For perspective: AMD "crashed" even more today (not to mention a catastrophic last month)Why Intel Stock Crashed 7% (at this moment)

Why Intel Stock Crashed 7% Today | The Motley Fool

Earnings weren't as bad as feared, but they were still pretty bad -- and guidance is lousy.www.fool.com

Array

(

[content] =>

[params] => Array

(

[0] => /forum/index.php?threads/intel-ccg-pc-op-margin-down-7-server-op-margin-down-10.15377/page-2

)

[addOns] => Array

(

[DL6/MLTP] => 13

[Hampel/TimeZoneDebug] => 1000070

[SV/ChangePostDate] => 2010200

[SemiWiki/Newsletter] => 1000010

[SemiWiki/WPMenu] => 1000010

[SemiWiki/XPressExtend] => 1000010

[ThemeHouse/XLink] => 1000970

[ThemeHouse/XPress] => 1010570

[XF] => 2021370

[XFI] => 1050270

)

[wordpress] => /var/www/html

)

Guests have limited access.

Join our community today!

Join our community today!

You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please, join our community today!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intel CCG (PC) op margin down 7%. Server op margin down 10%!!!

- Thread starter VCT

- Start date

hist78

Well-known member

Comparing AMD, TSMC, Nvidia or any other semiconductor companies' stock price won't help Intel to tackle their problems, at least for the next several years.For perspective: AMD "crashed" even more today (not to mention a catastrophic last month)

This is the seventh consecutive post earnings announcement crash for Intel. It seems no mater how hard Intel tried to paint the rosy pictures, the Street just doesn't buy it. If this is the case, can Intel leadership stop worrying about their stock price, stop buying stocks back, stop increasing dividends, and go straight into all their issues honestly?

tooLongInEDA

Moderator

Is there a case for Intel doing a management buy out - or going private - if they strongly believe the stock is under-valued and don't want the Wall Street quarterly pressure while they turn things round ?Comparing AMD, TSMC, Nvidia or any other semiconductor companies' stock price won't help Intel to tackle their problems, at least for the next several years.

This is the seventh consecutive post earnings announcement crash for Intel. It seems no mater how hard Intel tried to paint the rosy pictures, the Street just doesn't buy it. If this is the case, can Intel leadership stop worrying about their stock price, stop buying stocks back, stop increasing dividends, and go straight into all their issues honestly?

Check "Supplemental Platform Revenue Information" of quarterly results:Is the margin squeeze from higher R&D costs, lower volumes shipped or lower ASPs ? Or some combination of these ? That would tell us a bit more. Not good if it's lower ASPs.

https://www.intc.com/news-events/pr...ll-year-2021-financial?linkId=100000107027324 :

When comparing 2021 to 2020, desktop ASP went up, notebook / datacenter ASP went down.

This is the seventh consecutive post earnings announcement crash for Intel. It seems no mater how hard Intel tried to paint the rosy pictures, the Street just doesn't buy it.

Almost:

Starting 3 days after earnings, you will see on the internet lots of shills talking up INTC SP; and that shill content "the Street" does buy! The share price always goes up 3 days after earnings until the evening before next earnings, indeed driven by rosy Intel PR, but also shills posting content about how Intel is leading the competition, has great succes in diversifying and all that.

Earnings is always when reality sets in, reality being not the same as what the shills post to "popular investor" websites.

tooLongInEDA

Moderator

Thanks. I misread that first time - the data presentation makes it easy to mis-read it (perhaps intentionally ?).Check "Supplemental Platform Revenue Information" of quarterly results:

https://www.intc.com/news-events/pr...ll-year-2021-financial?linkId=100000107027324 :

When comparing 2021 to 2020, desktop ASP went up, notebook / datacenter ASP went down.

Yes, notebook ASPs have slipped significantly. During a [relative] chip shortage. Not a good sign. Also suggests Intel might be shipping more low end vs high end chips.

That's an oversimplification to say the least. There are plenty of articles in business press with negative outlook for INTC. There are people/funds on both long and short sides of INTC and they both do a PR. There is nothing special here about Intel.Almost:

Starting 3 days after earnings, you will see on the internet lots of shills talking up INTC SP; and that shill content "the Street" does buy! The share price always goes up 3 days after earnings until the evening before next earnings, indeed driven by rosy Intel PR, but also shills posting content about how Intel is leading the competition, has great succes in diversifying and all that.

