New Export Restrictions Target Advanced Semiconductor Nodes, Minimal Disruption Anticipated for TSMC

It is rumored in the market that some Chinese customers have obtained advanced process chips before the restrictions, which is why the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) is requiring TSMC to stop supplying all products below the N7 process to Chinese customers.

According to our understanding, the BIS has not yet formally issued an order, so TSMC is expected to avoid penalties by proactively complying with BIS export control regulations. TSMC will likely increase its level of scrutiny on Chinese AI businesses, and the new regulations are expected to take effect on November 11. Once the new regulations begin, N7 and below products may temporarily cease supply to Chinese customers. This is expected to have the greatest impact on HPC/AI and related products, while other consumer products should still be available to China as long as they comply with BIS’s conditions.

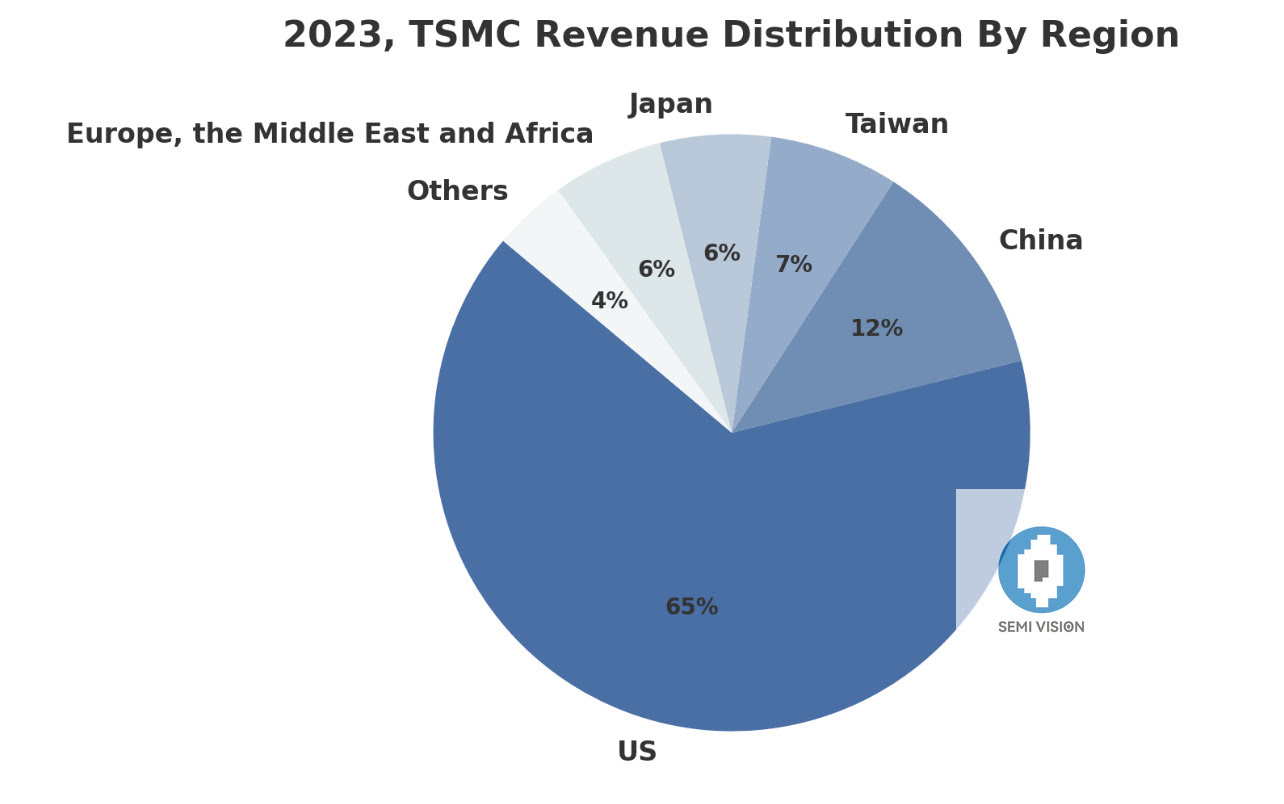

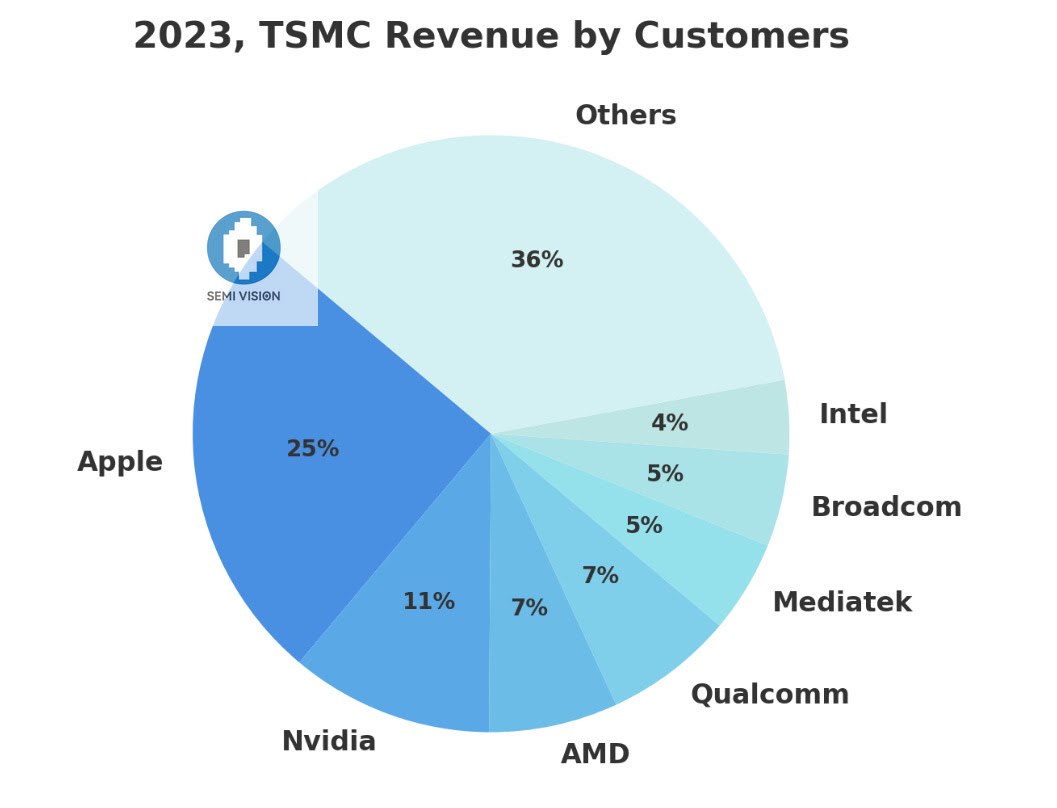

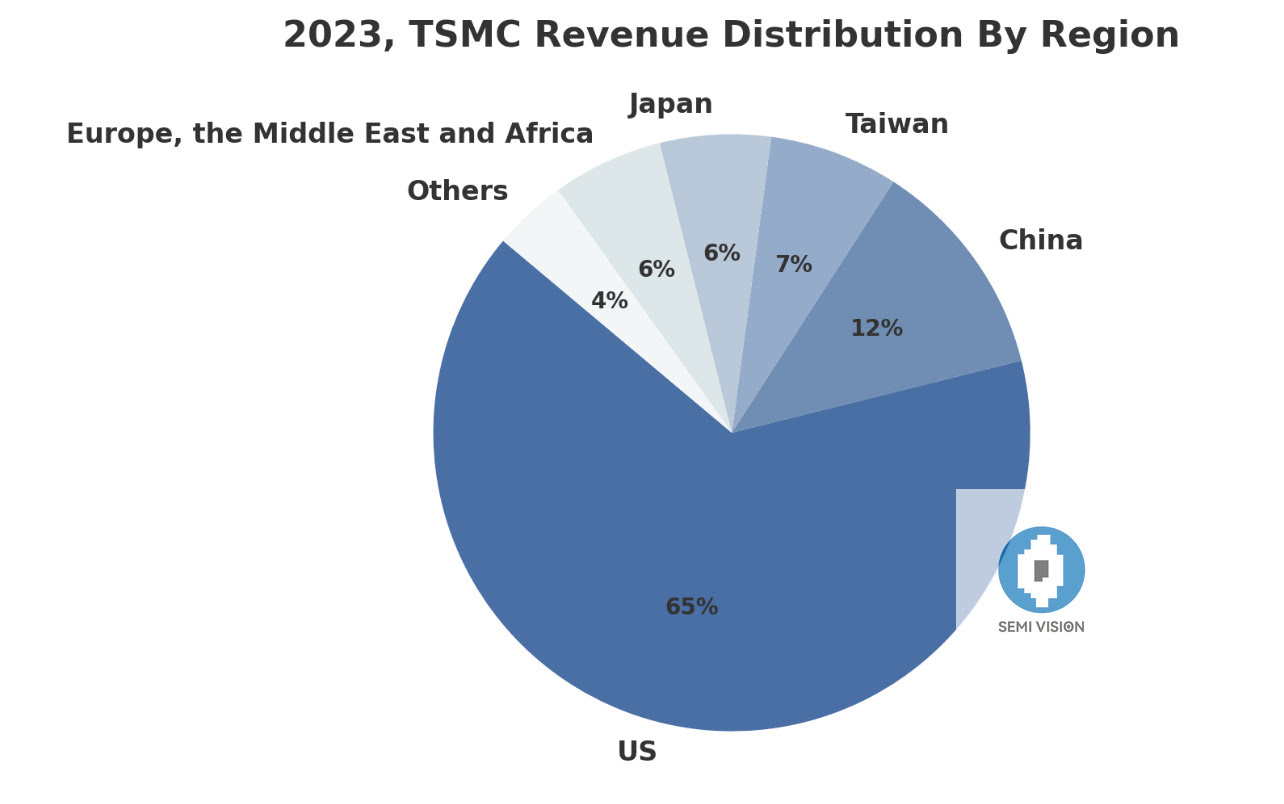

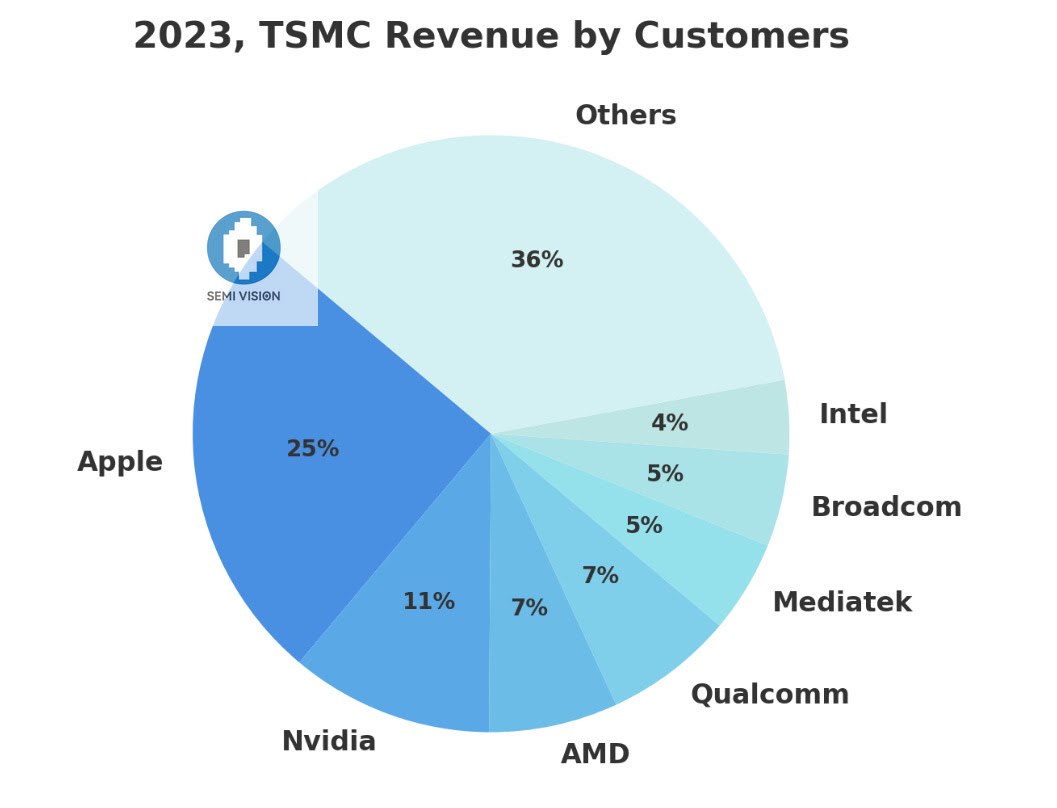

We believe TSMC will not be significantly affected in the short term. China’s revenue accounted for 12% of TSMC’s revenue in 2023, and we estimate a decline of less than 10% in 2024. Additionally, TSMC’s AI revenue from China is estimated to account for no more than 3% of total revenue in 2024, and this ratio may further decline by 2025.

