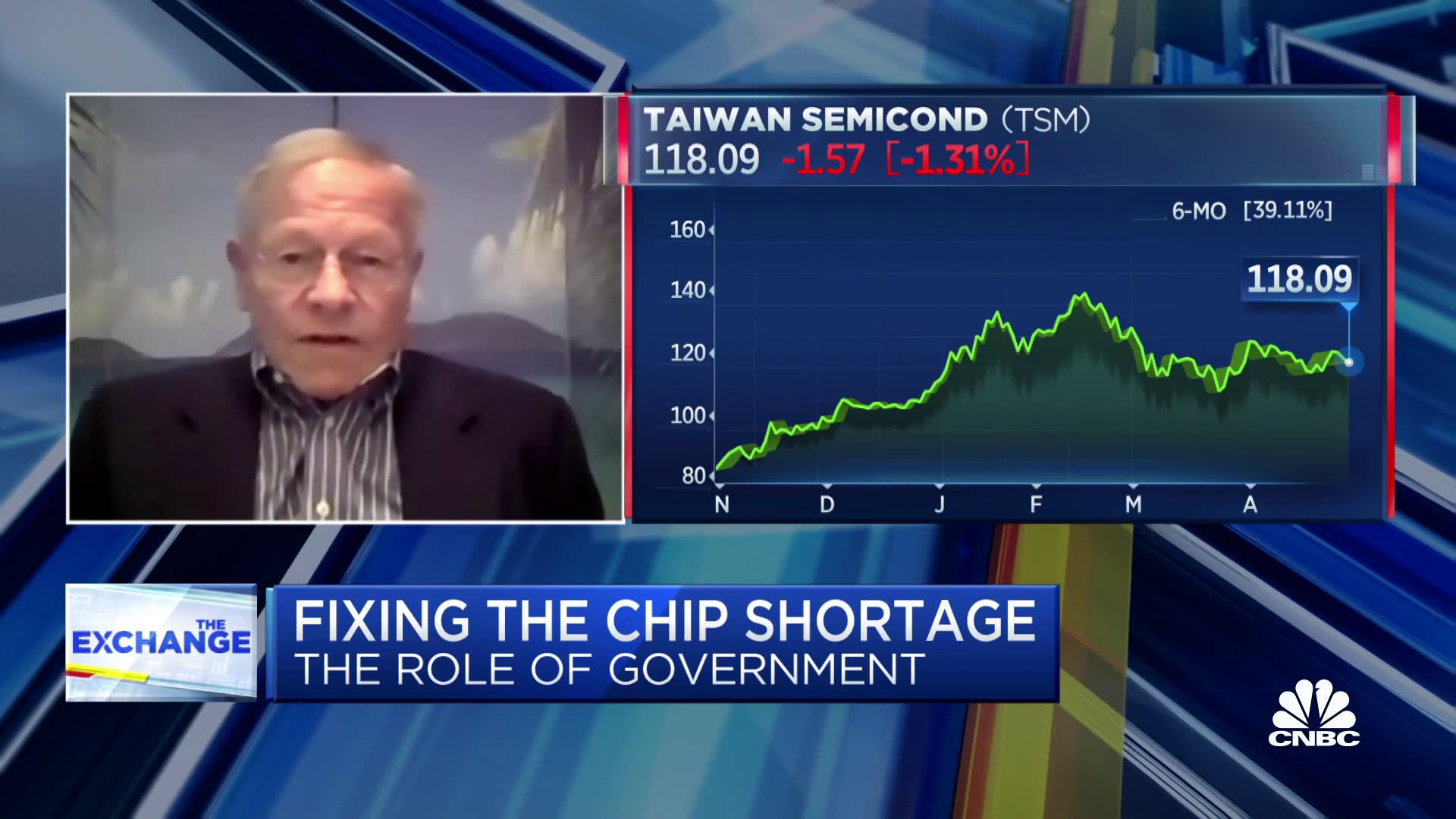

Rodgers makes a correct argument for a free market approach to the general issue of supply-demand and sourcing in industry. The invisible hand knows better than government. Industries that whiffed on demand forecasting and inventory management during COVID (or any other time for that matter) deserve no pity, inclusive of and starting with the auto industry.

That said, the free market misses a key dimension of "hand-eye coordination": national security. The free market is blind to the geopolitical threat of the over-concentration of supply of products critical to national security in specific regions. This is the case the US is dealing with today.

The CHIPS ACT should be tightly focused on incentivizing the re-shoring of production only of key technologies that the US is missing, specifically those that are critical to national security (defense, intel, cyber, space) and critical infrastructure. Public funding to incentivize and accelerate basic research and workforce development (STEM education) is also worthy. The semi industry and its downstream customers have the incentive and capital to fund the development, ecosystem build-out and capacity to translate basic research into economic value add. But they will focus their investments on the regions of the world that optimize the combination of financial returns, efficiency in supply chain, access to talent and customers, and acceptable political risk mitigation. The past 30 years has demonstrated this optimization is not in the US.

A focused, well structured and run CHIPS ACT can mitigate US national security risk by changing the optimization equation and being a catalyst to re-shore critical technologies. Rodgers misses the point that the objective of the ACT is not and has not been to "fix chip shortages".