Earnings is always when reality sets in, reality being not the same as what the shills post to "popular investor" websites.

hist78

Well-known member

My true intention is in in the second part of my post:Almost:

Starting 3 days after earnings, you will see on the internet lots of shills talking up INTC SP; and that shill content "the Street" does buy! The share price always goes up 3 days after earnings until the evening before next earnings, indeed driven by rosy Intel PR, but also shills posting content about how Intel is leading the competition, has great success in diversifying and all that.

Earnings is always when reality sets in, reality being not the same as what the shills post to "popular investor" websites.

"If this is the case, can Intel leadership stop worrying about their stock price, stop buying stocks back, stop increasing dividends, and go straight into all their issues honestly?"

There are plenty of difficulties, challenges, and opportunities in front of Intel for the next 5 years. Try to "manage" stock price is the least critical and less impactful for Intel's future.

hist78

Well-known member

Thanks. I misread that first time - the data presentation makes it easy to mis-read it (perhaps intentionally ?).

Yes, notebook ASPs have slipped significantly. During a [relative] chip shortage. Not a good sign. Also suggests Intel might be shipping more low end vs high end chips.

ASP is important but it might not tell the whole story. And for a company as large as Intel, how they come out the ASP is as important as the number itself.

If I understand it correctly, Intel sold 8% more units of desktop processors and 8% more units of notebook processors in 2021 than 2020. Yet Intel CCG 2021 operating income decreased 3% from 2020.

That means the more processors Intel sells the less operating income achieved by CCG!? It might be partially caused by closing down Intel modem and home gateway business within the CCG but is it the only reason? How can this strange thing happen during this global chip shortage and all other major semiconductor companies report double digit revenue growth and great profit?

Is Intel offering some rebate programs to PC makers (brought down the revenue), some incentive programs to customers in order to increase volume (increased expense and decreased profit), or due to the higher cost of manufacturing new products/new nodes?

Since the "Contra Revenue" practice Intel did about 7 years ago, I often felt Intel's financial reports become harder and harder to understand.

From Intel 10-K filing Intel just filed with SEC, Intel stated that:

"

▪Increased unit sales driven by continued strength in notebook demand and recovery in desktop demand driven by consumer and commercial recovery from COVID-19 lows.

▪Lower notebook ASPs due to strength in the consumer and education market segments, partially offset by higher desktop ASPs driven by commercial recovery from COVID-19.

▪Decrease in adjacent revenue primarily driven by the continued ramp down from the exit of our 5G smartphone modem and Home Gateway Platform businesses, partially offset by strength in wireless and connectivity.

"

Source: Page 22, https://www.intc.com/filings-reports/all-sec-filings##document-5130-0000050863-22-000007-1

P

Portland

Guest

America needs a pure play Fab that rivals tsmc. People want it to be Intel but they're an idm company.

The leadership at tsmc should be acknowledged.

The leadership at tsmc should be acknowledged.

ASP is important but it might not tell the whole story. And for a company as large as Intel, how they come out the ASP is as important as the number itself.

If I understand it correctly, Intel sold 8% more units of desktop processors and 8% more units of notebook processors in 2021 than 2020. Yet Intel CCG 2021 operating income decreased 3% from 2020.

That means the more processors Intel sells the less operating income achieved by CCG!? It might be partially caused by closing down Intel modem and home gateway business within the CCG but is it the only reason? How can this strange thing happen during this global chip shortage and all other major semiconductor companies report double digit revenue growth and great profit?

Is Intel offering some rebate programs to PC makers (brought down the revenue), some incentive programs to customers in order to increase volume (increased expense and decreased profit), or due to the higher cost of manufacturing new products/new nodes?

Since the "Contra Revenue" practice Intel did about 7 years ago, I often felt Intel's financial reports become harder and harder to understand.

From Intel 10-K filing Intel just filed with SEC, Intel stated that:

"

▪Increased unit sales driven by continued strength in notebook demand and recovery in desktop demand driven by consumer and commercial recovery from COVID-19 lows.

▪Lower notebook ASPs due to strength in the consumer and education market segments, partially offset by higher desktop ASPs driven by commercial recovery from COVID-19.

▪Decrease in adjacent revenue primarily driven by the continued ramp down from the exit of our 5G smartphone modem and Home Gateway Platform businesses, partially offset by strength in wireless and connectivity.

