White House Weighs Invoking Defense Law to Get Chip Data

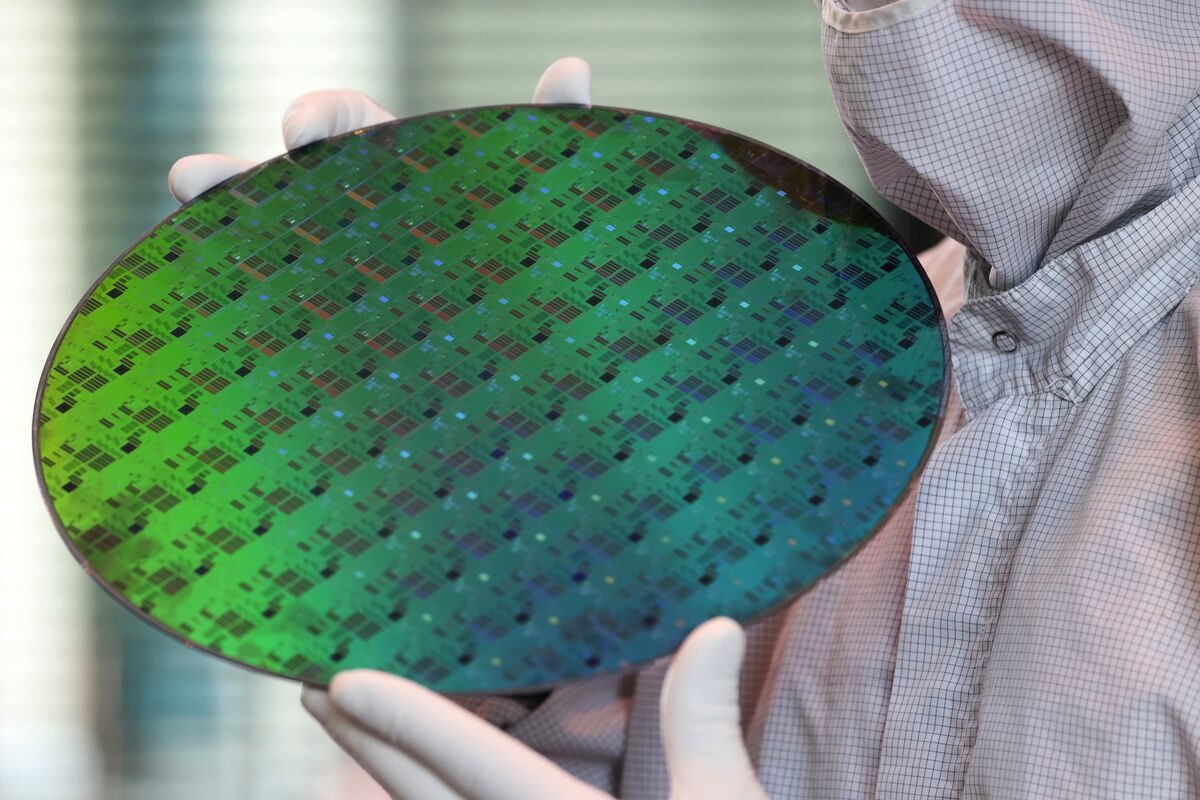

The Biden administration is considering invoking a Cold War-era national security law to force companies in the semiconductor supply chain to provide information on inventory and sales of chips, Commerce Secretary Gina Raimondo said Thursday.

White House to help solve the shortage through usage of Defense Production Act to force semiconductor companies to share information in order to solve the crises

What does the community think? I can see the logical merit in checking on customers whether they are double or triple ordering but this seems to be focused on suppliers.

My opinion (that my better judgement in me suggests that I should not share) is: how will the White House (most with political or liberal arts degrees that don’t understand the complexities or lead times) help one of the most complex industries with thousands of the smartest people in world…