Liang-rong Chen

Tech TaiwanNov 13, 2025

The AI prophet gets nervous.

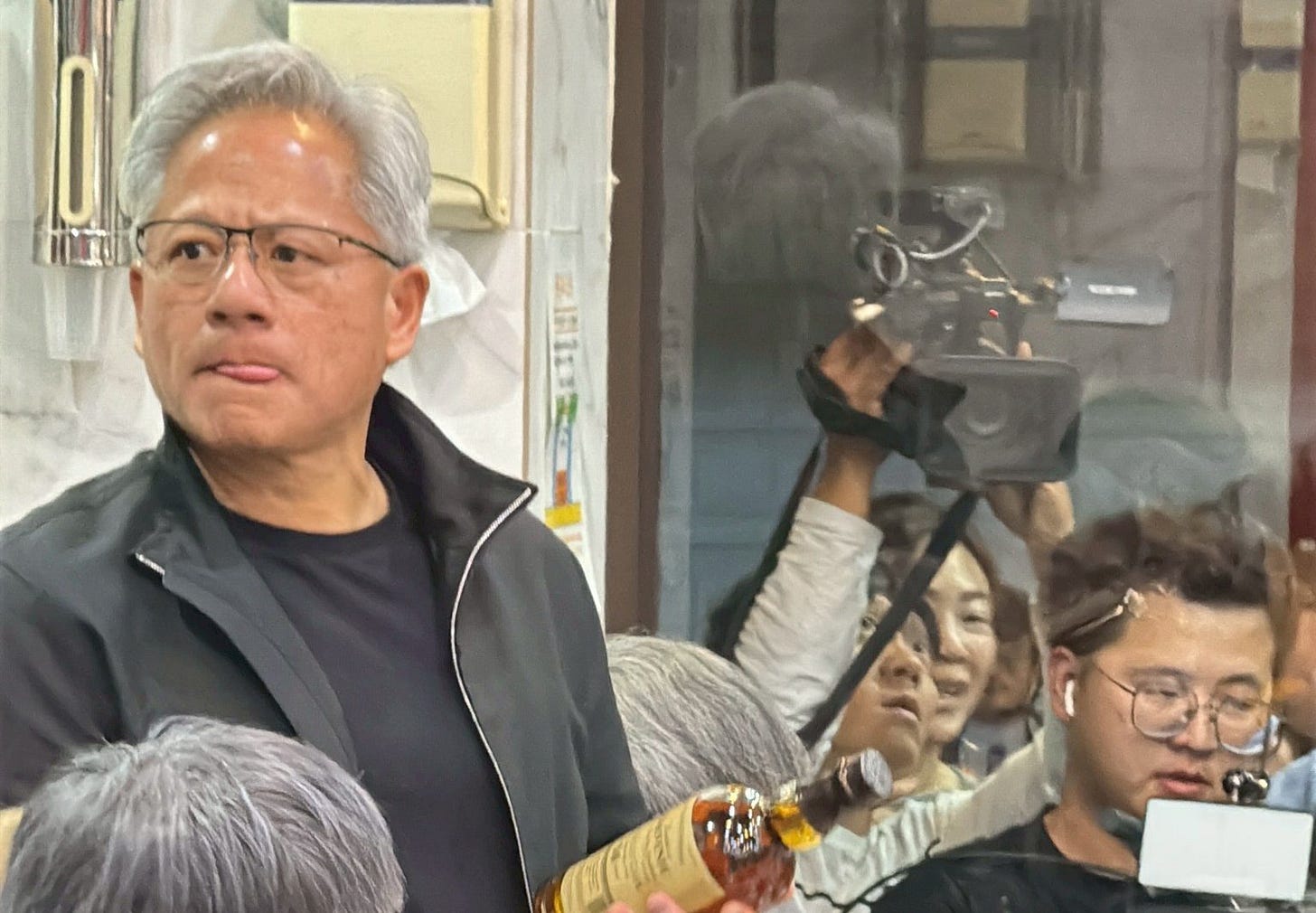

Here’s what I observed after sitting just a few meters away from Jensen Huang and TSMC executives during their two-hour dinner: the so-called AI Prophet isn’t just hyper-energetic in front of the media — he’s exactly the same in private.

