triceratops24

New member

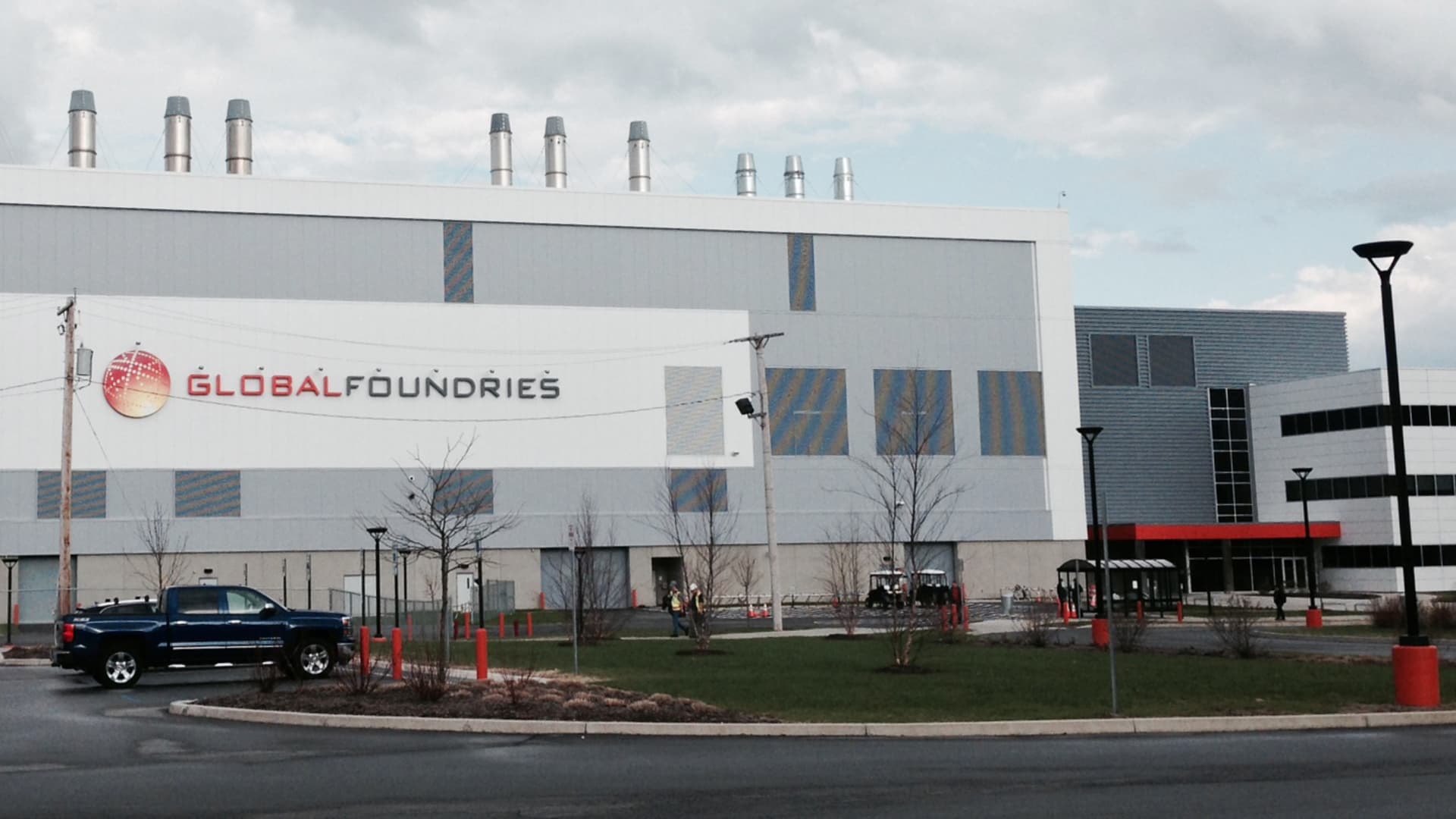

Abu Dhabi-controlled GlobalFoundries files for U.S. IPO amid worldwide chip shortage

GlobalFoundries, which is owned by the government of Abu Dhabi, is planning to sell shares in an IPO and trade on the Nasdaq.

Last edited by a moderator: