Original article in Tradition Chinese:

money.udn.com

money.udn.com

Machine translation:

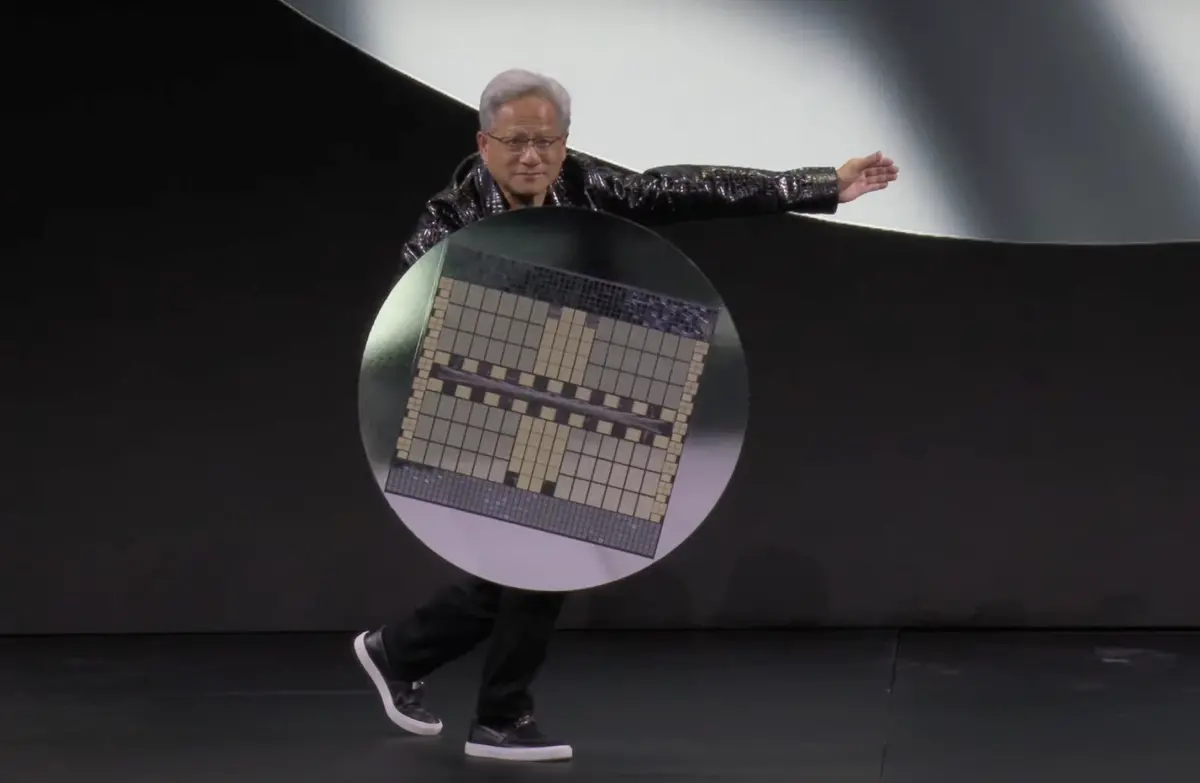

Recently, rumors circulated that NVIDIA had reduced its orders for TSMC's CoWoS (Chip-on-Wafer-on-Substrate) technology. However, related supply chain sources previously denied the claims, stating they had "heard nothing about it." Now, Nomura Securities has issued a fresh report naming NVIDIA as a key player in the slowdown of demand for several products. According to the report, NVIDIA is set to slash CoWoS-S orders at TSMC (2330) and UMC (2303) by as much as 80%, which is expected to reduce TSMC's revenue by 1% to 2%.

Nomura's semiconductor industry analyst, Ming-Tsung Cheng, pointed out that the discontinuation of NVIDIA's Hopper platform chips, limited demand for the new GB200A chips, and sluggish demand for GB300A are the primary reasons for the significant reduction in CoWoS-S orders for 2025. The projected annual decrease of 50,000 CoWoS-S units is anticipated to cut TSMC's revenue by 1% to 2%.

However, Cheng emphasized that despite the substantial reduction in CoWoS-S orders, AI demand is expected to drive TSMC's revenue growth this year. AI-related revenue contributions are projected to exceed 20% of the company's total revenue. As a result, Cheng maintained a "Buy" rating for TSMC, with a target price of NT$1,400.

Regarding revenue forecasts for the current quarter, Cheng predicts a 6% quarter-on-quarter decline but a 24% year-on-year increase. The quarterly decline is primarily attributed to seasonal factors. However, the impact of seasonality is mitigated by increased production capacity for AI GPUs and ASICs, as well as the launch of Apple's latest budget iPhone SE 4.

The annual growth forecast of 24% is slightly lower than Bloomberg's 27% projection. This difference is attributed to TSMC's stronger-than-expected revenue performance in Q4 of last year, coupled with potential negative impacts from new U.S. AI export regulations. These regulations may restrict GPU procurement in certain countries and could lead to a decline in CoWoS-S orders.

Outside of AI-related products, while the pace of economic recovery remains slow, the supply chain has adopted a cautious approach, limiting downward adjustments in non-AI demand.

台積電CoWoS砍單傳言再起 | 科技產業 | 產業 | 經濟日報

日前傳出輝達砍單台積電CoWoS消息,相關供應鏈直言:「沒聽說」的談話還言猶在耳,野村證券立馬又發出最新報告點名輝達因多...

Machine translation:

Recently, rumors circulated that NVIDIA had reduced its orders for TSMC's CoWoS (Chip-on-Wafer-on-Substrate) technology. However, related supply chain sources previously denied the claims, stating they had "heard nothing about it." Now, Nomura Securities has issued a fresh report naming NVIDIA as a key player in the slowdown of demand for several products. According to the report, NVIDIA is set to slash CoWoS-S orders at TSMC (2330) and UMC (2303) by as much as 80%, which is expected to reduce TSMC's revenue by 1% to 2%.

Nomura's semiconductor industry analyst, Ming-Tsung Cheng, pointed out that the discontinuation of NVIDIA's Hopper platform chips, limited demand for the new GB200A chips, and sluggish demand for GB300A are the primary reasons for the significant reduction in CoWoS-S orders for 2025. The projected annual decrease of 50,000 CoWoS-S units is anticipated to cut TSMC's revenue by 1% to 2%.

However, Cheng emphasized that despite the substantial reduction in CoWoS-S orders, AI demand is expected to drive TSMC's revenue growth this year. AI-related revenue contributions are projected to exceed 20% of the company's total revenue. As a result, Cheng maintained a "Buy" rating for TSMC, with a target price of NT$1,400.

Regarding revenue forecasts for the current quarter, Cheng predicts a 6% quarter-on-quarter decline but a 24% year-on-year increase. The quarterly decline is primarily attributed to seasonal factors. However, the impact of seasonality is mitigated by increased production capacity for AI GPUs and ASICs, as well as the launch of Apple's latest budget iPhone SE 4.

The annual growth forecast of 24% is slightly lower than Bloomberg's 27% projection. This difference is attributed to TSMC's stronger-than-expected revenue performance in Q4 of last year, coupled with potential negative impacts from new U.S. AI export regulations. These regulations may restrict GPU procurement in certain countries and could lead to a decline in CoWoS-S orders.

Outside of AI-related products, while the pace of economic recovery remains slow, the supply chain has adopted a cautious approach, limiting downward adjustments in non-AI demand.