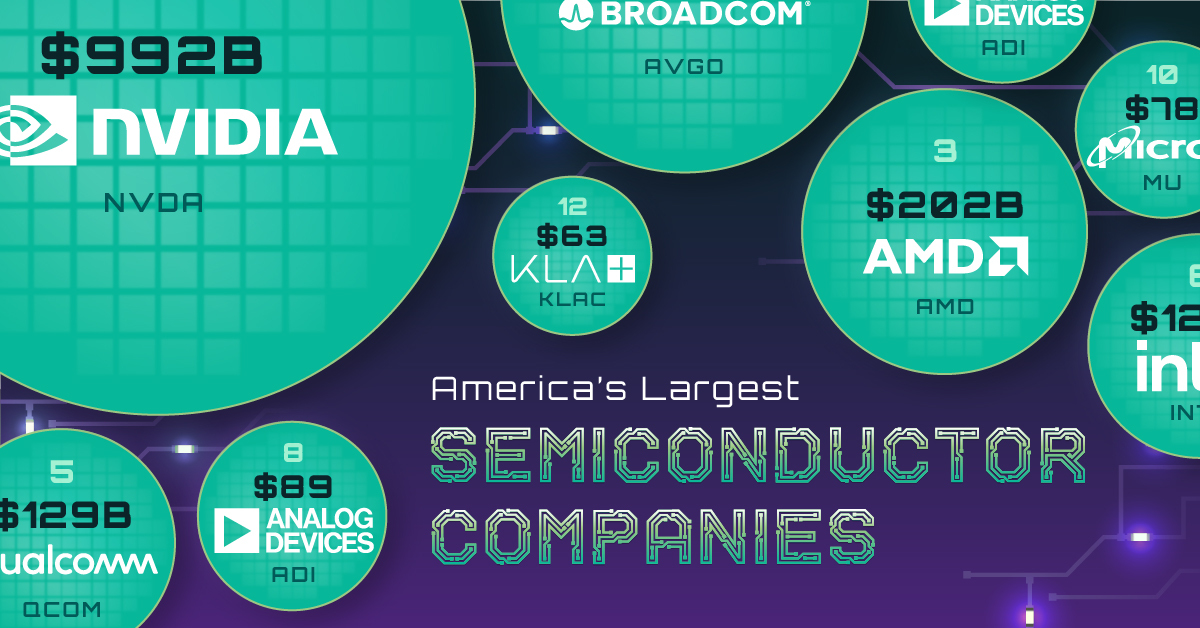

Ranking America’s Largest Semiconductor Companies

As our world moves further into an era of widespread digitization, few industries can be considered as important as semiconductors.

These components are found in almost everything we use on a daily basis, and the ability to produce them domestically has become a topic of national security. For example, in 2022 the Biden administration announced the CHIPS and Science Act, which aims to strengthen America’s position in everything from clean energy to artificial intelligence.

With this in mind, we’ve ranked the top 15 U.S. semiconductor companies by their market capitalizations.

Data and Highlights

The data we used to create this infographic is listed in the table below. Year-to-date (YTD) returns were included for additional context. Both metrics are as of May 30, 2023.

At the top is Nvidia, which became America’s newest $1 trillion company on Tuesday, May 30th. Shares pulled back slightly over the day and Nvidia closed at $992 billion. Over the past decade, Nvidia has transformed from a gaming-focused graphics card producer to a global leader in AI and data center chips.

In third and sixth place are two of America’s most well known chipmakers, AMD and Intel. These longtime rivals are moving in opposite trajectories, with AMD shares climbing 770% over the past five years, and Intel shares falling 47%. One reason for this is the data center segment, in which AMD appears to be stealing market share from Intel.

Further down the list we see Applied Materials in seventh, and Lam Research in ninth. Both firms specialize in semiconductor manufacturing equipment and thus play an important role in the industry’s supply chain.

Trade War Impacts

As tensions between the U.S. and China escalate, chipmakers are becoming increasingly entangled in geopolitical conflict.

In October 2022, the Biden administration introduced new export controls aimed at blocking China’s access to semiconductors produced with U.S. equipment. This impacted several companies in our top 15 list, including Lam Research and Applied Materials.

Shortly after the export controls were announced, Lam Research said it expected to lose upwards of $2.5 billion in annual revenues.

In response, China announced in May 2023 that it would no longer allow America’s largest memory chipmaker, Micron, to sell its products to “critical national infrastructure operators”.

This is not the first time Micron has been involved in a controversy with China. In 2018, the firm alleged that Fujian Jinhua Integrated Circuit, a Chinese state-owned company, had solicited a Micron employee to steal specifications for memory chips. The U.S. Department of Commerce imposed export restrictions on Fujian Jinhua as a result.

Chipmakers on both sides of the Pacific will be closely watching as competition between these two countries heats up.

www.visualcapitalist.com

www.visualcapitalist.com

As our world moves further into an era of widespread digitization, few industries can be considered as important as semiconductors.

These components are found in almost everything we use on a daily basis, and the ability to produce them domestically has become a topic of national security. For example, in 2022 the Biden administration announced the CHIPS and Science Act, which aims to strengthen America’s position in everything from clean energy to artificial intelligence.

With this in mind, we’ve ranked the top 15 U.S. semiconductor companies by their market capitalizations.

Data and Highlights

The data we used to create this infographic is listed in the table below. Year-to-date (YTD) returns were included for additional context. Both metrics are as of May 30, 2023.

At the top is Nvidia, which became America’s newest $1 trillion company on Tuesday, May 30th. Shares pulled back slightly over the day and Nvidia closed at $992 billion. Over the past decade, Nvidia has transformed from a gaming-focused graphics card producer to a global leader in AI and data center chips.

In third and sixth place are two of America’s most well known chipmakers, AMD and Intel. These longtime rivals are moving in opposite trajectories, with AMD shares climbing 770% over the past five years, and Intel shares falling 47%. One reason for this is the data center segment, in which AMD appears to be stealing market share from Intel.

Further down the list we see Applied Materials in seventh, and Lam Research in ninth. Both firms specialize in semiconductor manufacturing equipment and thus play an important role in the industry’s supply chain.

Trade War Impacts

As tensions between the U.S. and China escalate, chipmakers are becoming increasingly entangled in geopolitical conflict.

In October 2022, the Biden administration introduced new export controls aimed at blocking China’s access to semiconductors produced with U.S. equipment. This impacted several companies in our top 15 list, including Lam Research and Applied Materials.

Shortly after the export controls were announced, Lam Research said it expected to lose upwards of $2.5 billion in annual revenues.

In response, China announced in May 2023 that it would no longer allow America’s largest memory chipmaker, Micron, to sell its products to “critical national infrastructure operators”.

This is not the first time Micron has been involved in a controversy with China. In 2018, the firm alleged that Fujian Jinhua Integrated Circuit, a Chinese state-owned company, had solicited a Micron employee to steal specifications for memory chips. The U.S. Department of Commerce imposed export restrictions on Fujian Jinhua as a result.

Chipmakers on both sides of the Pacific will be closely watching as competition between these two countries heats up.

Ranked: America’s Largest Semiconductor Companies

This graphic visualizes the market capitalizations of America's 15 largest semiconductor companies.

www.visualcapitalist.com

www.visualcapitalist.com