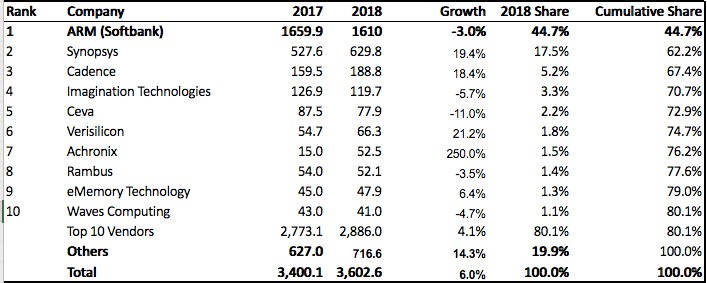

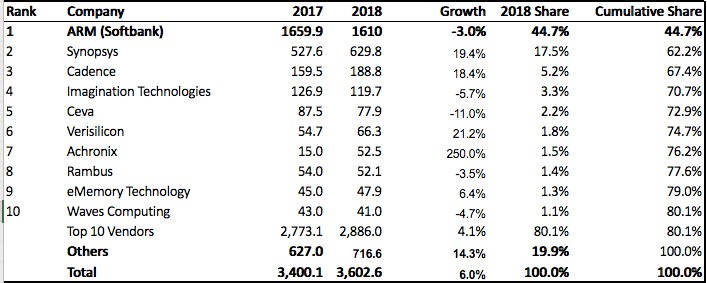

…but ARM, Imagination, MIPS or Ceva have declined and lose market share. Semiconductor design IP market is still doing good in 2018, with 6% growth year over year. It’s half the growth rate seen in 2017, 2016 and 2015 and the growth decline is imputable to bad results from ARM, the market leader, but also from Imagination (#4), MIPS (#10) or CEVA (#5).

In fact, 2018 was an excellent year for #2 Synopsys (+19.4%) or #3 Cadence (+18.4%), as well as for Achronix (eFPGA IP vendor) joining the Top 10 for the first time. We think that a combination of reasons is responsible of the market behavior. We can invoke the negative impact of corporate strategy for ARM or Imagination (or Apple’s decision to develop their own GPU to be more specific), but we think that these results highlight the beginning of a shift from general purpose IP toward more application specific products.

