Please remember this when you read that China is catching up in the race to semiconductor supremacy becuase its not gonna happen.

SHANGHAI (Reuters) - Tsinghua Unigroup, a major government-backed player in China’s technology race, has defaulted on a 1.3-billion-yuan ($197.96 million) bond, three sources said, as several high-profile delinquencies by state firms rattled the country’s bond market.

The default by Tsinghua Unigroup, a wholly-owned division of the prestigious Tsinghua University in Beijing, on Monday immediately triggered a credit rating downgrade that is expected to weaken the company’s financial health.

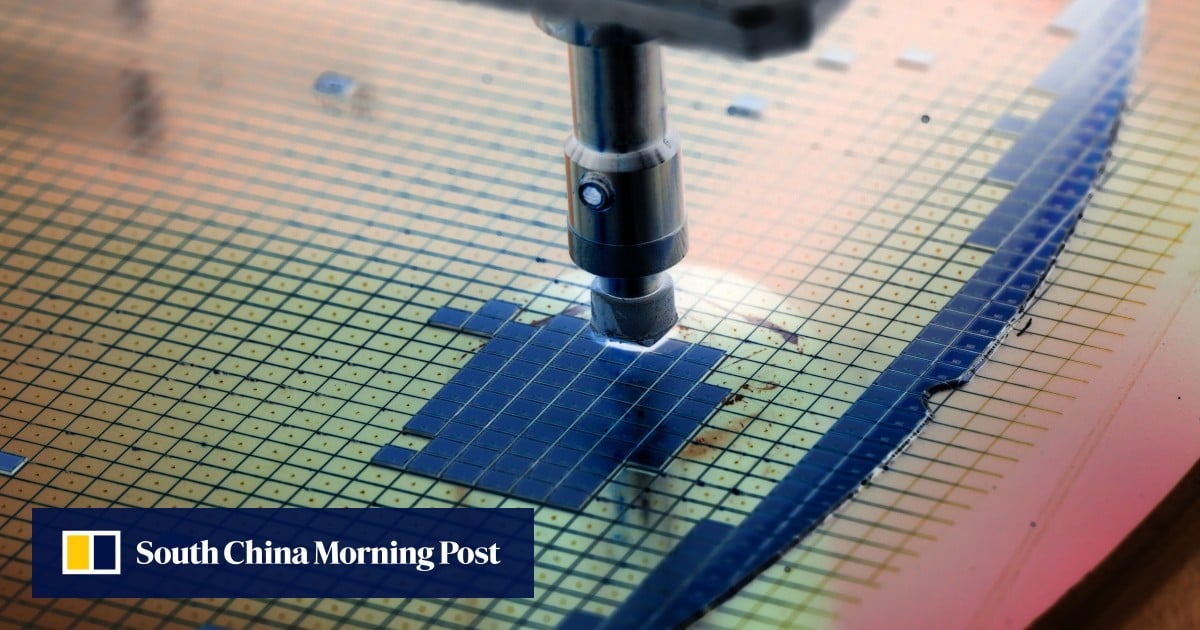

The semiconductor conglomerate has been a major driving force in Beijing’s campaign to boost its chip industry amid an ongoing spat over trade and technology with Washington, which has drawn attention to China’s reliance on key imported components.

Tsinghua Unigroup defaulted after its proposal to extend a repayment deadline failed to gain support from bondholders, sources said.

Tsinghua Unigroup’s credit rating was slashed to BBB from AA on Monday by China Chengxin International Credit Rating Co. The rating agency said the event could trigger cross-defaults, potentially strangling its funding and squeezing its liquidity.

RELATED COVERAGE

Factbox: China state enterprises facing debt problems

The company could not be immediately reached for comment.

Tsinghua Unigroup’s default follows other state borrowers, including coal miner Yongcheng Coal & Electricity Holding Group and automaker Huachen Automotive Group, which have failed to service debts on time, triggering a sell-off in some corners of the corporate bond market.

Even before the default, Tsinghua Unigroup’s bond prices had already plunged after the company said it would not exercise its option to redeem a perpetual bond.

On Tuesday, the price on a corporate bond issued by Unigroup’s parent, Tsinghua Holdings, tumbled more than 14%, making it the worst performing bond on the Shanghai Stock Exchange.

www.reuters.com

www.reuters.com

SHANGHAI (Reuters) - Tsinghua Unigroup, a major government-backed player in China’s technology race, has defaulted on a 1.3-billion-yuan ($197.96 million) bond, three sources said, as several high-profile delinquencies by state firms rattled the country’s bond market.

The default by Tsinghua Unigroup, a wholly-owned division of the prestigious Tsinghua University in Beijing, on Monday immediately triggered a credit rating downgrade that is expected to weaken the company’s financial health.

The semiconductor conglomerate has been a major driving force in Beijing’s campaign to boost its chip industry amid an ongoing spat over trade and technology with Washington, which has drawn attention to China’s reliance on key imported components.

Tsinghua Unigroup defaulted after its proposal to extend a repayment deadline failed to gain support from bondholders, sources said.

Tsinghua Unigroup’s credit rating was slashed to BBB from AA on Monday by China Chengxin International Credit Rating Co. The rating agency said the event could trigger cross-defaults, potentially strangling its funding and squeezing its liquidity.

RELATED COVERAGE

Factbox: China state enterprises facing debt problems

The company could not be immediately reached for comment.

Tsinghua Unigroup’s default follows other state borrowers, including coal miner Yongcheng Coal & Electricity Holding Group and automaker Huachen Automotive Group, which have failed to service debts on time, triggering a sell-off in some corners of the corporate bond market.

Even before the default, Tsinghua Unigroup’s bond prices had already plunged after the company said it would not exercise its option to redeem a perpetual bond.

On Tuesday, the price on a corporate bond issued by Unigroup’s parent, Tsinghua Holdings, tumbled more than 14%, making it the worst performing bond on the Shanghai Stock Exchange.

China's Tsinghua Unigroup defaults on $198 million bond: sources

Tsinghua Unigroup, a major government-backed player in China's technology race, has defaulted on a 1.3-billion-yuan ($197.96 million) bond, three sources said, as several high-profile delinquencies by state firms rattled the country's bond market.