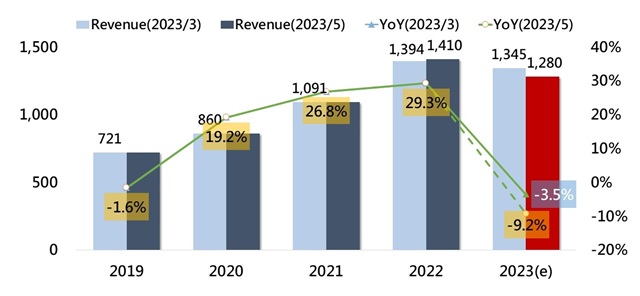

With the Ukraine war, global inflation, and geopolitical tensions, consumer electronics sales plunged, which further caused a decrease in semiconductor sales. Given the weakened demand for chips, DIGITIMES Research projects a 9.2% decline in global foundry industry revenue for 2023.

Global foundry revenue, 2019-2023 (Unit: US$100m)

Inventory adjustment in the first half of 2023 is taking longer than anticipated. Weak chip demand poses challenges for the global fabs revenue outlook. Analyst Eric Chen from DIGITIMES Research highlights that although the AI frenzy is bolstering the High-Performance Computing (HPC) market, the overall demand for foundries remains sluggish from the slowing global economy. While the electronics supply chain is expected to return to balance in the second half of 2023, significant activation in terms of materials preparation for typical peak seasons is yet to be seen so far.

Consumer electronics products have seen strong sales driven by the remote work trend since the COVID-19 pandemic. However, smartphones, PCs and notebooks shipment declined last year. Only server demand sees healthy growth from large data center operators. As a response in recession, chipmakers seek to reduce 2023 CapEX and output. Four product categories mentioned above are expected to continue shipment volume drop.

Apart from the weak demand, chip suppliers have to face geopolitical challenges. Taiwan captures over 60% of the global foundry market, surpassing South Korea, China, the United States, and other regions. Washington-Beijing tech battles have hammered China's semiconductor ambitions. Whether US-imposed sanctions really work depends on the forming alliances, especially Europe's intriguing stance. The shifts in the global semiconductor landscape will continue.

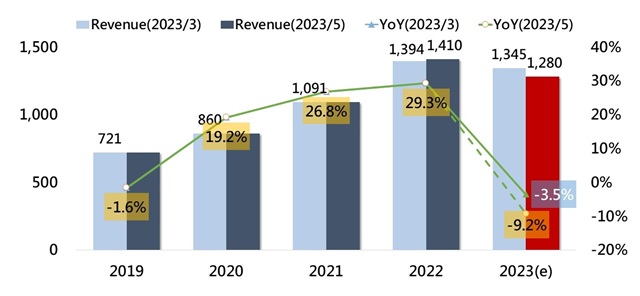

Global foundry revenue, 2019-2023 (Unit: US$100m)

Inventory adjustment in the first half of 2023 is taking longer than anticipated. Weak chip demand poses challenges for the global fabs revenue outlook. Analyst Eric Chen from DIGITIMES Research highlights that although the AI frenzy is bolstering the High-Performance Computing (HPC) market, the overall demand for foundries remains sluggish from the slowing global economy. While the electronics supply chain is expected to return to balance in the second half of 2023, significant activation in terms of materials preparation for typical peak seasons is yet to be seen so far.

Consumer electronics products have seen strong sales driven by the remote work trend since the COVID-19 pandemic. However, smartphones, PCs and notebooks shipment declined last year. Only server demand sees healthy growth from large data center operators. As a response in recession, chipmakers seek to reduce 2023 CapEX and output. Four product categories mentioned above are expected to continue shipment volume drop.

Apart from the weak demand, chip suppliers have to face geopolitical challenges. Taiwan captures over 60% of the global foundry market, surpassing South Korea, China, the United States, and other regions. Washington-Beijing tech battles have hammered China's semiconductor ambitions. Whether US-imposed sanctions really work depends on the forming alliances, especially Europe's intriguing stance. The shifts in the global semiconductor landscape will continue.

Global foundry revenue to drop 9% in 2023, says DIGITIMES Research

With the Ukraine war, global inflation, and geopolitical tensions, consumer electronics sales plunged, which further caused a decrease in semiconductor sales. Given the weakened demand for chips, DIGITIMES Research projects a 9.2% decline in global foundry industry revenue for 2023.

www.digitimes.com