The latest Gartner report has indicated the size of the global semiconductor revenue and the share of semiconductor vendors in 2024.

Samsung vs Intel in semiconductor market 2024

Revenue of the global semiconductor industry has increased 18.1 percent to $626 billion in 2024. Semiconductor revenue will be reaching an estimated $705 billion in 2025.

The surge in semiconductor revenue was largely driven by the demand for graphics processing units (GPUs) and AI processors utilized in data center applications, including servers and accelerator cards.

George Brocklehurst, VP Analyst at Gartner, highlighted that the growing need for AI and generative AI (GenAI) workloads propelled data centers to become the second-largest market for semiconductors in 2024, second only to smartphones. Data center semiconductor revenue totaled $112 billion in 2024, a significant increase from $64.8 billion in 2023.

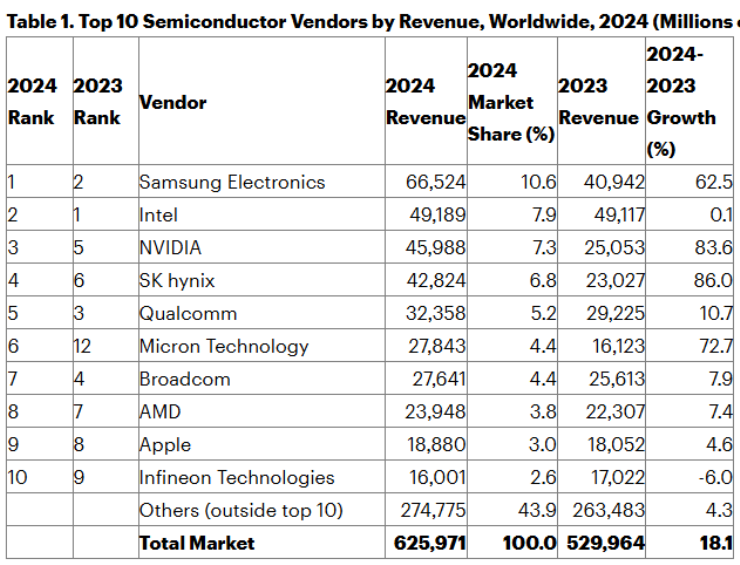

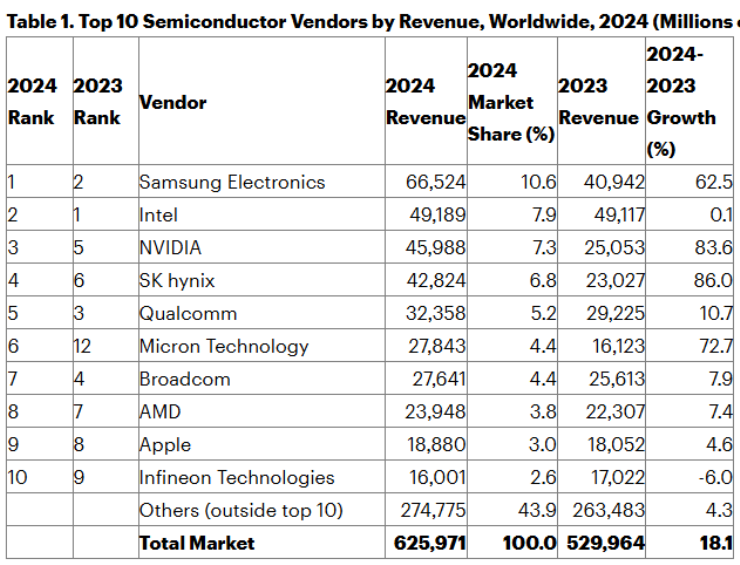

The strong market performance influenced the rankings of various semiconductor vendors, with eleven companies achieving double-digit growth. Eight of the top 25 semiconductor vendors experienced a decline in revenue during 2024.

Samsung Electronics reclaimed its position as the No. 1 semiconductor vendor in 2024, overtaking Intel. This achievement was primarily due to a strong rebound in memory device prices, leading to a revenue total of $66.5 billion for Samsung.

Intel, now ranked second, struggled with limited success in AI accelerators and modest growth in its x86 business. Despite this, Intel’s semiconductor revenue remained stable with a marginal growth of 0.1 percent in 2024.

Nvidia made substantial gains, increasing its semiconductor revenue by 84 percent to reach $46 billion, moving up two positions to claim the No. 3 spot, largely due to the strength of its AI business.