This is because most of TSMC’s AI revenue comes from U.S. customers. Therefore, we remain cautiously optimistic about TSMC’s future growth and believe that the U.S. will remain TSMC’s main growth driver.

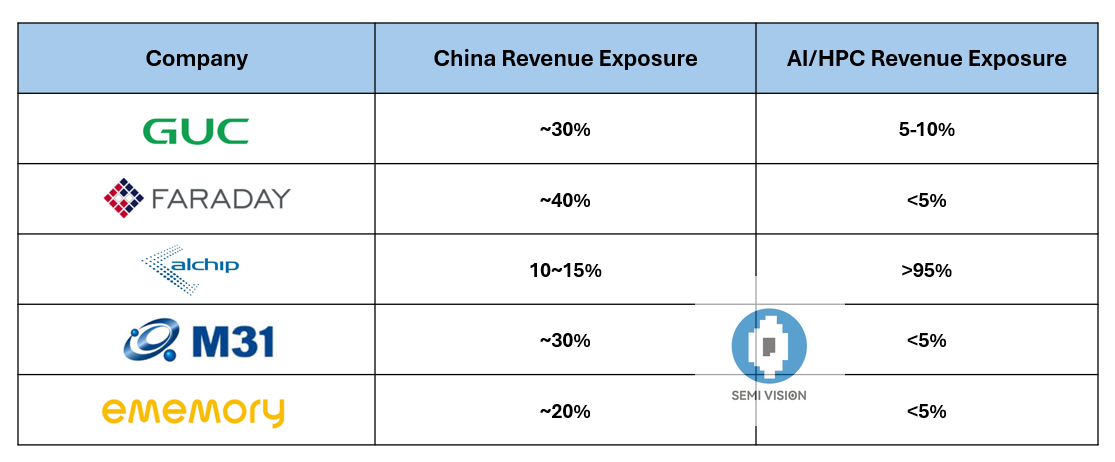

IP/IC design service companies face primarily limited risks from the latest export controls on China, focusing mainly on mature manufacturing processes with no direct impact.

