Specification summary:

-Apple A9X vs. Intel Core m3-6y30 processors are roughly comparable

-MHZ: 2260 (Apple), 900-2200 (Intel)

-Die Sq mm: 99 (Intel), 147 (Apple)

-Graphics cores: 24 (Intel), 12 (Apple)

-Graphics performance (PCMark Icestorm Unlimited): 33574 (Apple), 40995 (Intel)

-Cost: Apple iPad Pro ($799), Microsoft Surface 4 Pro ($899)

-Process nodes: Intel 14nm, TSMC "16nm"

Why "Mind Boggling": Intel doesn't advertise their die size, transistor count or core counts publicly anymore, so as to throw competitors off. However, these things are relatively easy to determine and public. Chipworks, Anandtech and other sources publish these things. They also publish the configuration for the Core m3 as "2+2", another obscuration technique. It means 2 cores and "GT2" graphics performance. GT2 refers to 1 slice, 3 subslices, totalling 24 execution units. This then rolls into a HD 515 designation for 24 execution units with a maximum clock speed of 850 MHZ.

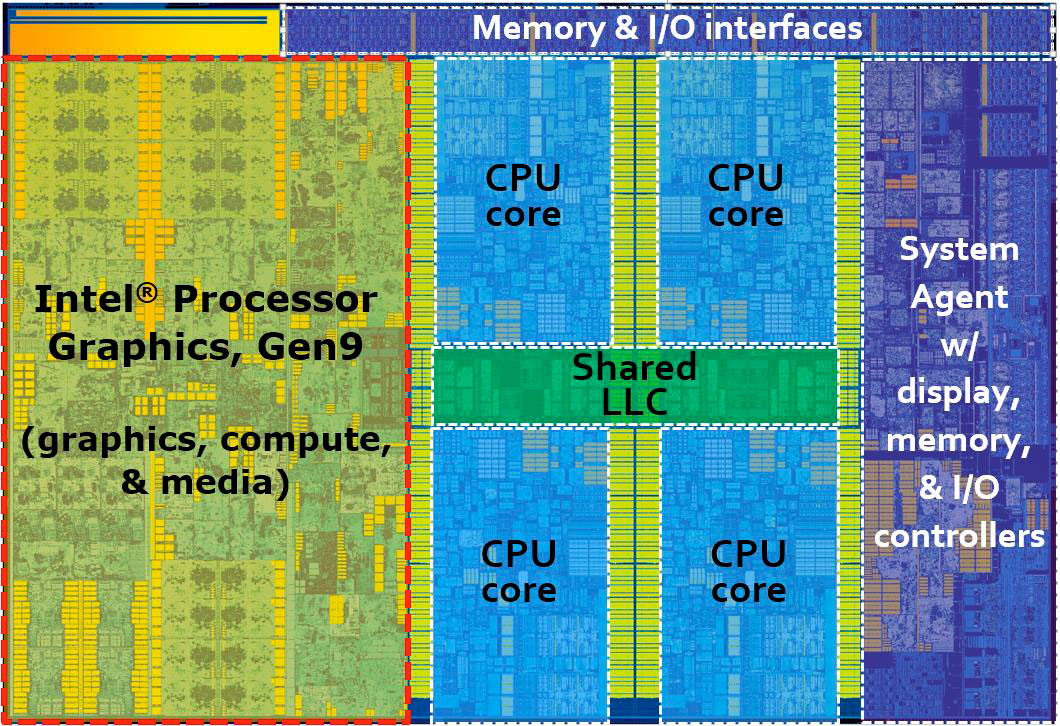

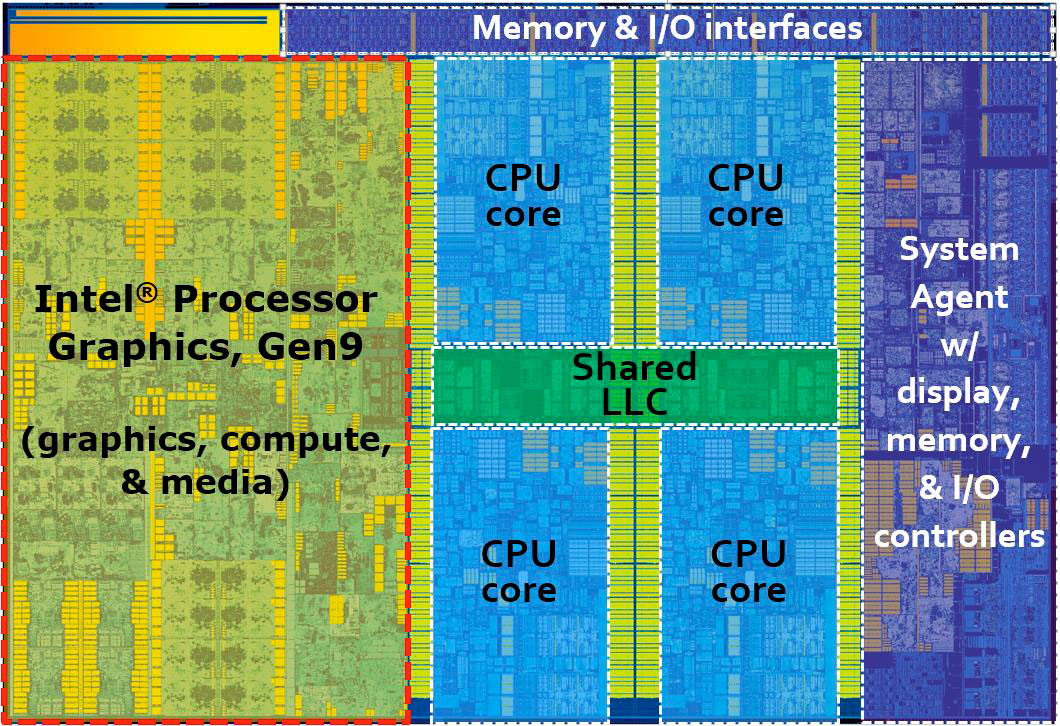

This is a lot of hiding behind jargon and numbers, but it is all public now. Finally, the die map for the Core i7-6700K has been published, showing, at the left, how those 24 execution units are arranged, with 16 in the upper left side, in line with 2 of the 4 cores, and 8 more in the middle-lower left corner in line with cores 3 and 4.

This is what is mind-boggling about Intel's process advantage: In order to include 24 EUs in the Core m3, they must include Cores 3 and 4 in the bargain, but disabled. That is 20% of the already superior (147 vs. 99 sqmm) die area. If they had designed a purpose-built high-end tablet chip, like the A9X, they could have probably reduced the die size to 70 or 80 mm. Intel is simply killing it in the high-end tablet chip sockets. And I think Apple may have to look hard at giving Intel a shot at it's next "X" chip, simply because they can get a better deal; better performance and lower cost.

-Apple A9X vs. Intel Core m3-6y30 processors are roughly comparable

-MHZ: 2260 (Apple), 900-2200 (Intel)

-Die Sq mm: 99 (Intel), 147 (Apple)

-Graphics cores: 24 (Intel), 12 (Apple)

-Graphics performance (PCMark Icestorm Unlimited): 33574 (Apple), 40995 (Intel)

-Cost: Apple iPad Pro ($799), Microsoft Surface 4 Pro ($899)

-Process nodes: Intel 14nm, TSMC "16nm"

Why "Mind Boggling": Intel doesn't advertise their die size, transistor count or core counts publicly anymore, so as to throw competitors off. However, these things are relatively easy to determine and public. Chipworks, Anandtech and other sources publish these things. They also publish the configuration for the Core m3 as "2+2", another obscuration technique. It means 2 cores and "GT2" graphics performance. GT2 refers to 1 slice, 3 subslices, totalling 24 execution units. This then rolls into a HD 515 designation for 24 execution units with a maximum clock speed of 850 MHZ.

This is a lot of hiding behind jargon and numbers, but it is all public now. Finally, the die map for the Core i7-6700K has been published, showing, at the left, how those 24 execution units are arranged, with 16 in the upper left side, in line with 2 of the 4 cores, and 8 more in the middle-lower left corner in line with cores 3 and 4.

This is what is mind-boggling about Intel's process advantage: In order to include 24 EUs in the Core m3, they must include Cores 3 and 4 in the bargain, but disabled. That is 20% of the already superior (147 vs. 99 sqmm) die area. If they had designed a purpose-built high-end tablet chip, like the A9X, they could have probably reduced the die size to 70 or 80 mm. Intel is simply killing it in the high-end tablet chip sockets. And I think Apple may have to look hard at giving Intel a shot at it's next "X" chip, simply because they can get a better deal; better performance and lower cost.