Array

(

[content] =>

[params] => Array

(

[0] => /forum/index.php?threads/intel-ccg-pc-op-margin-down-7-server-op-margin-down-10.15377/page-3

)

[addOns] => Array

(

[DL6/MLTP] => 13

[Hampel/TimeZoneDebug] => 1000070

[SV/ChangePostDate] => 2010200

[SemiWiki/Newsletter] => 1000010

[SemiWiki/WPMenu] => 1000010

[SemiWiki/XPressExtend] => 1000010

[ThemeHouse/XLink] => 1000970

[ThemeHouse/XPress] => 1010570

[XF] => 2021370

[XFI] => 1050270

)

[wordpress] => /var/www/html

)

Guests have limited access.

Join our community today!

Join our community today!

You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please, join our community today!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intel CCG (PC) op margin down 7%. Server op margin down 10%!!!

- Thread starter VCT

- Start date

hist78

Well-known member

AMD margin close to Intel after AMD paid TSMC a lot of money. That mean the cost of TSMC may be significantly lower than that of Intel.

However, AMD increased GPU price in Q4. Such high GPU margin is hard to sustain in the long run.

I have to say TSMC and TSMC's fabless customers are in partnership for greater profit. But it's a very different story between Intel and Intel's customers. The foundry and fabless model really works!

TSMC 2021 Gross Profit Margin: 51.60%

Selected TSMC Fabless customers 2021 Gross Profit Margin:

AMD: 48.00%

Apple: 41.78%

Broadcom: 62.62% (Oct. 2021)

Marvel: 50.45% (Fiscal year is February-January)

Mediatek: 46.90%

Nvidia: 65.20% (Oct. 2021 )

Qualcomm: 65.20% (Oct. 2021)

Xilinx: 68.40%

Intel 2021 Gross Profit Margin: 56.00%

Selected Intel customers 2021 Gross Profit Margin:

Acer: 17.70%

Asus: 10.90%

Dell: 28.54% (Fiscal year is February-January.)

HP Inc: 21.11% (Fiscal year is November-October)

HP Enterprise: 32.67% (Fiscal year is November-October)

Lenovo: 14.66% (Fiscal year is April-March)

Mike Bruzzone

New member

Input having read the comment string on AMD and Intel continuous production economic and financial assessment.

Intel is applying price pressure as an AMD competitive limiter and both enterprise's consumer components are currently netting their variable cost of production; $109 for Intel and range $72 to $82 for AMD; sales, MG&A, R&D cost, that's it. AMD 7nm product line is at run end late market and has no cost advantage v Intel SF 10/x on the TSMC mark up. AMD consumer gross is $197 per unit but then cost eats up the margin down to variable net.

Intel consumer gross is $204 in the same situation as AMD cost eating margin down to variable net. Intel Alder full line offering is missing its many SKUs 1K economic price points > $409 outside 900_. I expect Alder S top-bin $617, $715, $749, $999 to be filled into q2 and Alder H mobile will also pull up the gross. AMD will add 3D into the consumer line up, some high end dGPU however has primarily turned its focus to commercial sales and commercial margins especially in dGPU acceleration and high frequency compute on AMD and Nvidia racing for seats and sockets before Intel shows up strong in commercial. Channel inflated dGPU price also presents an issue causing supply to back up into the production chain where AMD and Nvidia have gone customer direct including for the margin. And for AMD especially will not allow margin secured from channel inflated Navi prices to fund channel and retail Intel Alder purchase where AMD sales cuts off channels who do not return margin made on AMD products on continuing procurements.

Note Intel SF10/x has reached cost parity with TSMC 7. At 7 its the TSMC markup draining AMD who already moved to 6/5 for the area performance advantage to make up for the TSMC markup within AMD price at 6/5.

AMD has moved to 6/5nm and Genoa has to be in production on AMD loss of performance for area advantage at 7 nm. Where AMD and Intel are making profit is on their commercial chips but not much. Average price of Epyc Milan/Genoa risk sample and Ice/CLr bundle/SR risk sample across the full line is $722 for Intel and $733 for AMD. AMD commercial (Epyc) gross is $1993 but TSMC markup eats up most of the profit. Intel Xeon gross is $1353.