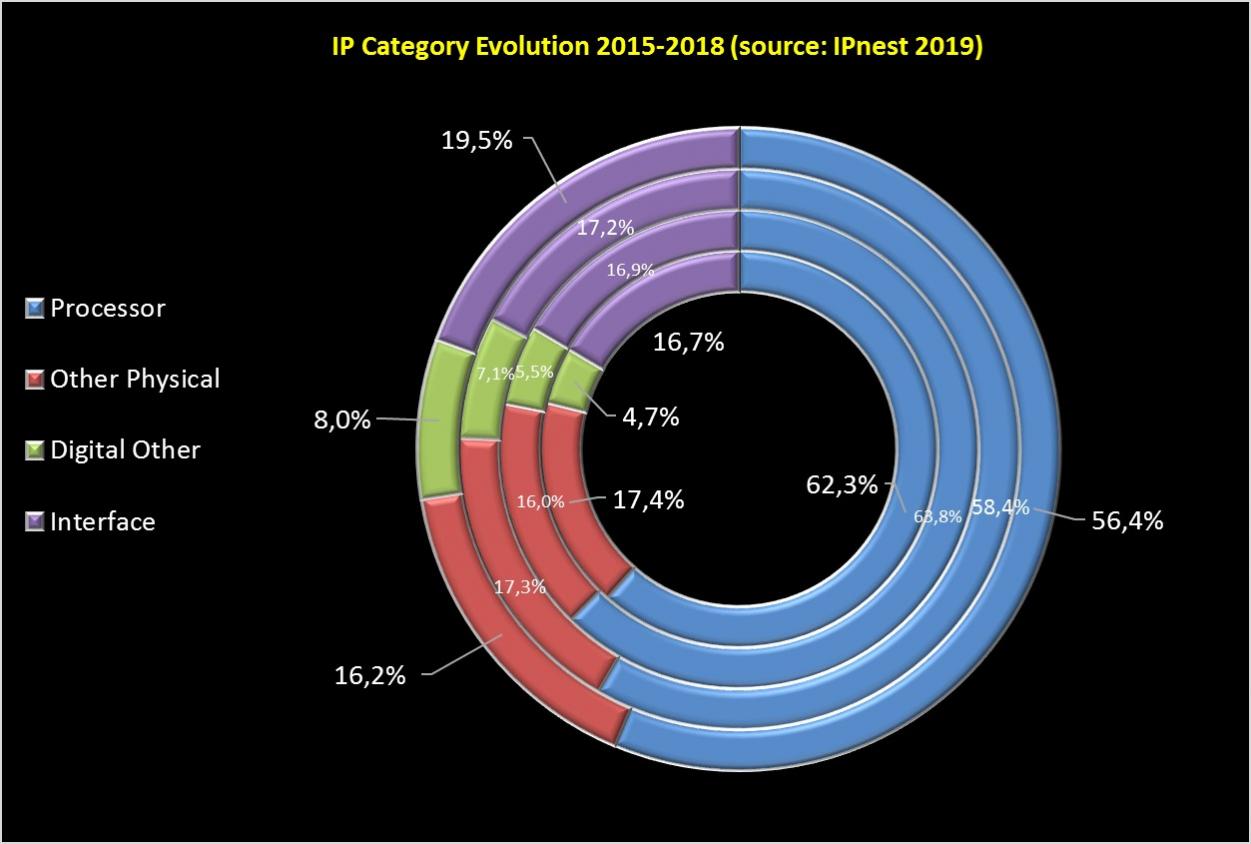

If we start by the positive outcome, the result of strategic decision taken long time ago by Synopsys or Cadence, we see that both companies have developed a strong offer in interface IP category. Namely, memory controller IP, PCI Express or Ethernet/SerDes for both, completed by USB, MIPI, SATA or HDMI for Synopsys. Synopsys has invested in the wired interface IP market with the acquisition of inSilicon (USB IP) in 2002 or Cascade (PCI Express) in 2004 and has built a one stop shop port-folio to address the interface market. With Denali acquisition in 2010, Cadence became a serious challenger, offering top class memory controller and PCI Express IP.

At that time, this wired interface market was just weighting $250 million (IPnest was already publishing the “Interface IP Survey”) and this market has seen a 13.7% CAGR for 2018/2010, to reach $700+ million. Betting on high growth and sustainable market just reflects the quality of a corporate strategy. (Should I remind you that, in 2005, ARM was one of key players, offering PCIe SerDes, before deciding to exit this market…)

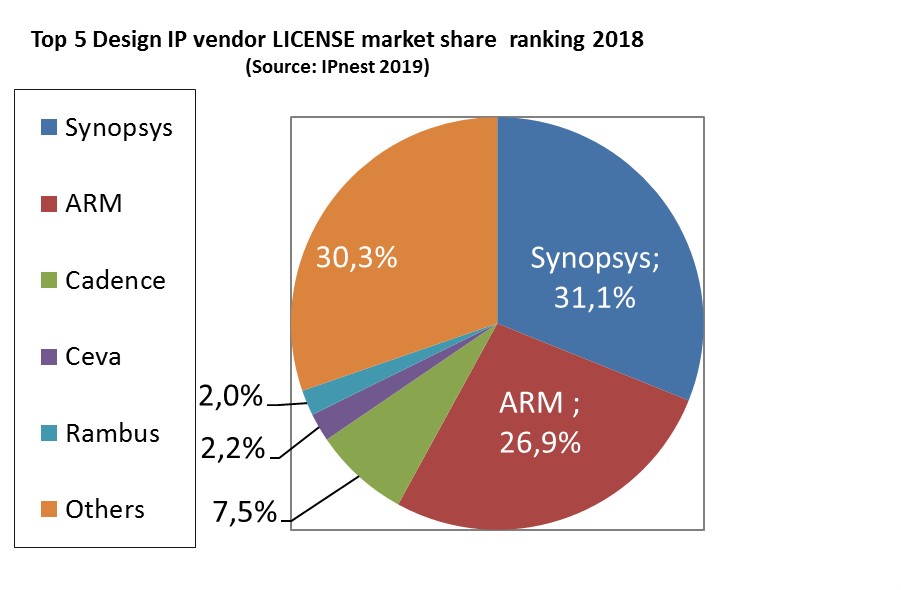

We can clearly see the market share transfer between “Processor” and “Interface” during 2015 to 2018 on the above graphic. But this market share transfer between these two categories can’t be the only explanation. In fact, both Cadence and Synopsys have acquired processor IP vendors, respectively ARC in 2010 and TenSilica in 2013. When ARM has seen strong licensing revenues decline (-16%) in 2018, both Cadence and Synopsys are experiencing good revenues growth (+12 to 13%) in the processor category. The impact on IP vendors ranking by licensingrevenues in 2018 is clear, as we can see on the below picture:

