Artificer60

Well-known member

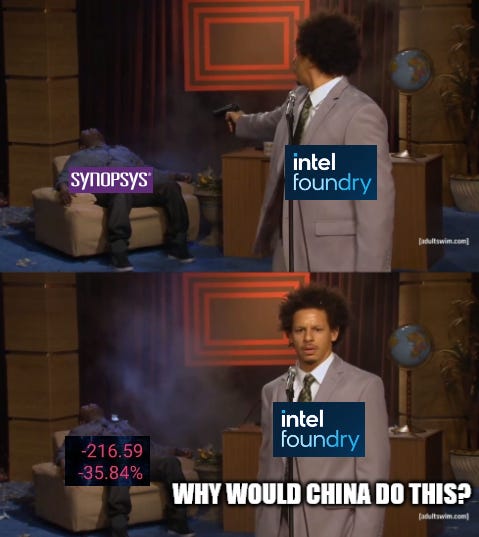

There are two reasons that yields can be rubbish. First is that your process development was a failure and you never get it off the ground. I believe this is the issue with Samsung's recent processes. Second is that you are having too many issues getting your performance to hit the desired targets and you have to keep revising the process. Each process rev results in a yield hit with the result that your yields keep dropping and your process yields don't ramp up quickly. I believe this is Intel's issue.But they did come, although they also left... The issue was, at least if we are to believe Zinsner, that 18A yields were simply rubbish and the process was not ready.

When Intel was strictly operating as an IDM they could get away with ramping yield late because they could just jam the line full of product, live with the yield hit, and still get by. Intel could make this work by just starting lots to hit and maintain an inventory level. It doesn't matter which lot gets out of the fab, you just scrap a bad lot and expedite a good lot to fill the gap. As a foundry they are going to have to build to order rather than to maintain inventory levels. This means they can't afford to have lots being scrapped because they aren't going to necessarily have more lots in line for that product that they can expedite. So early yield is more important as a foundry than it was under the IDM model.

Not sure if I've explained that well. If not I'm happy to try and clarify.