Though rising 7%, total semiconductor units forecast to fall short of all-time record.

Annual semiconductor unit shipments, including integrated circuits and optoelectronics, sensors, and discrete (O-S-D) devices are forecast to rise 7% in 2020 and surpass one trillion units for the second time in history, based on data presented in the new, 2020 edition of IC Insights’ McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry, released in January 2020.

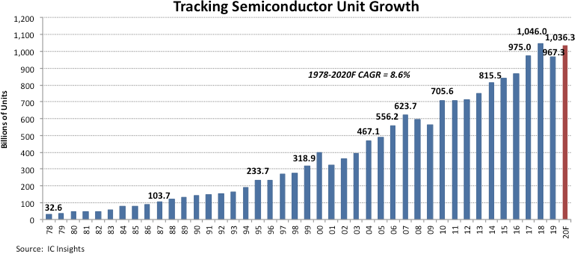

The 7% increase to 1,036.3 billion total semiconductor shipments expected in 2020 follows an 8% decline in 2019 and 7% growth in 2018, the year that semiconductor shipments reached 1,046.0 billion units—a record high that is expected to remain in place through at least this year (Figure 1). Starting with 32.6 billion units in 1978 and ending in 2020, the compound annual growth rate (CAGR) for semiconductor units is forecast to be 8.6%, an impressive annual growth rate over 42 years, given the cyclical and often volatile nature of the semiconductor industry.

Figure 1

From 2004-2007, semiconductor shipments broke through the 400-, 500-, and 600-billion unit levels before the global financial meltdown led to a steep decline in semiconductor shipments in 2008 and 2009. Unit growth rebounded sharply in 2010 with a 25% increase and surpassed 700 billion devices that year. Another strong increase in 2017 (12% growth) lifted semiconductor unit shipments beyond the 900-billion level before the one trillion mark was surpassed in 2018.

The 25% increase in 2010 was the second-highest growth rate across the time 42-year time span. The largest annual increase in semiconductor unit growth was 34% in 1984, and the biggest decline was 19% in 2001 following the dot-com bust. The global financial meltdown and ensuing recession caused semiconductor shipments to fall in both 2008 and 2009; the only time there have been consecutive years of unit shipment declines.

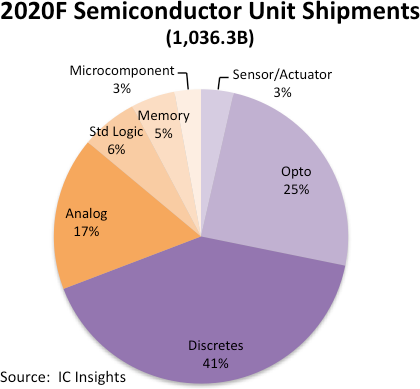

By a greater than 2:1 margin, the percentage split of total semiconductor shipments is forecast to remain weighted toward O-S-D devices in 2020 (Figure 2). O-S-D devices are forecast to account for 69% of total semiconductor units compared to 31% for ICs. This percentage split has remained fairly steady over the years. Many of the semiconductor categories forecast to have the strongest unit growth rates in 2020 are those that are essential building blocks for smartphones, automotive electronics systems, and devices that are essential in computing systems used in artificial intelligence, cloud and “big data” systems, and deep learning applications.

Figure 2

Report Details: The McClean Report 2020

Additional details on IC and semiconductor unit and market growth trends are provided in the 2020 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Report includes free monthly updates from March through November (including the 200+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual user license to The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

PDF Version of This Bulletin

A PDF version of this Research Bulletin can be downloaded from our website at http://www.icinsights.com/news/bulletins/

Annual semiconductor unit shipments, including integrated circuits and optoelectronics, sensors, and discrete (O-S-D) devices are forecast to rise 7% in 2020 and surpass one trillion units for the second time in history, based on data presented in the new, 2020 edition of IC Insights’ McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry, released in January 2020.

The 7% increase to 1,036.3 billion total semiconductor shipments expected in 2020 follows an 8% decline in 2019 and 7% growth in 2018, the year that semiconductor shipments reached 1,046.0 billion units—a record high that is expected to remain in place through at least this year (Figure 1). Starting with 32.6 billion units in 1978 and ending in 2020, the compound annual growth rate (CAGR) for semiconductor units is forecast to be 8.6%, an impressive annual growth rate over 42 years, given the cyclical and often volatile nature of the semiconductor industry.

Figure 1

From 2004-2007, semiconductor shipments broke through the 400-, 500-, and 600-billion unit levels before the global financial meltdown led to a steep decline in semiconductor shipments in 2008 and 2009. Unit growth rebounded sharply in 2010 with a 25% increase and surpassed 700 billion devices that year. Another strong increase in 2017 (12% growth) lifted semiconductor unit shipments beyond the 900-billion level before the one trillion mark was surpassed in 2018.

The 25% increase in 2010 was the second-highest growth rate across the time 42-year time span. The largest annual increase in semiconductor unit growth was 34% in 1984, and the biggest decline was 19% in 2001 following the dot-com bust. The global financial meltdown and ensuing recession caused semiconductor shipments to fall in both 2008 and 2009; the only time there have been consecutive years of unit shipment declines.

By a greater than 2:1 margin, the percentage split of total semiconductor shipments is forecast to remain weighted toward O-S-D devices in 2020 (Figure 2). O-S-D devices are forecast to account for 69% of total semiconductor units compared to 31% for ICs. This percentage split has remained fairly steady over the years. Many of the semiconductor categories forecast to have the strongest unit growth rates in 2020 are those that are essential building blocks for smartphones, automotive electronics systems, and devices that are essential in computing systems used in artificial intelligence, cloud and “big data” systems, and deep learning applications.

Figure 2

Report Details: The McClean Report 2020

Additional details on IC and semiconductor unit and market growth trends are provided in the 2020 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Report includes free monthly updates from March through November (including the 200+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual user license to The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

PDF Version of This Bulletin

A PDF version of this Research Bulletin can be downloaded from our website at http://www.icinsights.com/news/bulletins/