AMD production all up is currently range 33 M to 38 M units a quarter and surpassed 100 M for the first time ever at 117 M in 2021. Intel Xeon is 10 M per quarter down from 25 M per quarter at Scalable Skylake and Cascade Lakes. Intel Core is around 92 M units currently however between Xeon and Core the total is higher on bundle deal thrown into sales package hovering between 30m and 40 M units q3 and q4 Intel has been clearing slack from inventory (past hat) at a revenue sacrifice of around $4 billion although lower on an at cost basis.

On Chip Act there is no federal funding for Intel until Intel Inside price fix procurement overcharge under Title 48 is returned to the government. The federal and states offer on the table is $19 billion. However, States can make any deal they want with Intel. Traditionally Intel refuses national funds because Intel does not want government snooping in Intel's business. More AMD and Intel q4 and other data at my Seeking Alpha comment line scroll down through the last 30 days of comments including WW channel inventory; dGPU, desktop and there is a Xeon report at Next Platform.

Mike Bruzzone, Camp Marketing

Intel is applying price pressure as an AMD competitive limiter and both enterprise's consumer components are currently netting their variable cost of production; $109 for Intel and range $72 to $82 for AMD; sales, MG&A, R&D cost, that's it. AMD 7nm product line is at run end late market and has no cost advantage v Intel SF 10/x on the TSMC mark up. AMD consumer gross is $197 per unit but then cost eats up the margin down to variable net.

Intel consumer gross is $204 in the same situation as AMD cost eating margin down to variable net. Intel Alder full line offering is missing its many SKUs 1K economic price points > $409 outside 900_. I expect Alder S top-bin $617, $715, $749, $999 to be filled into q2 and Alder H mobile will also pull up the gross. AMD will add 3D into the consumer line up, some high end dGPU however has primarily turned its focus to commercial sales and commercial margins especially in dGPU acceleration and high frequency compute on AMD and Nvidia racing for seats and sockets before Intel shows up strong in commercial. Channel inflated dGPU price also presents an issue causing supply to back up into the production chain where AMD and Nvidia have gone customer direct including for the margin. And for AMD especially will not allow margin secured from channel inflated Navi prices to fund channel and retail Intel Alder purchase where AMD sales cuts off channels who do not return margin made on AMD products on continuing procurements.

Note Intel SF10/x has reached cost parity with TSMC 7. At 7 its the TSMC markup draining AMD who already moved to 6/5 for the area performance advantage to make up for the TSMC markup within AMD price at 6/5.

AMD has moved to 6/5nm and Genoa has to be in production on AMD loss of performance for area advantage at 7 nm. Where AMD and Intel are making profit is on their commercial chips but not much. Average price of Epyc Milan/Genoa risk sample and Ice/CLr bundle/SR risk sample across the full line is $722 for Intel and $733 for AMD. AMD commercial (Epyc) gross is $1993 but TSMC markup eats up most of the profit. Intel Xeon gross is $1353.

AMD production all up is currently range 33 M to 38 M units a quarter and surpassed 100 M for the first time ever at 117 M in 2021. Intel Xeon is 10 M per quarter down from 25 M per quarter at Scalable Skylake and Cascade Lakes. Intel Core is around 92 M units currently however between Xeon and Core the total is higher on bundle deal thrown into sales package hovering between 30m and 40 M units q3 and q4 Intel has been clearing slack from inventory (past hat) at a revenue sacrifice of around $4 billion although lower on an at cost basis.

On Chip Act there is no federal funding for Intel until Intel Inside price fix procurement overcharge under Title 48 is returned to the government. The federal and states offer on the table is $19 billion. However, States can make any deal they want with Intel. Traditionally Intel refuses national funds because Intel does not want government snooping in Intel's business. More AMD and Intel q4 and other data at my Seeking Alpha comment line scroll down through the last 30 days of comments including WW channel inventory; dGPU, desktop and there is a Xeon report at Next Platform.

Mike Bruzzone, Camp Marketing

hist78

Well-known member

Input having read the comment string on AMD and Intel continuous production economic and financial assessment.

