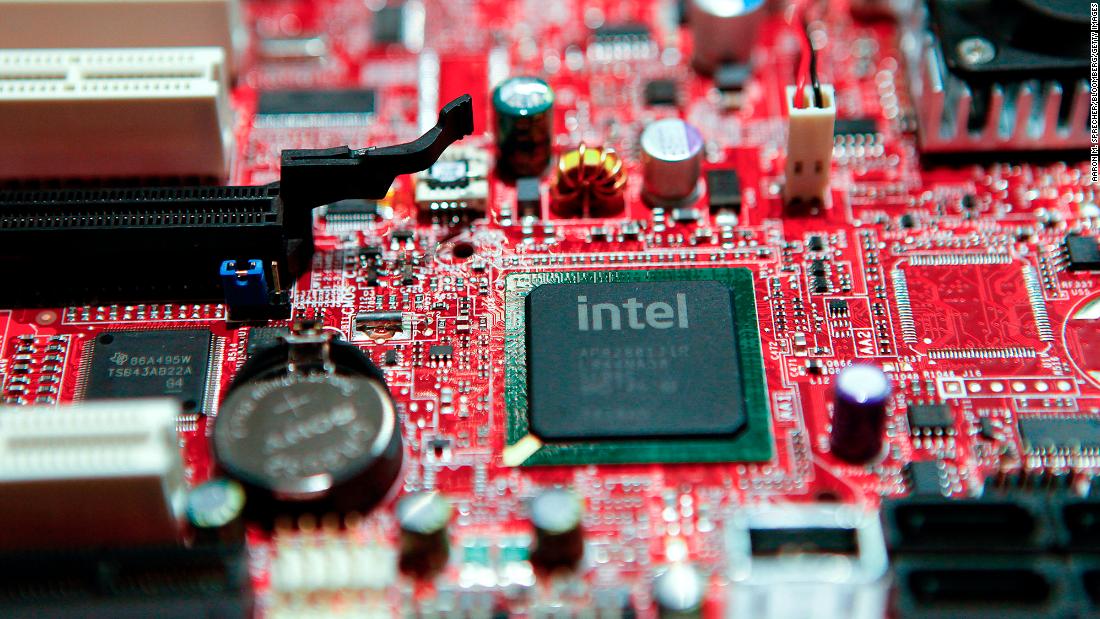

Yes, the DJIA is a price-weighted index, so higher performing stocks accrue a greater weight over time than lower-performing ones. The performance of INTC has been rather abysmal compared to most of the other 29 stocks in the average. Still, based on the experience of other stocks which fell out of the Dow 30, if a company is selected to be dropped, its stock price falls every time.

The WSJ committee which manages the DJIA index does not like volatility. So QCOM and NVDA probably give them indigestion. So would MU. BRCM, the best choice IMO, probably has history that's too controversial for the committee. The chip equipment companies are pretty small, market cap-wise. Given this index is more artificial (meaning, human committee driven), as far as I'm concerned it gets far more attention than it deserves, and it wouldn't bother me at all if it went away.

My choice would be Broadcom, but, like I said, I doubt it would be considered.