At 6 p.m. on November 7, in a fresh beef hot-pot restaurant about a ten-minute drive from the Southern Taiwan Science Park, a long table for ten on the first floor was already set with food and drinks.

Moments later, Nvidia founder Jensen Huang and TSMC CEO C.C. Wei entered with a group of senior TSMC executives. Glancing around the room, Huang burst out in Taiwanese as soon as he walked in: “Eh sái lim tsiú-bué? (Can we start drinking yet?)”

Not long after, he turned to Wei and called out, “C.C., I need something to drink right away!”

Moments later, the CEO of the world’s most valuable company was happily holding a bottle of Taiwan Beer, toasting and clinking glasses with Wei; co-COO Y.P. Chyn (秦永沛); deputy co-COO Kevin Zhang (張曉強); and Nvidia EVP of Operations Debora Shoquist. His easy gestures and smooth rhythm made him seem anything but a foreigner.

The story began a little after 2 p.m. on November 7, when I got a tip: Jensen Huang, who had just finished touring TSMC’s 3-nanometer fab in the Southern Taiwan Science Park, was heading to Liu Jia Zhuang Beef Hot Pot (劉家莊牛肉爐) in Yongkang (永康).

I jumped on the high-speed rail immediately. By the time I arrived by taxi, night had fallen — and a crowd of excited TSMC engineers from the Tainan fab had already gathered at the entrance, waiting for the AI Prophet to arrive.

What followed was a scene that later went viral on television and social media: the CEO of the world’s most valuable company sitting by a large glass window on the first floor while reporters and onlookers crowded outside, watching him dine as if peering into an aquarium. Huang even waved at them occasionally.

Insiders later said TSMC had originally booked a private room upstairs, but Huang — insisting on being “down to earth” — asked to move to the front.

It echoed his dinner a week earlier in Seoul with Samsung chairman Jay Y. Lee and Hyundai chairman Chung Mong-Koo, held in a glass-walled fried-chicken restaurant that drew massive public attention.

The most memorable moment came near the end of the meal, around 8 p.m. After several rounds of drinks, Wei and other executives stood up — they had to catch the high-speed rail back to Hsinchu for TSMC’s sports day the next morning.

I assumed Huang would leave as well, but instead he sat back down and resumed eating, as if he had only stood up to see his hosts off. Imagine Tim Cook or Elon Musk being left at a table while their hosts rushed off to catch a train — that’s hard to picture.

The scene showed how deep the relationship between Nvidia and TSMC has grown. There was no need for formality — Wei could leave, and Huang didn’t take offense. His words the next morning at TSMC’s sports day — “TSMC is my family” — weren’t empty rhetoric.

Among the few TSMC executives who stayed was Ying-Lang Wang (王英郎), who had recently stepped down as CEO of TSMC Arizona. He handed Huang a plate with a large zongzi — a famous Tainan snack, the signature eight-treasure zongzi (八寶粽) from Zai Fa Hao (再發號肉粽). Huang ate it with great relish, quickly devouring most of it — clearly famished.

I can testify firsthand: Huang barely touched the fresh beef hot pot, too busy signing autographs for TSMC managers from the Southern Taiwan Science Park fab — using a marker to sign the liquor bottles each of them had brought along.

Y.P. Chyn, the senior vice president overseeing manufacturing operations, stood beside him handing bottles to Huang one by one and explaining each recipient’s English name and role.

When a young manager introduced himself as working on “CoWoS,” Huang lit up, praising his work and chatting with him in detail.

“Jensen really knows how to connect with people,” a former TSMC executive told me later. “He expresses genuine appreciation to factory managers, making them want to go the extra mile for him.”

Given the current capacity crunch, Huang’s trip to Tainan was more than symbolic — it was a statement of sincerity.

How Tight Is Capacity? TSMC’s Tainan Fab Turns to Taichung for Backup

Despite the 2-nanometer fab in Kaohsiung entering production, TSMC’s most in-demand node remains its 3-nanometer process in Tainan.According to multiple sources, the shortage has become so severe that wafers partially processed in Tainan are being transported to the Central Taiwan Science Park’s 7-nanometer lines for intermediate steps — then brought back to Southern Taiwan for completion, all under ultra-clean transport conditions.