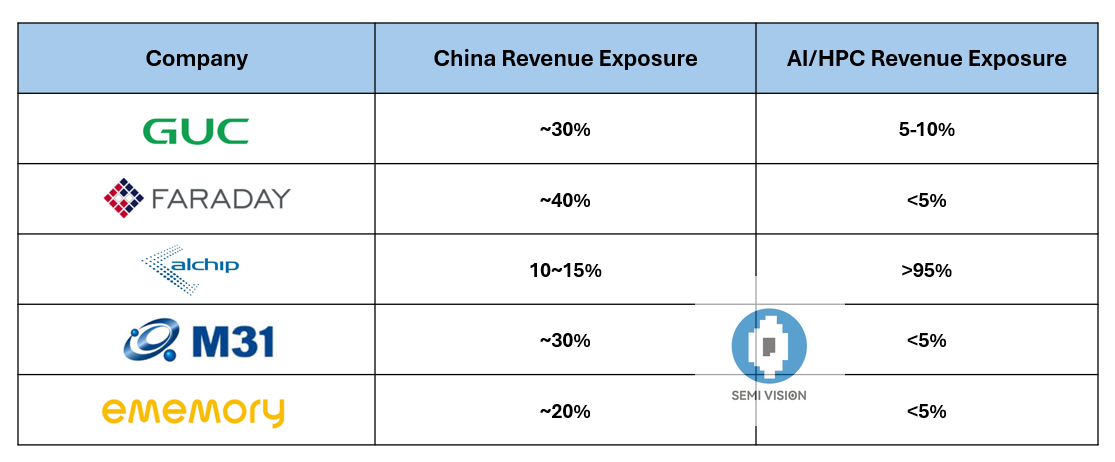

The new wave of export controls on China may affect AI applications, particularly in HPC and related fields. Taiwanese IC design companies generally concentrate on mature processes, and their revenue exposure to China has already been gradually reduced since the 2023 export controls. For example, GUC and Alchip focus on industrial and network applications for China, with the majority of their sales in N12 and above processes. Therefore, the impact of the new regulations is expected to be minimal. According to Alchip, its revenue from China has recently decreased to about 10%, with only specific HPC-related projects, such as ADAS, potentially facing a negative impact.

Overall, we believe the IC design service industry will experience minimal impact, although there may be some influence on their Chinese orders. As for IP vendors, the new regulatory measures are expected to bring no direct impact in the short term. However, if design houses are restricted from shipping to China due to stricter regulatory compliance, they may face indirect impacts.

tspasemiconductor.substack.com

tspasemiconductor.substack.com

It is rumored in the market that some Chinese customers have obtained advanced process chips before the restrictions, which is why the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) is requiring TSMC to stop supplying all products below the N7 process to Chinese customers.

According to our understanding, the BIS has not yet formally issued an order, so TSMC is expected to avoid penalties by proactively complying with BIS export control regulations. TSMC will likely increase its level of scrutiny on Chinese AI businesses, and the new regulations are expected to take effect on November 11. Once the new regulations begin, N7 and below products may temporarily cease supply to Chinese customers. This is expected to have the greatest impact on HPC/AI and related products, while other consumer products should still be available to China as long as they comply with BIS’s conditions.

We believe TSMC will not be significantly affected in the short term. China’s revenue accounted for 12% of TSMC’s revenue in 2023, and we estimate a decline of less than 10% in 2024. Additionally, TSMC’s AI revenue from China is estimated to account for no more than 3% of total revenue in 2024, and this ratio may further decline by 2025.

This is because most of TSMC’s AI revenue comes from U.S. customers. Therefore, we remain cautiously optimistic about TSMC’s future growth and believe that the U.S. will remain TSMC’s main growth driver.

IP/IC design service companies face primarily limited risks from the latest export controls on China, focusing mainly on mature manufacturing processes with no direct impact.

The new wave of export controls on China may affect AI applications, particularly in HPC and related fields. Taiwanese IC design companies generally concentrate on mature processes, and their revenue exposure to China has already been gradually reduced since the 2023 export controls. For example, GUC and Alchip focus on industrial and network applications for China, with the majority of their sales in N12 and above processes. Therefore, the impact of the new regulations is expected to be minimal. According to Alchip, its revenue from China has recently decreased to about 10%, with only specific HPC-related projects, such as ADAS, potentially facing a negative impact.

Overall, we believe the IC design service industry will experience minimal impact, although there may be some influence on their Chinese orders. As for IP vendors, the new regulatory measures are expected to bring no direct impact in the short term. However, if design houses are restricted from shipping to China due to stricter regulatory compliance, they may face indirect impacts.

BIS Imposes Export Controls on TSMC’s N7 and Below Chips, Impact Expected to Be Limited

New Export Restrictions Target Advanced Semiconductor Nodes, Minimal Disruption Anticipated for TSMC