We think that these results reflects a change in the chip maker behavior. During the last two decades, the SoC designers have integrated a CPU which was available, proven and benefiting from a strong ecosystem, and they could concentrate on developing the chip on the next node to benefit from Moore’ law impact on cost, performance and power consumption.

Today, except for data center, networking or application processor, the chip makers have to differentiate while using less expensive nodes. They have to develop an application specific chip, differentiating on power consumption and/or cost rather than pure performance. They expect to integrate a CPU (or DSP) which can be exactly tailored for their application need, instead than just a general purpose CPU/DSP.

When looking at the IP offering from Cadence or Synopsys, they can find this kind of application specific CPU/DSP. In short, this move from general purpose CPU/DSP IP towards application specific IP could explain Synopsys or Cadence success.

To comfort this theory, the decline of ARM licensing is not unique, and two very dynamic IP vendors, CEVA (DSP) and Andes Technology (CPU) have experienced the same decline in licensing revenues in 2018. Nevertheless 2019 and after will be very interesting, with RISC-V potential adoption (will this attractive solution be effectively widely adopted?) and the explosion of chips developed using performance intensive AI.

Unfortunately for ARM, offering RISC-V is not realistic, and MIPS has been the first to take the virage to AI support, thanks to their acquisition by Waves Computing. Nevertheless, ARM will stay the king of application processor for smartphone, offering a very complete solution with their CPU, big-little and GPU IP. This should grow again their royalty flow (like it did in 2018), but what’s about their licensing revenues?

If I want to be exhaustive about ARM, I have to mention the company “strategy” in China, which I find pretty difficult to understand. I propose to just give validated facts, to be honest I have no insight information, and I prefer the reader to make his decision:

- In May 2017, ARM (SoftBank) create a JV with “Chinese Partners”

- In June 2018 “Arm, owned by SoftBank, has agreed to sell control of its Chinese business for $775m”

- In February 2019, ARM publish their results for 2018, showing a 16.1% decline for licensing revenues ($490 million in 2018 vs $584 million in 2017) after 8.3% in 2017 ($584 million in 2017 vs $637 million in 2016)

If anybody would like to comment or provide some validated information, please feel free to do it!

Let’s end with some very positive information that the reader could find in the “Design IP Report” 2019 version from IPnest, related to the mid-size IP vendors who are doing very well, posting revenues growing by 25% or even 40% YoY. This is an heterogeneous list of companies, like Silicon Creations, PLDA or Achronix. That they have in common is a strong focus on the product they develop, the goal to provide top quality IP and support their customer differentiation needs.

If you buy a PLL in 7nm to Silicon Creations, it really has to perfectly work, or your SoC will collapse. PLDA sells PCIe controller IP, for 15 years, and knows how to fill customer needs for differentiation. Achronix is selling high-end FPGA since mid-2000, and the company has decided to offer embedded FPGA (eFPGA IP) since a couple of years, making the necessary investment to offer a viable solution. The company strategy has been recognized in 2018 with IP revenues topping $50 million.

Finally, I have no doubt that next year we will see the quantitative effect of very high speed DSP-based SerDes adoption. It should positively impact the 56/112G SerDes IP licensing revenues of Synopsys, Cadence, Alphawave, Rambus or eSilicon… Don’t forget that this type of SerDes is an essential piece of the overal modern system, used to linked data center, networking and 5G base stations (more to come about PAM4 112G SerDes, the session that I chair at DAC this year)…

If you’re interested by this “Design IP Report” released in May 2019, just contact me: eric.esteve@ip-nest.com .

I hope you will go to the DAC 2019 in Las Vegas, so we could meet!

Eric Esteve from IPnest

The Data Crisis is Unfolding – Are We Ready?