Increased sales of equipment for HBM and advanced packaging

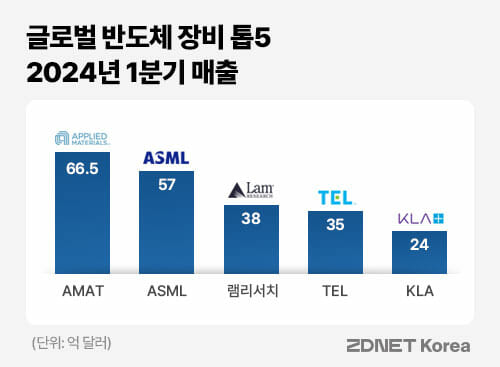

It was found that the sales of the top five global semiconductor equipment companies in the first quarter of this year were increasingly directed toward AI semiconductors and the proportion of China increased.

The top five companies in global semiconductor equipment sales are Applied Materials (AMAT), ASML of the Netherlands, Lam Research of the United States, Tokyo Electron (TEL) of Japan, and KAL of the United States.

Market research firm Trend Force diagnosed, “The first quarter performance of the top five semiconductor equipment companies was focused on investment in cutting-edge processes to respond to the continued increase in demand for AI and HBM (high bandwidth memory).”

AMAT's second quarter (January 29 - April 28) sales were $6.65 billion (approximately KRW 9.0559 trillion), maintaining the same level as last year. The proportion of Chinese sales in total sales was 43%, more than double compared to the same period last year (21%).

The company said, “AMAT has temporarily delayed orders from some customers who produce ICAPS-related chips such as IoT, Communications, Automotive, Power, and Sensor, but the equipment used to manufacture AI semiconductors “The demand for it continues to increase,” he explained.

In particular, sales related to HBM and Advanced Packaging are on the rise. AMAT predicted that advanced packaging sales would increase four-fold compared to the previous year in its first quarter performance, but revised it upward to $1.7 billion, a six-fold increase in this second quarter performance.

(Data = public announcements from each company, graphics = GD Net Korea)

ASML's first quarter (January 1 - March 31) net sales were 5.29 billion euros (about 7.8224 trillion won, $5.7 billion), a 21.6% decrease compared to the same period last year. Orders for top-level EUV (extreme ultraviolet) exposure equipment plummeted from EUR 5.6 billion to EUR 656 million in the previous quarter. The proportion of sales by region reached an all-time high, with China accounting for half from 39% in the previous quarter to 49% in the first quarter. On the other hand, the proportion of sales in Taiwan and Korea fell from 13% and 25% to 6% and 19%, respectively.

Lam Research's fiscal third quarter (December 25, 2023 - March 31, 2024) sales were calculated to be $3.8 billion (KRW 5.1794 trillion), a slight increase of 0.9% from the previous year. This performance benefited from HBM-related equipment spending and continued investment in China.

TEL recorded 547.2 billion yen (approximately 4.7659 trillion won, $3.5 billion) in sales in the fourth quarter of fiscal year 2024 (January 1 to March 31), a 2% decrease compared to the same period last year.

TEL said, “Chip demand due to generative AI is expected to promote further growth in the semiconductor equipment market,” and “DDR5 and HBM demand is expected to increase in the second half of the year, driving cutting-edge DRAM investment.”

KLA's sales in the third quarter of fiscal 2024 (January 1 to March 31) were $2.4 billion (approximately 3.2724 trillion won), a 3% decrease compared to the same period last year.

zdnet-co-kr.translate.goog

zdnet-co-kr.translate.goog

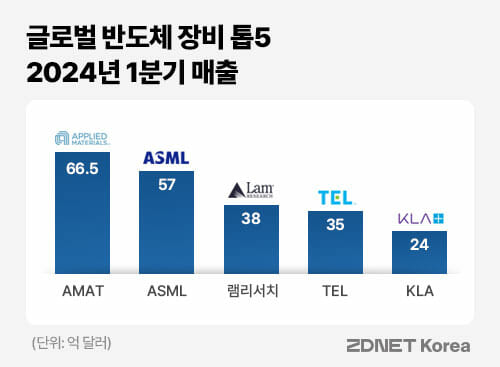

It was found that the sales of the top five global semiconductor equipment companies in the first quarter of this year were increasingly directed toward AI semiconductors and the proportion of China increased.

The top five companies in global semiconductor equipment sales are Applied Materials (AMAT), ASML of the Netherlands, Lam Research of the United States, Tokyo Electron (TEL) of Japan, and KAL of the United States.

Market research firm Trend Force diagnosed, “The first quarter performance of the top five semiconductor equipment companies was focused on investment in cutting-edge processes to respond to the continued increase in demand for AI and HBM (high bandwidth memory).”

AMAT's second quarter (January 29 - April 28) sales were $6.65 billion (approximately KRW 9.0559 trillion), maintaining the same level as last year. The proportion of Chinese sales in total sales was 43%, more than double compared to the same period last year (21%).

The company said, “AMAT has temporarily delayed orders from some customers who produce ICAPS-related chips such as IoT, Communications, Automotive, Power, and Sensor, but the equipment used to manufacture AI semiconductors “The demand for it continues to increase,” he explained.

In particular, sales related to HBM and Advanced Packaging are on the rise. AMAT predicted that advanced packaging sales would increase four-fold compared to the previous year in its first quarter performance, but revised it upward to $1.7 billion, a six-fold increase in this second quarter performance.

(Data = public announcements from each company, graphics = GD Net Korea)

ASML's first quarter (January 1 - March 31) net sales were 5.29 billion euros (about 7.8224 trillion won, $5.7 billion), a 21.6% decrease compared to the same period last year. Orders for top-level EUV (extreme ultraviolet) exposure equipment plummeted from EUR 5.6 billion to EUR 656 million in the previous quarter. The proportion of sales by region reached an all-time high, with China accounting for half from 39% in the previous quarter to 49% in the first quarter. On the other hand, the proportion of sales in Taiwan and Korea fell from 13% and 25% to 6% and 19%, respectively.

Lam Research's fiscal third quarter (December 25, 2023 - March 31, 2024) sales were calculated to be $3.8 billion (KRW 5.1794 trillion), a slight increase of 0.9% from the previous year. This performance benefited from HBM-related equipment spending and continued investment in China.

TEL recorded 547.2 billion yen (approximately 4.7659 trillion won, $3.5 billion) in sales in the fourth quarter of fiscal year 2024 (January 1 to March 31), a 2% decrease compared to the same period last year.

TEL said, “Chip demand due to generative AI is expected to promote further growth in the semiconductor equipment market,” and “DDR5 and HBM demand is expected to increase in the second half of the year, driving cutting-edge DRAM investment.”

KLA's sales in the third quarter of fiscal 2024 (January 1 to March 31) were $2.4 billion (approximately 3.2724 trillion won), a 3% decrease compared to the same period last year.

반도체 장비 톱5, 1분기 매출↑...AI·중국 비중 확대

글로벌 반도체 장비 상위 5개 기업의 올해 1분기 매출이 AI 반도체향이 늘고 중국 비중이 증가한 것으로 나타났다.글로벌 반도체 장비 매출 상위 5개 기업은 어플라이드머티얼리얼즈(AMAT), 네덜란드 ASML, 미국 램리서치, 일본 도쿄일렉트론(TEL), 미국 KAL 순으로 차지한다.사진=...