fansink

Well-known member

Intel’s wobbles may force Washington to choose between two of its ideological priorities: promoting national champions and preventing corporate consolidation. On a clear day, there’s little chance antitrust regulators would allow Intel to merge with any of its rivals. Expediency often forces policy compromises — see JPMorgan’s emergency rescue of First Republic last year — but if Commerce Secretary Gina Raimondo can outmuscle Federal Trade Commission Chair Lina Khan, it will show just how deep Intel’s problems run.

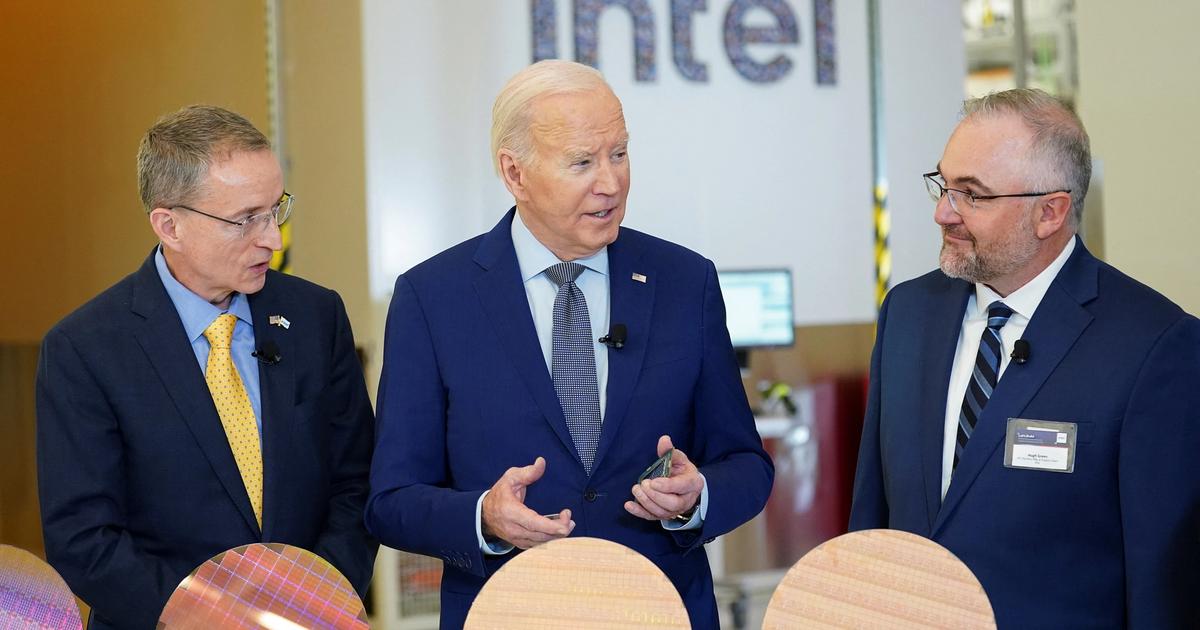

Policymakers in Washington have grown worried enough about chipmaker Intel to begin quietly discussing scenarios should it need further assistance, beyond the billions in government funds the company is already slated to receive, people familiar with the matter said.

A strong quarterly earnings outlook yesterday bought the company breathing room with investors, but abstract concerns in Washington have turned into potential backup options, should Intel’s finances continue to deteriorate.

Top officials at the Commerce Department, which oversees implementation of the CHIPS Act funding to reinvigorate American chip production, and members of Congress including Sen. Mark Warner, one of the law’s leading champions, have discussed whether the company needs more help, the people said.

The talks, which the people described as purely precautionary, show that Intel is seen as too strategically important to be allowed to fall into serious trouble. The US is seeking a national champion in the semiconductor space to ensure its own supply chain and as a counterweight to China, where manufacturing for global chips has moved.

“We have outlined a clear strategy that we are executing with rigor, and the strong operational performance we delivered in Q3 demonstrates important progress against our plan,” an Intel spokesperson said in a statement. “Intel is the only American company that designs and manufactures leading-edge chips and is playing a critical role to enable a globally competitive semiconductor ecosystem in the US.”

Intel suspended its dividend in August to preserve cash and said it would lay off about 15% of its workforce as part of a $10 billion cost-cutting effort. It is the second-worst performing stock in the S&P 500 this year, after Walgreens. Credit ratings agencies downgraded the chipmaker this summer, increasing its borrowing costs.

One option is a merger, led by the private sector but possibly encouraged by the government, of Intel’s chip-design business with a rival like AMD or Marvell, the people said. There’s little appetite for a 2008-style bailout, in which the government took direct stakes in automakers and banks, because policymakers are worried about losing money given Intel’s continued sales declines.

