Foreign companies (e.g., Samsung, SK Hynix, TSMC, etc.) are expected continue to comprise more than 50% of IC production in China through 2026

IC Insights’ 112-page May 2Q Update to The McClean Report 2022 is now available for subscribers to download. It includes a current outlook for the 2022 global economy, detailed market, unit shipment, and ASP forecasts for IC and O-S-D products through 2026, 2021 semiconductor supplier rankings by product type, the 1Q22 top-25 semiconductor supplier ranking, an analysis of the IC market by region with additional focus on the China market, semiconductor R&D spending trends, and an overview of various government-sponsored investment programs targeting the semiconductor industry.

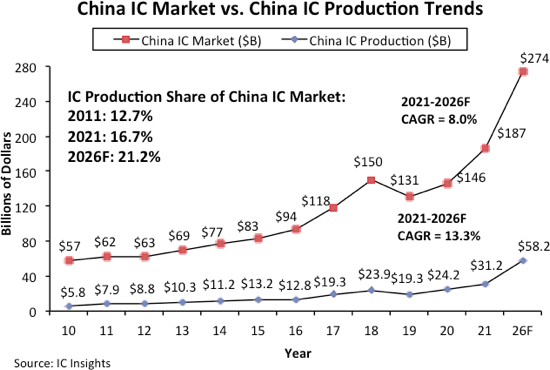

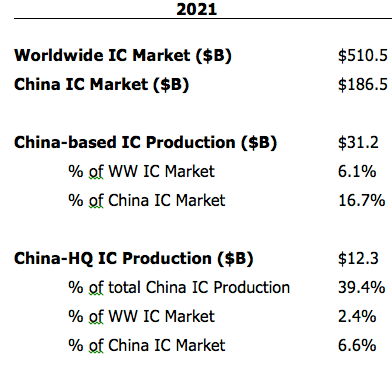

A very clear distinction should be made between China’s IC market and China’s indigenous IC production. IC Insights has often stated that although China has been the largest consuming country for ICs since 2005, it does not necessarily mean that large increases in IC production within China would immediately follow, or ever follow. As shown in Figure 1, IC production in China represented 16.7% of its $186.5 billion IC market in 2021, up from 12.7% 10 years earlier in 2011. Moreover, IC Insights forecasts that this share will increase by 4.5 percentage points from 2021 to 21.2% in 2026 (a 0.9 percentage point per-year gain on average).

Of the $31.2 billion worth of ICs manufactured in China last year, China-headquartered companies produced $12.3 billion (39.4%), accounting for only 6.6% of the country’s $186.5 billion IC market. TSMC, SK Hynix, Samsung, Intel, UMC, and other foreign companies that have IC wafer fabs located in China produced the rest. IC Insights estimates that of the $12.3 billion in ICs manufactured by China-based companies, about $2.7 billion was from IDMs and $9.6 billion was from pure-play foundries like SMIC.

If China-based IC manufacturing rises to $58.2 billion in 2026 as IC Insights forecasts, China-based IC production would still represent only 8.1% of the total forecasted 2026 worldwide IC market of $717.7 billion. Even after adding a significant markup to some of the Chinese producers’ IC sales (many Chinese IC producers are foundries that sell their ICs to companies that re-sell these products to the electronic system producers), China-based IC production would still likely represent only about 10% of the global IC market in 2026.

Figure 1

Report Details: The 2022 McClean Report

The McClean Report—A Complete Analysis and Forecast of the Semiconductor Industry, is now available. A subscription to The McClean Report service includes the January Semiconductor Industry Flash Report, which provides clients with IC Insights’ initial overview and forecast of the semiconductor industry for this year through 2026. In addition, the second of four Quarterly Updates to the report was released in May, with additional Quarterly Updates to be released in August and November of this year. An individual user license to the 2022 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2022.

PDF Version of This Bulletin

A PDF version of this Research Bulletin can be downloaded from our website at https://www.icinsights.com/news/bulletins/

IC Insights’ 112-page May 2Q Update to The McClean Report 2022 is now available for subscribers to download. It includes a current outlook for the 2022 global economy, detailed market, unit shipment, and ASP forecasts for IC and O-S-D products through 2026, 2021 semiconductor supplier rankings by product type, the 1Q22 top-25 semiconductor supplier ranking, an analysis of the IC market by region with additional focus on the China market, semiconductor R&D spending trends, and an overview of various government-sponsored investment programs targeting the semiconductor industry.

A very clear distinction should be made between China’s IC market and China’s indigenous IC production. IC Insights has often stated that although China has been the largest consuming country for ICs since 2005, it does not necessarily mean that large increases in IC production within China would immediately follow, or ever follow. As shown in Figure 1, IC production in China represented 16.7% of its $186.5 billion IC market in 2021, up from 12.7% 10 years earlier in 2011. Moreover, IC Insights forecasts that this share will increase by 4.5 percentage points from 2021 to 21.2% in 2026 (a 0.9 percentage point per-year gain on average).

Of the $31.2 billion worth of ICs manufactured in China last year, China-headquartered companies produced $12.3 billion (39.4%), accounting for only 6.6% of the country’s $186.5 billion IC market. TSMC, SK Hynix, Samsung, Intel, UMC, and other foreign companies that have IC wafer fabs located in China produced the rest. IC Insights estimates that of the $12.3 billion in ICs manufactured by China-based companies, about $2.7 billion was from IDMs and $9.6 billion was from pure-play foundries like SMIC.

If China-based IC manufacturing rises to $58.2 billion in 2026 as IC Insights forecasts, China-based IC production would still represent only 8.1% of the total forecasted 2026 worldwide IC market of $717.7 billion. Even after adding a significant markup to some of the Chinese producers’ IC sales (many Chinese IC producers are foundries that sell their ICs to companies that re-sell these products to the electronic system producers), China-based IC production would still likely represent only about 10% of the global IC market in 2026.

Figure 1

Report Details: The 2022 McClean Report

The McClean Report—A Complete Analysis and Forecast of the Semiconductor Industry, is now available. A subscription to The McClean Report service includes the January Semiconductor Industry Flash Report, which provides clients with IC Insights’ initial overview and forecast of the semiconductor industry for this year through 2026. In addition, the second of four Quarterly Updates to the report was released in May, with additional Quarterly Updates to be released in August and November of this year. An individual user license to the 2022 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2022.

PDF Version of This Bulletin

A PDF version of this Research Bulletin can be downloaded from our website at https://www.icinsights.com/news/bulletins/