Nvidia’s next-generation AI chip, Rubin — the successor to Blackwell — will use this very 3-nanometer process and is expected to launch in 2025. With a six- to seven-month manufacturing cycle, wafer starts are likely already underway in Southern Taiwan.

No wonder that when reporters asked about the purpose of his Taiwan trip the next day, C.C. Wei jumped in to answer for him: “He asks for wafers.” Huang laughed and added, “Demand is very strong.”

A Sudden Surge in Demand — Even TSMC Didn’t See It Coming

What’s coming could be the biggest capacity expansion wave in a decade.In recent earnings calls, every major U.S. cloud player — Microsoft, Google, AWS, and Meta — announced they were running out of compute power and raising capex for 2024. Google even said next year’s investment will be “much higher.”

Add to that OpenAI’s recent long-term “perpetual-motion” contracts with Nvidia and AMD, pledging over $1.4 trillion in AI infrastructure spending by 2030 to build roughly 30 gigawatts of compute capacity.

Anthropic, the largest U.S. commercial AI startup after OpenAI, followed suit, announcing a $500 billion data-center plan on November 12, set to begin operations in 2026.

He had surveyed TSMC’s capacity plans in September and October and found no sign of this surge. Because TSMC traditionally expands cautiously, supply for advanced nodes will inevitably lag demand.“This wave came too fast — it caught TSMC off guard,” one foreign analyst told me.

“Building a new fab takes a decade. Who knows how long this boom will really last?” he said, summing up TSMC’s mindset. Meanwhile, the man who once declared that “Moore’s Law is dead” has changed his tune.

Why Jensen Huang Suddenly Rushed to the Front — and Chose TSMC’s Priciest Process

Historically, Nvidia’s flagship chips have used nodes one or two generations behind the most advanced process — Blackwell, for example, uses 4 nanometers, one generation behind AMD’s equivalent product.That strategy now seems to be shifting. Analysts say Nvidia will be the first customer for TSMC’s upcoming A16 process, a 2-nanometer derivative featuring the much-hyped backside power delivery technology — expected to deliver a full generational leap in performance.

Why is Nvidia suddenly racing to be first again? The official explanation is TSMC’s own: its new backside power delivery technology is said to be the most suitable for high-performance computing — essentially, for AI.

But industry insiders see it differently. “Jensen’s getting nervous,” one analyst said. The clearest sign? AMD’s growing threat.

In its latest earnings call, AMD CEO Lisa Su (蘇姿丰) made a bold forecast — expecting the company’s AI server business to grow 80 percent annually over the next three to five years. AMD’s shares jumped 9 percent after the announcement.

Her confidence stems largely from a 6-GW AI chip supply agreement signed last month with OpenAI.

“It means someone’s finally buying AMD’s stuff,” the analyst said. “Even though the MI300 series is on par with Nvidia in hardware specs, CUDA’s software ecosystem kept everyone locked in. Now, with OpenAI and others eager for a second supplier, AMD has an opening.”

The Hidden Signals in CoWoS Capacity

Morgan Stanley recently raised its forecast for AMD’s CoWoS (Chip-on-Wafer-on-Substrate) packaging capacity at TSMC for 2026 — from 60,000 to 115,000 12-inch wafers per month.Both AMD and Google are expected to move into 2 nanometers next. “That’s why Nvidia’s going for A16 — to leapfrog on process leadership,” another analyst said.Broadcom’s allocation grew even more dramatically — from 85,000 to 210,000 wafers — reflecting Google TPU’s expected explosion in 2026.

Another sign of the AI Prophet’s anxiety is that Jensen Huang has begun flexing his financial muscle — the kind that comes with running the world’s most valuable company.

He’s reportedly asking TSMC to lock in capacity far beyond Nvidia’s actual needs, effectively booking up production lines to starve his rivals of supply. After all, Nvidia sits on a massive cash pile — $56.79 billion including marketable securities.

Multiple industry sources also told me Huang tried the same tactic with substrate suppliers — the companies controlling key CoWoS materials — but, as one source added, “none of them said yes.”

Why Is Jensen Huang Getting Nervous About TSMC’s 3nm Shortage?

Liang-rong Chen

Last edited: