NAND flash, DRAM, computer CPU, and embedded MPUs show improvement for 2020, but consumers and businesses moving cautiously forward with system purchases.

IC Insights recently released its Mid-Year Update to The McClean Report 2020. The update includes IC Insights’ ranking of revenue growth rates for the 33 IC product categories defined by the World Semiconductor Trade Statistics (WSTS) organization.

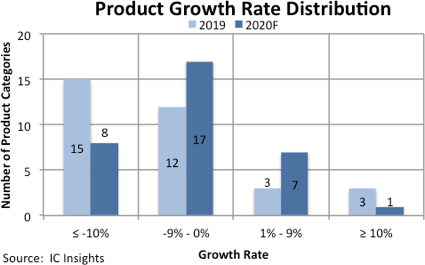

Figure 1 shows the distribution of growth rates for the 33 IC product categories in 2019 and IC Insights’ forecast for 2020. Growth rates across most IC segments are expected to improve this year, but not greatly. Eight product categories, led by NAND flash with an expected market increase of 27%, are forecast to see sales gains this year. In 2019, only six IC product categories experienced sales growth. Five product categories are forecast to expand at or above the total IC market growth rate of 3% this year, including both NAND flash and DRAM, which were the two worst growth segments in 2019.

Figure 1

Figure 1

The list of 33 major IC product categories ranked by forecasted sales growth in 2020 is shown in Figure 2. The list shows the impact that Covid-19 is having across the entire IC industry this year. With consumers and businesses delaying or moving cautiously forward with system purchases, forecast sales for most IC segments have been scaled down. It remains to be seen if and how quickly typical buying patterns will resume. The July-September quarter of each year is usually the strongest for IC sales growth, but even a solid rebound in demand may not be enough to raise IC sales growth much beyond the forecast levels shown.

Figure 2

Report Details: The 2020 McClean Report

Additional details on semiconductor and IC market trends are provided in the Mid-Year Update to The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Report includes free monthly updates from March through November (including the Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual user license to the 2020 edition of The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

PDF Version of This Bulletin

A PDF version of this Research Bulletin can be downloaded from our website at http://www.icinsights.com/news/bulletins/

IC Insights recently released its Mid-Year Update to The McClean Report 2020. The update includes IC Insights’ ranking of revenue growth rates for the 33 IC product categories defined by the World Semiconductor Trade Statistics (WSTS) organization.

Figure 1 shows the distribution of growth rates for the 33 IC product categories in 2019 and IC Insights’ forecast for 2020. Growth rates across most IC segments are expected to improve this year, but not greatly. Eight product categories, led by NAND flash with an expected market increase of 27%, are forecast to see sales gains this year. In 2019, only six IC product categories experienced sales growth. Five product categories are forecast to expand at or above the total IC market growth rate of 3% this year, including both NAND flash and DRAM, which were the two worst growth segments in 2019.

The list of 33 major IC product categories ranked by forecasted sales growth in 2020 is shown in Figure 2. The list shows the impact that Covid-19 is having across the entire IC industry this year. With consumers and businesses delaying or moving cautiously forward with system purchases, forecast sales for most IC segments have been scaled down. It remains to be seen if and how quickly typical buying patterns will resume. The July-September quarter of each year is usually the strongest for IC sales growth, but even a solid rebound in demand may not be enough to raise IC sales growth much beyond the forecast levels shown.

Figure 2

Report Details: The 2020 McClean Report

Additional details on semiconductor and IC market trends are provided in the Mid-Year Update to The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Report includes free monthly updates from March through November (including the Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual user license to the 2020 edition of The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

PDF Version of This Bulletin

A PDF version of this Research Bulletin can be downloaded from our website at http://www.icinsights.com/news/bulletins/