user nl

Well-known member

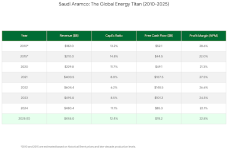

It is so easy these days to have AI make some historic financial overview of business performances. Below is a table generated by Google's Gemini

summarizing some key numbers for TSMC and INTEL, and it is really amazing when you compare these numbers.

It will be interesting to see what will happen when during the next 3 years 2026-2028 TSMC will "flood" the semi-system with some >150 B$ in capex and how their Fabs/nodes (2, 3, 5, 7 etc) will become (and are already) enormous cash printing machines.

TSMC may spend more in Capex in 2026 than the total (expected) revenue of INTEL this year.

Of course, INTEL and SAMSUNG will pump some overflow "made-in-USA-oil" orders from customers because of the lack of capacity at TSMC. But once that wafer and advanced packing capacity of TSMC is "on the market" around 2029, it is hard to see how INTEL Foundry will be an economical competitor to TSMC.

If we assume a (conservative) CAGR of 25% during 2026-2029 the expected revenue of TSMC will be 300 B$ and if they keep their net profit margin of 45-50% they will generate a net profit of some 150 B$ in a single year.

TSMC will be a one-member "OPEC" for the best (performance/watt) oil of the 21st century. Amazing story.........

summarizing some key numbers for TSMC and INTEL, and it is really amazing when you compare these numbers.

It will be interesting to see what will happen when during the next 3 years 2026-2028 TSMC will "flood" the semi-system with some >150 B$ in capex and how their Fabs/nodes (2, 3, 5, 7 etc) will become (and are already) enormous cash printing machines.

TSMC may spend more in Capex in 2026 than the total (expected) revenue of INTEL this year.

Of course, INTEL and SAMSUNG will pump some overflow "made-in-USA-oil" orders from customers because of the lack of capacity at TSMC. But once that wafer and advanced packing capacity of TSMC is "on the market" around 2029, it is hard to see how INTEL Foundry will be an economical competitor to TSMC.

If we assume a (conservative) CAGR of 25% during 2026-2029 the expected revenue of TSMC will be 300 B$ and if they keep their net profit margin of 45-50% they will generate a net profit of some 150 B$ in a single year.

TSMC will be a one-member "OPEC" for the best (performance/watt) oil of the 21st century. Amazing story.........