"

View attachment 637

Source: Page 22, https://www.intc.com/filings-reports/all-sec-filings##document-5130-0000050863-22-000007-1

Not entirely sure, but in the last few years; you will always see in the "Profit walk", the reasons why revenue went up or down.

And it always has been saying, less income because of more 10nm.

That is, the less 14nm; the less the income, the less the margin.

For CCG, It's at page 22, see below.

Costs are ramping up 4nm (EUV I guess??), ramping down 14nm I'm not sure what it means, maybe if you have less 14nm you have less scale advantage.

"850M of Increased investment in leadership products" --> I'm not sure what that means, but if I understood correctly 10nm (or maybe 7nm as it's called now) has more steps than 14nm, so more operating expenses. Also there's the backported Rocket-Lake, taking huge amounts of die space, and I guess the whole big.Little adaptation (I don't remember what Intel calls it) was probably also expensive.

$14,672 - 2021 Operating Income

(850) Higher operating expenses driven by increased investment in leadership products

(565) Higher period charges primarily associated with the ramp up of Intel 4

(240) Higher period charges primarily associated with the ramp down of 14nm

(185) Lower adjacent product margin primarily driven by the exit of our 5G smartphone modem business

(140) Higher period charges driven by less sell-through of reserves on non-qualified platform products in 2021 as compared to in 2020, and other reserves taken in 2021[/TD]

....

...

$15,129

2020 Operating Income

Costs are ramping up 4nm (EUV I guess??), ramping down 14nm I'm not sure what it means, maybe if you have less 14nm you have less scale advantage.

"850M of Increased investment in leadership products" --> I'm not sure what that means, but if I understood correctly 10nm (or maybe 7nm as it's called now) has more steps than 14nm, so more operating expenses. Also there's the backported Rocket-Lake, taking huge amounts of die space, and I guess the whole big.Little adaptation (I don't remember what Intel calls it) was probably also expensive.

$14,672 - 2021 Operating Income

(850) Higher operating expenses driven by increased investment in leadership products

(565) Higher period charges primarily associated with the ramp up of Intel 4

(240) Higher period charges primarily associated with the ramp down of 14nm

(185) Lower adjacent product margin primarily driven by the exit of our 5G smartphone modem business

(140) Higher period charges driven by less sell-through of reserves on non-qualified platform products in 2021 as compared to in 2020, and other reserves taken in 2021[/TD]

....

...

$15,129

2020 Operating Income

Last edited:

hist78

Well-known member

To @hkwint and @VCT,

There are things in Intel's earnings report I don't understand. Using CCG as an example.

Deploying new manufacturing technologies may increase expense but they are always amortized to multiple years (say five years) by taxing and accounting rules. Intel is not a startup company and they know how to handle it. Intel did explain why CCG's expense increased but didn't explain convincingly why CCG revenue stays flat, $40.5 billion in 2021 vs. $40.1 billion in 2020, 1% Year over Year increase.

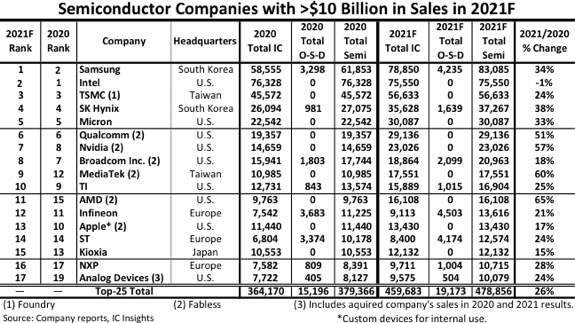

On the other hand Intel managed to increase CCG 2020 revenue by 8% from 2019 under the horrible supply chain disruptions during the 2020 Covid-19 pandemic. Then in 2021 under the assault of Covid-19 all top 17 semiconductor companies (except Intel) experienced double-digit growth! Intel is still blaming this staggering CCG 2021 revenue to Covid-19 and supply chain problems. Why Intel is so different from other? I don't expect CCG to grow as much as AMD's 65% but I don't think 5% to 10% is unreasonable for Intel to achieve in 2021. The 1% CCG 2021 growth is very intriguing to me.