Intel is set to be the biggest recipient of government funding under the CHIPS Act, which aims to help American manufacturers of key tech components build their products in the US and compete with China. The company is slated to receive $8.5 billion in grants and $11 billion in low-interest loans; these funds would not be part of any further assistance, should Intel need one.

But Intel hasn’t received any of that CHIPS money yet amid doubts about its prospects. Bloomberg reported that the company has been reluctant to share certain information sought by US officials tasked with ensuring that the company has a viable turnaround plan.

On Thursday, Intel reported a $16.6 billion net loss largely due to write-downs and other restructuring charges and updated its planned layoffs, increasing them by about 10% to 16,500 employees. But it gave a better-than-expected revenue outlook for the fourth quarter, and shares rose 6% on Friday morning.

On Intel’s earnings call Thursday, CEO Pat Gelsinger said the company is on track to begin producing its most advanced chips, known as 18A, next year.

Intel is different from other US chipmakers like Nvidia and Qualcomm because it has always built its chips at its own facilities, known as “fabs,” instead of outsourcing production to Taiwan, Korea and elsewhere. But Intel made strategic mistakes, causing it to fall behind rivals. With CHIPS Act funding, the US aimed to encourage Intel to revitalize its production capabilities.

A successful launch of the 18A generation chip — something many in the industry doubted the company could pull off — would put Intel back on par with industry leader TSMC.

Amazon last month made a multi-billion-dollar commitment to buy a new custom-designed AI chip from Intel that will be built using the 18A process. And on the earnings call Thursday, Gelsinger said two more “compute-centric companies” have agreed to use 18A.

“We have confidence in Intel’s overall vision for manufacturing chips in the United States,” a Commerce Department spokesperson said “We continue to work closely with the company to finalize their award and will provide further updates as they become available.”

Warner’s office declined to comment.

It’s surprising Intel stayed at the top of the market as long as it did. It set the rules of its own game with co-founder Gordon Moore’s “law” that the number of semiconductors on a chip will double about every two years. That was in the 1960s. It still has nearly 80% market share for CPUs a half century later.

But like many big, old companies, Intel had trouble staying ahead of younger, more nimble competitors. It failed to adapt to changes in the chip industry and fell victim to the innovator’s dilemma.

It makes sense for the US government to try to salvage the situation and to prop up a “national champion” in the chip space. America is in a high stakes race for technological superiority over China, which subsidizes its private-sector efforts.

Bringing chip production “fabs” back to the US solves the immediate dilemma of supply chain vulnerabilities and the possibility of China taking control of TSMC’s Taiwan headquarters, where most of the world’s leading-edge chips are manufactured.

The longer term problem is that the US government forgot how to spearhead innovation in key areas.

For instance, it’s ironic that one of Intel’s competitive threats is from Arm-based processors, which are slowly gaining market share in PCs and data centers. Arm is based on an architecture called Reduced Instruction Set Computer, or RISC. DARPA spearheaded its development by funding a nascent research project at UC Berkeley in the 1970s. It ultimately became one of the seminal breakthroughs in that era of computer science.

Arm (Advanced RISC Machines), was co-founded in the UK by Apple and Acorn Computers in 1990. It became essentially the foundation for most of the microprocessors in your life, from your car to your smartphone. There is now even an Arm China.

The open system that allows US innovation to prop up non-US competitors only works if the US keeps innovating. The question is whether the government — hampered by divisive politics — can produce the next Intel, or the next RISC-based processor. Or the next breakthrough in lithography to leapfrog current semiconductor manufacturing techniques.

Former Intel CEO Craig Barrett argued last week that splitting up Intel makes no sense:

“We’ve seen this movie before. Years ago, a struggling AMD split off its manufacturing capacity into Global Foundries. Pundits applauded the split at the time. A decade later, AMD is doing well using TSMC, while Global Foundries has little if any differentiated technology. Global Foundries just didn’t have enough research and development (R&D) budget, and with limited production and revenue, struggled to keep up with market leaders.

The economic reality is that it takes massive investment to drive Moore’s Law. In today’s semiconductor industry, only three companies (Intel, Samsung, and TSMC) have sufficient revenue to contend for technology leadership. If you split up Intel, the foundry portion will probably fail because of decreased R&D spending along with the complex realities of splitting up a huge multinational company in the midst of a multiyear turnaround effort.”

“Intel is on the verge of completing an unprecedented pace of node development to catch up to TSMC. It has taken the lead on next-gen technologies that will shape the semiconductor industry for years to come, such as high NA EUV lithography and backside power delivery. Yes, more work is needed—but this is a good start, and they must keep going.”

Concerns grow in Washington over Intel

Policymakers have grown worried enough about the chipmaker to quietly discuss scenarios should it need further assistance.