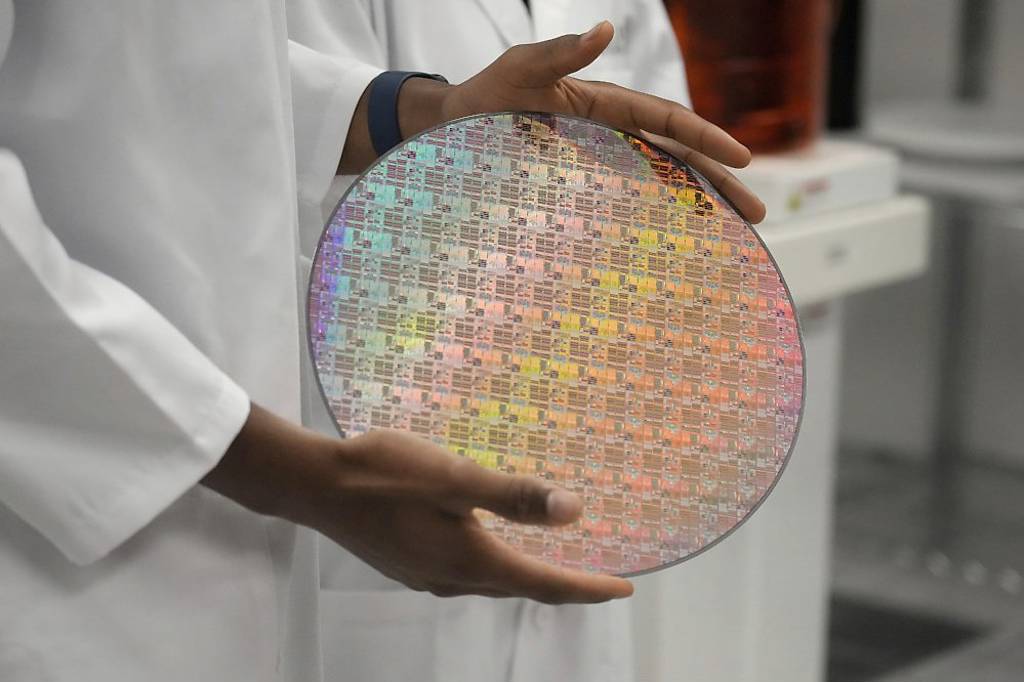

US President Trump has announced that he may impose chip tariffs starting February 18. TSMC's advanced process quotation increase in 2025 may be raised from the originally estimated 5% to 10% to more than 15%. Photo/Associated Press

US President Trump has announced that he may impose chip tariffs starting February 18. TSMC's advanced process quotation increase in 2025 may be raised from the originally estimated 5% to 10% to more than 15%. Photo/Associated PressThe US chip tariffs are about to be imposed. Legal persons pointed out that "Made in the USA" semiconductors are the general trend. TSMC is facing rising chip tariffs and production costs. The price increase of advanced process quotations in 2025 may be raised from the originally estimated 5% to 10% to more than 15%.