Source: https://semiwiki.com/forum/index.ph...o-have-10-0-billion-in-sales-this-year.15237/

In addition to Intel's official explanations, my guess/speculation about the staggering 2021 CCG revenue and its increased expense is as follows:

1. Intel might offer various incentives to CCG customers in order to compete against AMD and maintain volumes. Those incentives could not impact the revenue and reduce the ASP at all. For example, offering some joint marketing/advertising money to PC manufacturers.

2. Intel's CCG products doesn't have a good lineup to meet market demand.

3. Intel's manufacturing capacity and yield limited CCG's growth.

3. AMD is eating into some Intel's market.

4. Intel decided to let CCG to shoulder more cost to help DCG (Data Center Group). Intel DCG 2021 revenue was down 1% from 2020. Again DCG's 2021 negative growth is against the performance of the whole semiconductor industry achieved.

There are things in Intel's earnings report I don't understand. Using CCG as an example.

Deploying new manufacturing technologies may increase expense but they are always amortized to multiple years (say five years) by taxing and accounting rules. Intel is not a startup company and they know how to handle it. Intel did explain why CCG's expense increased but didn't explain convincingly why CCG revenue stays flat, $40.5 billion in 2021 vs. $40.1 billion in 2020, 1% Year over Year increase.

On the other hand Intel managed to increase CCG 2020 revenue by 8% from 2019 under the horrible supply chain disruptions during the 2020 Covid-19 pandemic. Then in 2021 under the assault of Covid-19 all top 17 semiconductor companies (except Intel) experienced double-digit growth! Intel is still blaming this staggering CCG 2021 revenue to Covid-19 and supply chain problems. Why Intel is so different from other? I don't expect CCG to grow as much as AMD's 65% but I don't think 5% to 10% is unreasonable for Intel to achieve in 2021. The 1% CCG 2021 growth is very intriguing to me.

Source: https://semiwiki.com/forum/index.ph...o-have-10-0-billion-in-sales-this-year.15237/

In addition to Intel's official explanations, my guess/speculation about the staggering 2021 CCG revenue and its increased expense is as follows:

1. Intel might offer various incentives to CCG customers in order to compete against AMD and maintain volumes. Those incentives could not impact the revenue and reduce the ASP at all. For example, offering some joint marketing/advertising money to PC manufacturers.

2. Intel's CCG products doesn't have a good lineup to meet market demand.

3. Intel's manufacturing capacity and yield limited CCG's growth.

3. AMD is eating into some Intel's market.

4. Intel decided to let CCG to shoulder more cost to help DCG (Data Center Group). Intel DCG 2021 revenue was down 1% from 2020. Again DCG's 2021 negative growth is against the performance of the whole semiconductor industry achieved.

Last edited:

Most Intel 12th gen motherboards requires DDR5 DRAM which has very little supply in 2021 Q4.To @hkwint and @VCT,

There are things in Intel's earnings report I don't understand. Using CCG as an example.

Deploying new manufacturing technologies may increase expense but they are always amortized to multiple years (say five years) by taxing and accounting rules. Intel is not a startup company and they know how to handle it. Intel did explain why CCG's expense increased but didn't explain convincingly why CCG revenue stays flat, $40.5 billion in 2021 vs. $40.1 billion in 2020.

On the other hand Intel managed to increase CCG 2020 by 8% from 2019 under the horrible supply chain disruptions during the 2020 Covid-19 pandemic. Then in 2021 under the assault of Covid-19 all top 17 semiconductor companies (except Intel) experienced double-digit growth! Intel is blaming this staggering CCP 2021 revenue to Covid-19. Why Intel is so different from other? I don't expect CCG to grow as much as AMD's 65% but I don't think 5% to 10% is unreasonable for Intel to achieve in 2021.

View attachment 638

Source: https://semiwiki.com/forum/index.ph...o-have-10-0-billion-in-sales-this-year.15237/

In addition to Intel's official explanations, my guess/speculation about the staggering 2021 CCG revenue and its increased expense is as follows:

1. Intel might offer various incentives to CCG customers in order to compete against AMD and maintain volumes. Those incentives might not impact the revenue and reduce the ASP at all. For example, offering some joint marketing/advertising money to PC manufacturers.

2. Intel's CCG products doesn't have a good lineup to meet market demand.

3. Intel's manufacturing capacity and yield limited CCG's growth.

3. AMD is eating into some Intel's market.

4. Intel decided to let CCG to shoulder more cost to help DCG (Data Center Group). Intel DCG 2021 revenue was down 1% from 2020. Again DCG's 2021 negative growth is against the performance of the whole semiconductor industry achieved.

tooLongInEDA

Moderator

It's even more baffling than that. Intel has been spent at least 5 years getting 10nm out. That means that at least some of their 10nm fab equipment must now be fully depreciated and so any cost impact from the new node transition should be reduced ... . The fact that the results do not make sense merely reinforces some of the credibility gap around Intel at the moment. You would have thought that playing it straight would be more in their interests at the moment.To @hkwint and @VCT,

There are things in Intel's earnings report I don't understand. Using CCG as an example.

Deploying new manufacturing technologies may increase expense but they are always amortized to multiple years (say five years) by taxing and accounting rules. Intel is not a startup company and they know how to handle it. Intel did explain why CCG's expense increased but didn't explain convincingly why CCG revenue stays flat, $40.5 billion in 2021 vs. $40.1 billion in 2020.

On the other hand Intel managed to increase CCG 2020 revenue by 8% from 2019 under the horrible supply chain disruptions during the 2020 Covid-19 pandemic. Then in 2021 under the assault of Covid-19 all top 17 semiconductor companies (except Intel) experienced double-digit growth! Intel is still blaming this staggering CCP 2021 revenue to Covid-19 and supply chain problems. Why Intel is so different from other? I don't expect CCG to grow as much as AMD's 65% but I don't think 5% to 10% is unreasonable for Intel to has achieve in 2021.

View attachment 638

Source: https://semiwiki.com/forum/index.ph...o-have-10-0-billion-in-sales-this-year.15237/

In addition to Intel's official explanations, my guess/speculation about the staggering 2021 CCG revenue and its increased expense is as follows:

1. Intel might offer various incentives to CCG customers in order to compete against AMD and maintain volumes. Those incentives might not impact the revenue and reduce the ASP at all. For example, offering some joint marketing/advertising money to PC manufacturers.

2. Intel's CCG products doesn't have a good lineup to meet market demand.

3. Intel's manufacturing capacity and yield limited CCG's growth.

3. AMD is eating into some Intel's market.

4. Intel decided to let CCG to shoulder more cost to help DCG (Data Center Group). Intel DCG 2021 revenue was down 1% from 2020. Again DCG's 2021 negative growth is against the performance of the whole semiconductor industry achieved.

hist78

Well-known member

Yes, you're right. Unless Intel really waited until the last moment to invest? It's a similar situation that Intel invested the most money in ASML yet purchased the least number (vs TSMC and Samsung) of EUV machines from ASML.It's even more baffling than that. Intel has been spent at least 5 years getting 10nm out. That means that at least some of their 10nm fab equipment must now be fully depreciated and so any cost impact from the new node transition should be reduced ... . The fact that the results do not make sense merely reinforces some of the credibility gap around Intel at the moment. You would have thought that playing it straight would be more in their interests at the moment.

Bob swan mentioned a year(or two) ago that Intel 14nm node was the most profitable node. This means Intel 10nm(or Intel 7) isn't really that profitable so it's somewhat expected. What we really need to look into is how Intel 4 and 3 work along with their IDM 2.0 model. Quite curious how IDM and foundry mix works along with advanced packaging technology, on a financial point as well.

What I find it hard to believe is that they spent at least 5 years to get 10nm out and now the new ceo is delusional enough to think he can eke out 5 node advances in 5 years. Let's face it he wasn't exactly in the bleeding edge foundry business in the last decade plus. So my money is on Intel falling flat on their face yet again as they look to expand sharply into the fab business: 2 plants in AZ, 1 massive one in OH and more to come..).It's even more baffling than that. Intel has been spent at least 5 years getting 10nm out. That means that at least some of their 10nm fab equipment must now be fully depreciated and so any cost impact from the new node transition should be reduced ... . The fact that the results do not make sense merely reinforces some of the credibility gap around Intel at the moment. You would have thought that playing it straight would be more in their interests at the moment.

hist78

Well-known member

AMD just released their 2021 earnings. It's in a stark contrast with Intel's earnings direction.

https://semiwiki.com/forum/index.ph...-up-over-3-percentage-points-from-2020.15401/

https://semiwiki.com/forum/index.ph...-up-over-3-percentage-points-from-2020.15401/