternative light source" for extreme ultraviolet (EUV) lithography machines that power cutting-edge chip production, the press release said.

xLight said on its website that its systems would enhance Dutch firm ASML's machines, "the undisputed global leader in EUV lithography systems." EUV systems are only produced by ASML. xLight's technology will "transform semiconductor fab capabilities and dramatically reduce capital and operating expenses," it added.

Pat Gelsinger, who was pushed out as Intel CEO late last year after the company struggled with weak earnings and fell behind in the AI chip race, became xLight's executive chairman in March. He is also a general partner at Playground Global, the venture firm that led xLight's $40 million Series B round in July.

Gelsinger, who was CEO of Intel from 2021 to 2024, said in an interview with CNBC's "Squawk Box" in October that Intel "made a set of bad decisions over 15 years" and that technical leadership wasn't "led by technologists for many years."

"We were late on AI as well," he added.

Gelsinger spent decades rising through the ranks at Intel and became one of the most influential voices behind the 2022 CHIPS Act, a landmark manufacturing legislation that reshaped America's chip strategy.

xLight has the potential to "drive the next era of Moore's Law, accelerating fab productivity, while developing a critical domestic capability," said Gelsinger in a Monday press release.

Read the original article on Business Insider

- xLight is chaired by Pat Gelsinger, who ran Intel until his resignation late last year.

- The deal signals Washington's effort to regain leadership in chipmaking.

- The US government is poised to become a shareholder in a semiconductor startup chaired by Pat Gelsinger, who ran Intel until his resignation last year.

The Commerce Department said on Monday that the Trump administration signed a nonbinding letter of intent to invest up to $150 million in xLight, a startup trying to build a more advanced and cost-effective way to manufacture chips.

The investment would come from the CHIPS and Science Act and would be structured as equity, giving the federal government direct ownership in the company.

Pat Gelsinger

The deal — a first from the Trump administration's CHIPS Research and Development Office — signals Washington's effort to regain leadership in chipmaking. Most advanced semiconductors are manufactured outside the US, led by TSMC in Taiwan and Samsung in South Korea — areas where China's influence looms large.

Intel warned in July that it may halt development of its next-generation chip, 14A, due to financial reasons. If Intel gives up on 14A, this could be a death blow to US chip manufacturing, Business Insider's Alistair Barr wrote in a July report.

"For far too long, America ceded the frontier of advanced lithography to others. Under President Trump, those days are over," said Commerce Secretary Howard Lutnick in Monday's press release.

"This partnership would back a technology that can fundamentally rewrite the limits of chipmaking. Best of all, we would be doing it here at home," Lutnick added.

The Palo Alto-based startup, founded in 2021, is developing free-electron laser technology, "an alternative light source" for extreme ultraviolet (EUV) lithography machines that power cutting-edge chip production, the press release said.

xLight said on its website that its systems would enhance Dutch firm ASML's machines, "the undisputed global leader in EUV lithography systems." EUV systems are only produced by ASML. xLight's technology will "transform semiconductor fab capabilities and dramatically reduce capital and operating expenses," it added.

Pat Gelsinger, who was pushed out as Intel CEO late last year after the company struggled with weak earnings and fell behind in the AI chip race, became xLight's executive chairman in March. He is also a general partner at Playground Global, the venture firm that led xLight's $40 million Series B round in July.

Gelsinger, who was CEO of Intel from 2021 to 2024, said in an interview with CNBC's "Squawk Box" in October that Intel "made a set of bad decisions over 15 years" and that technical leadership wasn't "led by technologists for many years."

"We were late on AI as well," he added.

Gelsinger spent decades rising through the ranks at Intel and became one of the most influential voices behind the 2022 CHIPS Act, a landmark manufacturing legislation that reshaped America's chip strategy.

xLight has the potential to "drive the next era of Moore's Law, accelerating fab productivity, while developing a critical domestic capability," said Gelsinger in a Monday press release.

Read the original article on Business Insider