Intel is applying price pressure as an AMD competitive limiter and both enterprise's consumer components are currently netting their variable cost of production; $109 for Intel and range $72 to $82 for AMD; sales, MG&A, R&D cost, that's it. AMD 7nm product line is at run end late market and has no cost advantage v Intel SF 10/x on the TSMC mark up. AMD consumer gross is $197 per unit but then cost eats up the margin down to variable net.

Intel consumer gross is $204 in the same situation as AMD cost eating margin down to variable net. Intel Alder full line offering is missing its many SKUs 1K economic price points > $409 outside 900_. I expect Alder S top-bin $617, $715, $749, $999 to be filled into q2 and Alder H mobile will also pull up the gross. AMD will add 3D into the consumer line up, some high end dGPU however has primarily turned its focus to commercial sales and commercial margins especially in dGPU acceleration and high frequency compute on AMD and Nvidia racing for seats and sockets before Intel shows up strong in commercial. Channel inflated dGPU price also presents an issue causing supply to back up into the production chain where AMD and Nvidia have gone customer direct including for the margin. And for AMD especially will not allow margin secured from channel inflated Navi prices to fund channel and retail Intel Alder purchase where AMD sales cuts off channels who do not return margin made on AMD products on continuing procurements.

Note Intel SF10/x has reached cost parity with TSMC 7. At 7 its the TSMC markup draining AMD who already moved to 6/5 for the area performance advantage to make up for the TSMC markup within AMD price at 6/5.

AMD has moved to 6/5nm and Genoa has to be in production on AMD loss of performance for area advantage at 7 nm. Where AMD and Intel are making profit is on their commercial chips but not much. Average price of Epyc Milan/Genoa risk sample and Ice/CLr bundle/SR risk sample across the full line is $722 for Intel and $733 for AMD. AMD commercial (Epyc) gross is $1993 but TSMC markup eats up most of the profit. Intel Xeon gross is $1353.

AMD production all up is currently range 33 M to 38 M units a quarter and surpassed 100 M for the first time ever at 117 M in 2021. Intel Xeon is 10 M per quarter down from 25 M per quarter at Scalable Skylake and Cascade Lakes. Intel Core is around 92 M units currently however between Xeon and Core the total is higher on bundle deal thrown into sales package hovering between 30m and 40 M units q3 and q4 Intel has been clearing slack from inventory (past hat) at a revenue sacrifice of around $4 billion although lower on an at cost basis.

On Chip Act there is no federal funding for Intel until Intel Inside price fix procurement overcharge under Title 48 is returned to the government. The federal and states offer on the table is $19 billion. However, States can make any deal they want with Intel. Traditionally Intel refuses national funds because Intel does not want government snooping in Intel's business. More AMD and Intel q4 and other data at my Seeking Alpha comment line scroll down through the last 30 days of comments including WW channel inventory; dGPU, desktop and there is a Xeon report at Next Platform.

Mike Bruzzone, Camp Marketing

"Intel is applying price pressure as an AMD competitive limiter and both enterprise's consumer components are currently netting their variable cost of production..."

You brought up an interesting point.

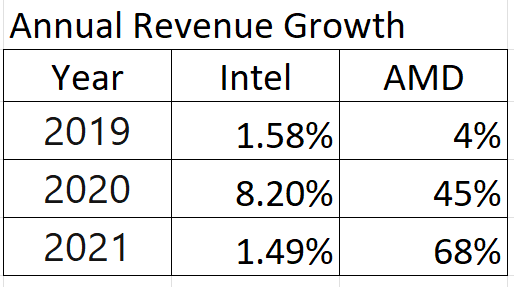

In the past three years, Intel and AMD annual revenue growth rate (vs previous year) is as follows:

If Intel is applying price pressure on AMD, I can't see Intel achieved a great result from that practice. I'm wondering what could have happened if Intel didn't cut their price?

To me it's AMD imposing heavy price pressure on Intel in the past three years.

Last edited:

tooLongInEDA

Moderator

But the picture is reversed if you're looking in the rear view mirror !"Intel is applying price pressure as an AMD competitive limiter and both enterprise's consumer components are currently netting their variable cost of production..."

You brought up an interesting point.

In the past three years, Intel and AMD annual revenue growth rate (vs previous year) is as follows:

View attachment 643

If Intel is applying price pressure on AMD, we can't see a great result from that practice. I'm wondering what could have happened if Intel didn't cut their price?

To me it's AMD imposing heavy price pressure on Intel in the past three years.

Biggest difference is that AMD was able to significantly improve the production capacity, Intel seems to be struggling with ramping up its 7nm products. The situation with supply will get worse because Intel wants to move to 3nm in 2023."Intel is applying price pressure as an AMD competitive limiter and both enterprise's consumer components are currently netting their variable cost of production..."

You brought up an interesting point.

In the past three years, Intel and AMD annual revenue growth rate (vs previous year) is as follows:

View attachment 643

If Intel is applying price pressure on AMD, I can't see Intel achieved a great result from that practice. I'm wondering what could have happened if Intel didn't cut their price?

To me it's AMD imposing heavy price pressure on Intel in the past three years.

Arthur Hanson

Well-known member

Only Biden would choose to invest in a loser, when he could invest in a proven winners like the combination of TSM, AMD and Nvidia. Which would be better a proven winner like TSM building a fab or letting Intel attempt to build one and taking your chances? I wish Intel was the winner, but their record speaks for itself. This is not the critical time to take chances, when the US has a chance to retake the lead.

hist78

Well-known member

According to Intel's roadmap, by 2025 they will ramp up or deliver 4 new generations of professors including Intel 7, Intel 4, Intel 3, and Intel 20A. How can Intel rapidly bring their products to the market under so many internal and external manufacturing and supply chain issues?Biggest difference is that AMD was able to significantly improve the production capacity, Intel seems to be struggling with ramping up its 7nm products. The situation with supply will get worse because Intel wants to move to 3nm in 2023.

Especially many of those external supply chain constraints are not what Intel can control.

You are comparing profit margins between companies from different industries. What exactly the point of such comparison?I have to say TSMC and TSMC's fabless customers are in partnership for greater profit. But it's a very different story between Intel and Intel's customers. The foundry and fabless model really works!

TSMC 2021 Gross Profit Margin: 51.60%

Selected TSMC Fabless customers 2021 Gross Profit Margin:

AMD: 48.00%

Apple: 41.78%

Broadcom: 62.62% (Oct. 2021)

Marvel: 50.45% (Fiscal year is February-January)

Mediatek: 46.90%

Nvidia: 65.20% (Oct. 2021 )

Qualcomm: 65.20% (Oct. 2021)

Xilinx: 68.40%

Intel 2021 Gross Profit Margin: 56.00%

Selected Intel customers 2021 Gross Profit Margin:

Acer: 17.70%

Asus: 10.90%

Dell: 28.54% (Fiscal year is February-January.)

HP Inc: 21.11% (Fiscal year is November-October)

HP Enterprise: 32.67% (Fiscal year is November-October)

Lenovo: 14.66% (Fiscal year is April-March)

tooLongInEDA

Moderator

It is obviously better if your customers are profitable and growing fast. This is also one reason why automotive is a less attractive market historically for chip vendors - their customers have very tight profit margins.You are comparing profit margins between companies from different industries. What exactly the point of such comparison?

Sure. Yet oone can't expect the same profit margins for the customers when one company's customers are computer OEMs and another company's customers are chip designers. Those are incompatible businesses with totally different revenue and cost structures.It is obviously better if your customers are profitable and growing fast. This is also one reason why automotive is a less attractive market historically for chip vendors - their customers have very tight profit margins.

hist78

Well-known member

It's about ecosystem and it's about value proposition.You are comparing profit margins between companies from different industries. What exactly the point of such comparison?

TSMC: Please do business with us because you'll make a lot profit while we (TSMC) are making a lot of money too.

Intel: Please do business with us because you'll not make a lot profit while we (Intel) are making a lot money.

For most investors their choice will be easily going for TSMC and TSMC's customers/partners after looking at the profit and revenue performance. More profit, more revenue, and more investment will enable TSMC and TSMC's customers to do more R&D, more marketing, and more innovations. It's a very healthy cycle.

On the Intel side, Intel is fighting multiple wars all by themselves. With limited profit margin, Intel's customers can't afford to invest too much and can't help Intel too much either.

Last year TSMC's customers were willing to send in $6.7 billion prepayment to secure capacity and help out TSMC's expansion. Do we hear Intel's customers doing similar things? Intel's customers are struggling and exhausted.

Intel's IDM business model is the most significant factor that causes many Intel's problems. Even with the new Intel Foundry Service, I don't think Intel can improve their value proposition too much.

Are you suggesting Lenovo, Dell etc. to buy CPUs from TSMC instead of Intel to increase their profit margins? How about Nvidia's profit margins? They are doing business with the biggest IDM out there: Samsung. Also, look at Apple. Their customers (people) are making zero profits. Does that mean Apple is doomed? Comparing Intel's IDM business with TSMC's foundry business is just silly (well, there are some comparisons that would make sense but not the profit margins of their customers). Wait until Intel builds some meaningful foundry business and then compare it with TSMC.It's about ecosystem and it's about value proposition.

TSMC: Please do business with us because you'll make a lot profit while we (TSMC) are making a lot of money too.

Intel: Please do business with us because you'll not make a lot profit while we (Intel) are making a lot money.

For most investors their choice will be easily going for TSMC and TSMC's customers/partners after looking at the profit and revenue performance. More profit, more revenue, and more investment will enable TSMC and TSMC's customers to do more R&D, more marketing, and more innovations. It's a very healthy cycle.

On the Intel side, Intel is fighting multiple wars all by themselves. With limited profit margin, Intel's customers can't afford to invest too much and can't help Intel too much either.

Last year TSMC's customers were willing to send in $6.7 billion prepayment to secure capacity and help out TSMC's expansion. Do we hear Intel's customers doing similar things? Intel's customers are struggling and exhausted.

Intel's IDM business model is the most significant factor that causes many Intel's problems. Even with the new Intel Foundry Service, I don't think Intel can improve their value proposition too much.

hist78

Well-known member

"Are you suggesting Lenovo, Dell etc. to buy CPUs from TSMC instead of Intel to increase their profit margins?"

Some of them don't need to go too far to find a remedy. They just need to send purchase orders to AMD instead of Intel. They have done so already and are still doing it today. That's why AMD's revenue growth rate is much much faster than Intel's.

For those companies with deep pockets, they may choose to add inhouse semi design projects. Their consideration are based on cost, features, performance, availability, and competitiveness. Their strategies go above and beyond what Intel can or can't do. Amazon, Apple, Google, and Microsoft are doing so with great results.

Some of them don't need to go too far to find a remedy. They just need to send purchase orders to AMD instead of Intel. They have done so already and are still doing it today. That's why AMD's revenue growth rate is much much faster than Intel's.

For those companies with deep pockets, they may choose to add inhouse semi design projects. Their consideration are based on cost, features, performance, availability, and competitiveness. Their strategies go above and beyond what Intel can or can't do. Amazon, Apple, Google, and Microsoft are doing so with great results.

Last edited:

How is Intel going to build foundry comparable to TSMC? Samsung wasn't able to do it and Samsung is bigger financial powerhouse than Intel.Are you suggesting Lenovo, Dell etc. to buy CPUs from TSMC instead of Intel to increase their profit margins? How about Nvidia's profit margins? They are doing business with the biggest IDM out there: Samsung. Also, look at Apple. Their customers (people) are making zero profits. Does that mean Apple is doomed? Comparing Intel's IDM business with TSMC's foundry business is just silly (well, there are some comparisons that would make sense but not the profit margins of their customers). Wait until Intel builds some meaningful foundry business and then compare it with TSMC.

I wouldn't know. We'll see. I think we all agree it's not going to be easy.How is Intel going to build foundry comparable to TSMC? Samsung wasn't able to do it and Samsung is bigger financial powerhouse than Intel.

tooLongInEDA

Moderator

Realised I forgot the obvious corrollary to my earlier comment about some of the Intel 10nm fab equipment being fully depreciated by now - i.e. that's even more true for Intel 14nm ! Intel's depreciation costs must surely be competitive or lower than TSMC's. I wonder if we'll ever see historic yield numbers for Intel 10nm over the last 5-6 years. Any guesses where they might be right now ?