According to Gartner’s rankings for the top 10 semiconductor vendors by revenue in 2024, Samsung Electronics led with a 10.6 percent market share, followed by Intel with 7.9 percent and Nvidia with 7.3 percent.

SK hynix also saw impressive growth, climbing to fourth place with an 86 percent revenue increase. Other notable vendors included Qualcomm, Micron Technology, Broadcom, AMD, Apple, and Infineon Technologies, with most companies showing positive revenue growth except for Infineon Technologies, which saw a decline of 6.0 percent.

The memory segment played a crucial role in the semiconductor market’s expansion, recording a 71.8 percent increase in revenue for 2024. Memory devices accounted for 25.2 percent of the total semiconductor market share, with DRAM revenue growing by 75.4 percent and NAND revenue increasing by 75.7 percent year-over-year. High-bandwidth memory (HBM) was a major contributor to DRAM revenue, representing 13.6 percent of total DRAM sales in 2024.

Nonmemory semiconductor revenue also experienced growth, increasing by 6.9 percent in 2024 and accounting for 74.8 percent of the total semiconductor market. Analysts predict that memory and AI-driven semiconductors will continue to be key drivers of growth. HBM, in particular, is expected to represent 19.2 percent of DRAM revenue by 2025, with projected revenue reaching $19.8 billion, reflecting a 66.3 percent increase from the previous year.

telecomlead.com

telecomlead.com

Samsung vs Intel in semiconductor market 2024

Revenue of the global semiconductor industry has increased 18.1 percent to $626 billion in 2024. Semiconductor revenue will be reaching an estimated $705 billion in 2025.

The surge in semiconductor revenue was largely driven by the demand for graphics processing units (GPUs) and AI processors utilized in data center applications, including servers and accelerator cards.

George Brocklehurst, VP Analyst at Gartner, highlighted that the growing need for AI and generative AI (GenAI) workloads propelled data centers to become the second-largest market for semiconductors in 2024, second only to smartphones. Data center semiconductor revenue totaled $112 billion in 2024, a significant increase from $64.8 billion in 2023.

The strong market performance influenced the rankings of various semiconductor vendors, with eleven companies achieving double-digit growth. Eight of the top 25 semiconductor vendors experienced a decline in revenue during 2024.

Samsung Electronics reclaimed its position as the No. 1 semiconductor vendor in 2024, overtaking Intel. This achievement was primarily due to a strong rebound in memory device prices, leading to a revenue total of $66.5 billion for Samsung.

Intel, now ranked second, struggled with limited success in AI accelerators and modest growth in its x86 business. Despite this, Intel’s semiconductor revenue remained stable with a marginal growth of 0.1 percent in 2024.

Nvidia made substantial gains, increasing its semiconductor revenue by 84 percent to reach $46 billion, moving up two positions to claim the No. 3 spot, largely due to the strength of its AI business.

According to Gartner’s rankings for the top 10 semiconductor vendors by revenue in 2024, Samsung Electronics led with a 10.6 percent market share, followed by Intel with 7.9 percent and Nvidia with 7.3 percent.

SK hynix also saw impressive growth, climbing to fourth place with an 86 percent revenue increase. Other notable vendors included Qualcomm, Micron Technology, Broadcom, AMD, Apple, and Infineon Technologies, with most companies showing positive revenue growth except for Infineon Technologies, which saw a decline of 6.0 percent.

The memory segment played a crucial role in the semiconductor market’s expansion, recording a 71.8 percent increase in revenue for 2024. Memory devices accounted for 25.2 percent of the total semiconductor market share, with DRAM revenue growing by 75.4 percent and NAND revenue increasing by 75.7 percent year-over-year. High-bandwidth memory (HBM) was a major contributor to DRAM revenue, representing 13.6 percent of total DRAM sales in 2024.

Nonmemory semiconductor revenue also experienced growth, increasing by 6.9 percent in 2024 and accounting for 74.8 percent of the total semiconductor market. Analysts predict that memory and AI-driven semiconductors will continue to be key drivers of growth. HBM, in particular, is expected to represent 19.2 percent of DRAM revenue by 2025, with projected revenue reaching $19.8 billion, reflecting a 66.3 percent increase from the previous year.

Samsung beats Intel to reclaim #1 position in semiconductor industry - TelecomLead

The latest Gartner report has indicated the size of the global semiconductor revenue and the share of semiconductor vendors in 2024.

telecomlead.com

telecomlead.com