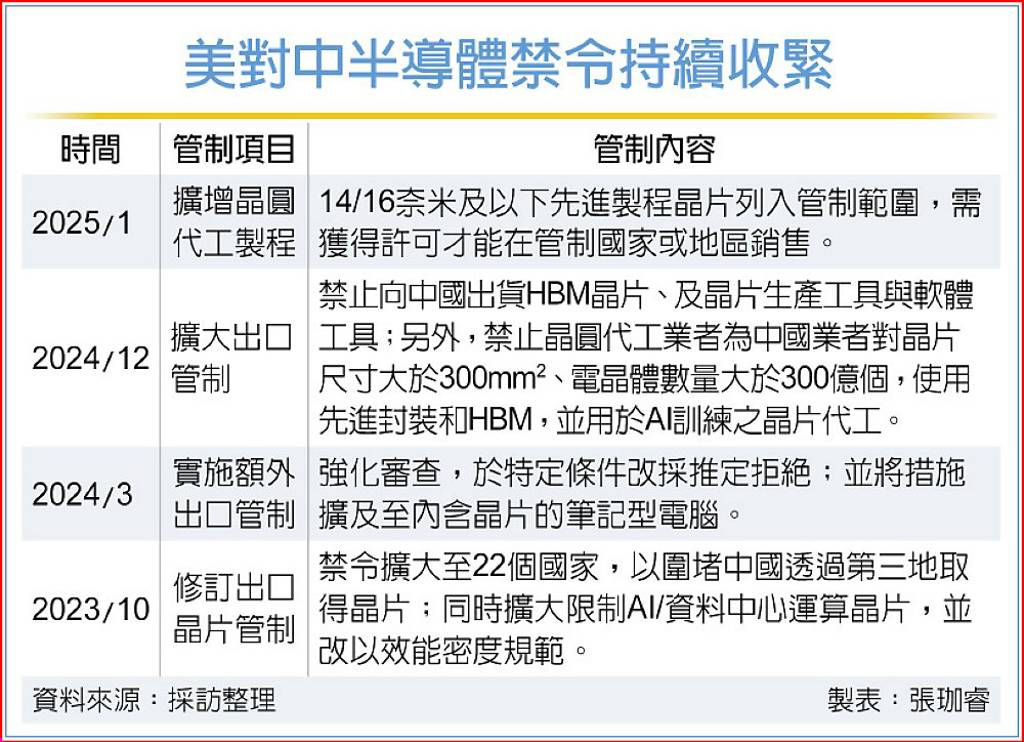

The United States has taken another step to block China from obtaining advanced chips, imposing the "license" from the U.S. Department of Commerce. All advanced process chips below 14 to 16 nanometers must obtain authorization, and the chip ban will become increasingly tight in the future. In addition, US President Trump predicted that "we will eventually impose tariffs on chips" and that chip tariffs may be imposed starting February 18.

TSMC has its roots in Taiwan, but with globalization dead in the background, the pressure to set up factories in the United States has increased greatly. Semiconductor industry insiders pointed out that Trump's tough stance on chip policy will make local manufacturing a trend. Coupled with the 10% to 25% tariffs imposed by the United States on Canada, Mexico and China, it is equivalent to the collapse of the USMCA (United States-Mexico-Canada Agreement), and supply chain companies are forced to adjust their global layout.

US continues to tighten ban on Chinese semiconductors

US continues to tighten ban on Chinese semiconductorsIt is reported that the US government is drafting a new chip ban, and the scope of control continues to expand; currently, advanced process chips below 14 to 16 nanometers sold to China have been included in the control scope and require an export license.

Trump has threatened to impose tariffs on chips. Analysts believe that the impact on foundry manufacturers will be small and can be passed on to customers. As for setting up factories in the United States without subsidies, it will have an impact on profit levels. Supply chain calculations show that without subsidies, the profit level of the Arizona factory in the United States is estimated to be only 70% of that of the Taiwan factory, which will lower the overall gross profit margin.

Legal persons pointed out that due to the impact of Trump's 2.0 tariff policy, it is estimated that TSMC's advanced process prices below 7 nanometers will be increased by more than 15% to mitigate the impact of cost increases. Technology determines everything in the semiconductor industry. Customers must purchase the most advanced chips to maintain their market share, otherwise they will lose the market.

Semiconductor industry insiders said that TSMC, the leading foundry company, has the ability to pass on prices due to its technological leadership, and coupled with the rapid development of advanced processes, it is reported that it is already looking for sites for 1nm. TSMC said on the 3rd that there are many considerations in choosing a location for a factory, and it will continue to cooperate with the competent authorities to evaluate suitable land for factory construction and will not rule out any possibilities.

However, Trump's 2.0 tariff strategy has a great impact. If the terminal price increase is successful, it will cause price inflation. If it is unsuccessful, it will bring another serious impact on the already weak consumer market. Legal persons believe that Trump's tariffs are still a negotiating tool, but each industry must still prepare relevant measures to cope with the rapidly changing political and economic environment.