hist78

Well-known member

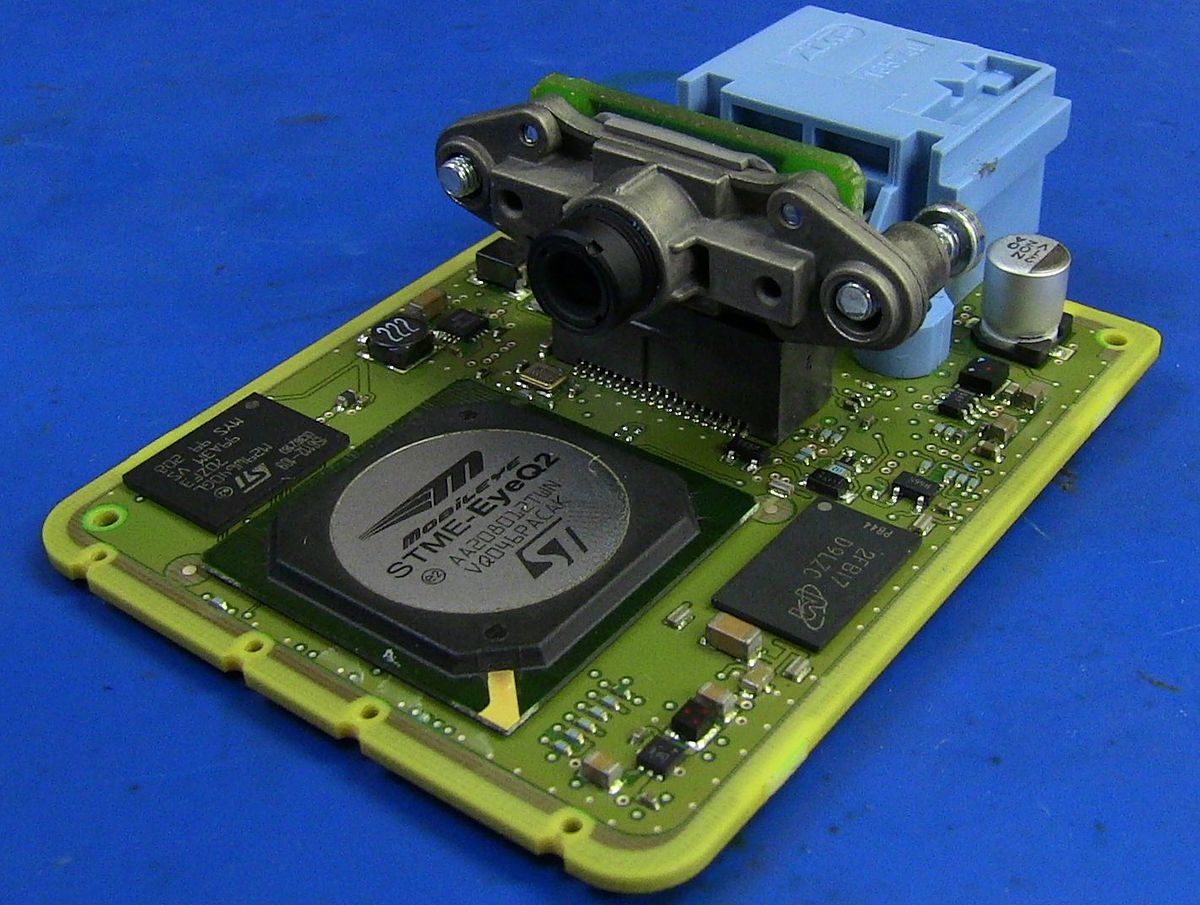

This new $15 billion valuation is much smaller than the original $40 to $50 billion estimate.

"Intel Corp.'s self-driving-car unit, Mobileye Global Inc., expects a market valuation of roughly $15 billion at the projected pricing midpoint of its initial public offering."

www.marketwatch.com

www.marketwatch.com

"Intel Corp.'s self-driving-car unit, Mobileye Global Inc., expects a market valuation of roughly $15 billion at the projected pricing midpoint of its initial public offering."

Intel's Mobileye Plans to Offer 41 Mln Shares in IPO at $18-$21 Each

By Robb M. Stewart Intel Corp.'s self-driving-car unit, Mobileye Global Inc., expects a market valuation of roughly $15 billion at the projected pricing...