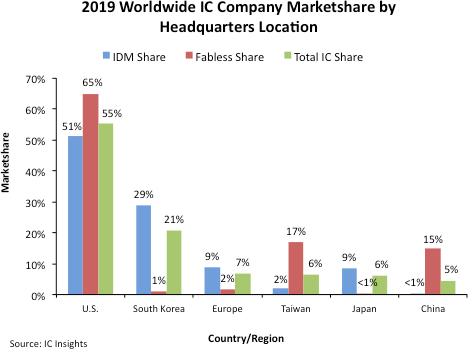

U.S. IC Companies Maintain Global Marketshare Lead Propelled by 51% share of IDM sales and 65% share of fabless sales, U.S. companies captured 55% of the total worldwide IC market in 2019

Regional marketshares of IDMs (companies operating wafer fabs), fabless companies, and total IC sales were led by U.S. headquartered companies in 2019, according to data presented in the recently released March Update to The McClean Report 2020.

Figure 1 shows U.S. companies held 55% of the total worldwide IC market in 2019 followed by the South Korean companies with a 21% share, down six percentage points from 2018. Taiwanese companies, on the strength of their fabless company IC sales, held 6% of total IC sales, one point less than the European companies.

Figure 1

South Korean and Japanese companies have an extremely weak presence in the fabless IC segment and the Taiwanese and Chinese companies have a noticeably low share of the IDM portion of the IC market. Overall, U.S.-headquartered companies showed the most balance with regard to IDM, fabless, and total IC industry marketshare.

Driven by a collapse in DRAM and NAND flash memory IC sales in 2019, the South Korean-headquartered companies, primarily Samsung and SK Hynix, registered a 32% sales drop, the worst of any major country/region (Figure 2). Interestingly, the South Korean companies logged the largest increase in sales in 2018 at 26%. However, with the memory market expected to show a rebound in 2020, it would not be surprising to see the South Korean companies go from “first to worst” regarding IC sales growth by company headquarters location this year as compared to last year. The Chinese, European, Taiwanese, and U.S. companies declined at a lesser rate than the total IC industry (-15%) last year.

Figure 2

Report Details: The McClean Report 2020

Additional details on IC market trends are provided in the 2020 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Report includes free monthly updates from March through November (including the 200+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual user license to The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

A PDF version of this Research Bulletin can be downloaded from our website at http://www.icinsights.com/news/bulletins/

IC Insights, Inc. is a leading semiconductor market research company headquartered in Scottsdale, Arizona, USA. Founded in 1997, IC Insights offers complete analysis of the integrated circuit (IC), optoelectronic, sensor/actuator, and discrete semiconductor markets with coverage including current business, economic, and technology trends, top supplier rankings, capital spending and wafer capacity trends, the impact of new semiconductor products on the market, and other relevant semiconductor industry information.

IC Insights brings over 170 years of combined semiconductor market research experience and expertise to the forefront with its products and services. The company is highly regarded in the industry for its understanding of market dynamics and technology trends, its forecast accuracy, and its attention to maintaining excellent customer relationships. IC Insights is frequently called upon to speak and present its ideas on market trends at conferences and seminars around the world.

IC Insights is the semiconductor industry's most respected market research firm!

Regional marketshares of IDMs (companies operating wafer fabs), fabless companies, and total IC sales were led by U.S. headquartered companies in 2019, according to data presented in the recently released March Update to The McClean Report 2020.

Figure 1 shows U.S. companies held 55% of the total worldwide IC market in 2019 followed by the South Korean companies with a 21% share, down six percentage points from 2018. Taiwanese companies, on the strength of their fabless company IC sales, held 6% of total IC sales, one point less than the European companies.

Figure 1

South Korean and Japanese companies have an extremely weak presence in the fabless IC segment and the Taiwanese and Chinese companies have a noticeably low share of the IDM portion of the IC market. Overall, U.S.-headquartered companies showed the most balance with regard to IDM, fabless, and total IC industry marketshare.

Driven by a collapse in DRAM and NAND flash memory IC sales in 2019, the South Korean-headquartered companies, primarily Samsung and SK Hynix, registered a 32% sales drop, the worst of any major country/region (Figure 2). Interestingly, the South Korean companies logged the largest increase in sales in 2018 at 26%. However, with the memory market expected to show a rebound in 2020, it would not be surprising to see the South Korean companies go from “first to worst” regarding IC sales growth by company headquarters location this year as compared to last year. The Chinese, European, Taiwanese, and U.S. companies declined at a lesser rate than the total IC industry (-15%) last year.

Figure 2

Report Details: The McClean Report 2020

Additional details on IC market trends are provided in the 2020 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Report includes free monthly updates from March through November (including the 200+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual user license to The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

A PDF version of this Research Bulletin can be downloaded from our website at http://www.icinsights.com/news/bulletins/

IC Insights, Inc. is a leading semiconductor market research company headquartered in Scottsdale, Arizona, USA. Founded in 1997, IC Insights offers complete analysis of the integrated circuit (IC), optoelectronic, sensor/actuator, and discrete semiconductor markets with coverage including current business, economic, and technology trends, top supplier rankings, capital spending and wafer capacity trends, the impact of new semiconductor products on the market, and other relevant semiconductor industry information.

IC Insights brings over 170 years of combined semiconductor market research experience and expertise to the forefront with its products and services. The company is highly regarded in the industry for its understanding of market dynamics and technology trends, its forecast accuracy, and its attention to maintaining excellent customer relationships. IC Insights is frequently called upon to speak and present its ideas on market trends at conferences and seminars around the world.

IC Insights is the semiconductor industry's most respected market research firm!