Wow, amazing start of 2022 for TSMC. A record setting quarter leading to a record setting year, absolutely. Just wait until N3 kicks in!

TSMC Reports First Quarter EPS of NT$7.82 HSINCHU, Taiwan, R.O.C., Apr. 14, 2022 -- TSMC (TWSE: 2330, NYSE: TSM) today announced consolidated revenue of NT$491.08 billion, net income of NT$202.73 billion, and diluted earnings per share of NT$7.82 (US$1.40 per ADR unit) for the first quarter ended March 31, 2022. Year-over-year, first quarter revenue increased 35.5% while net income and diluted EPS both increased 45.1%. Compared to fourth quarter 2021, first quarter results represented a 12.1% increase in revenue and a 22.0% increase in net income.

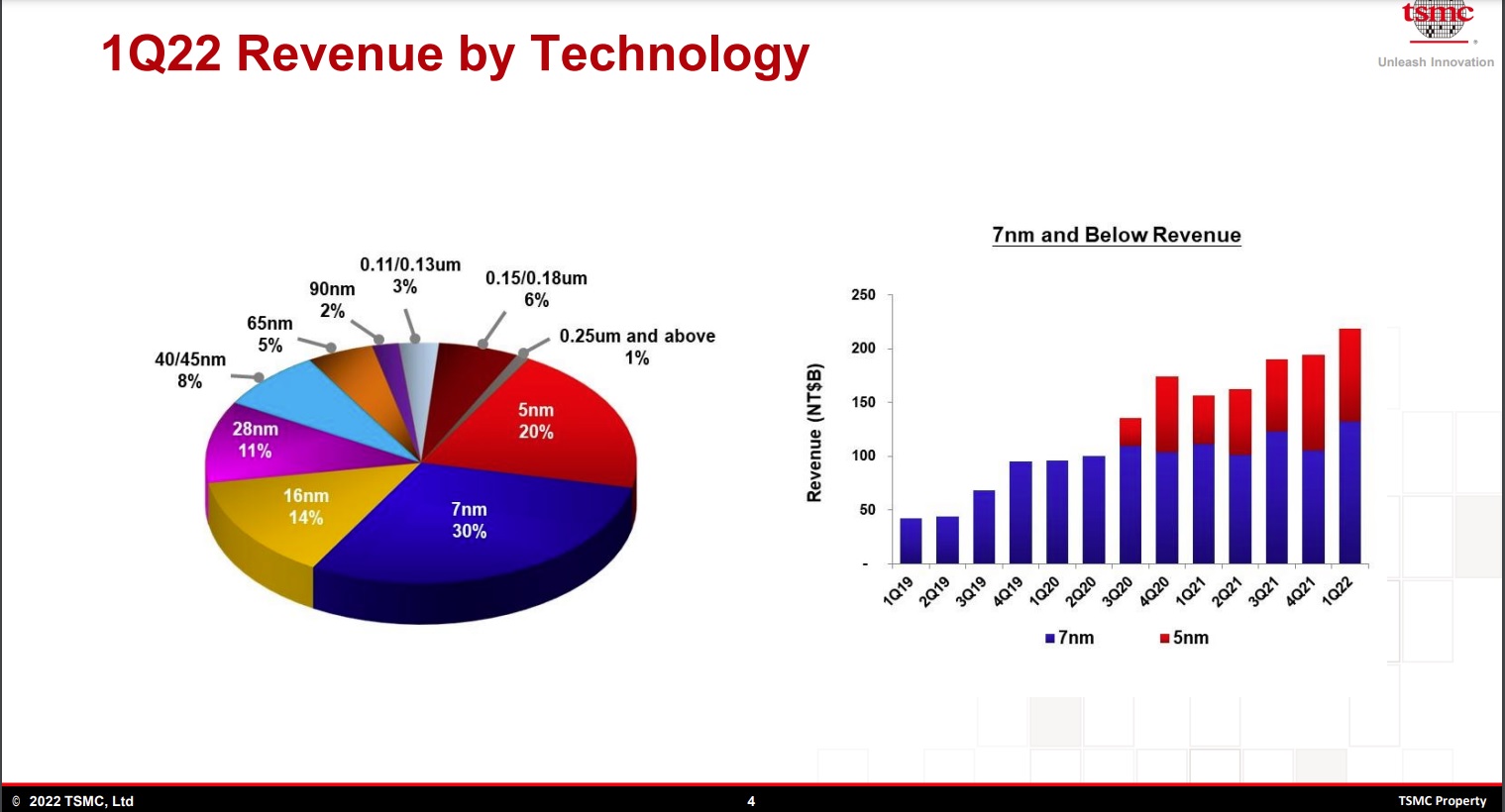

All figures were prepared in accordance with TIFRS on a consolidated basis. In US dollars, first quarter revenue was $17.57 billion, which increased 36.0% year-over-year and increased 11.6% from the previous quarter. Gross margin for the quarter was 55.6%, operating margin was 45.6%, and net profit margin was 41.3%. In the first quarter, shipments of 5-nanometer accounted for 20% of total wafer revenue; 7- nanometer accounted for 30%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 50% of total wafer revenue.

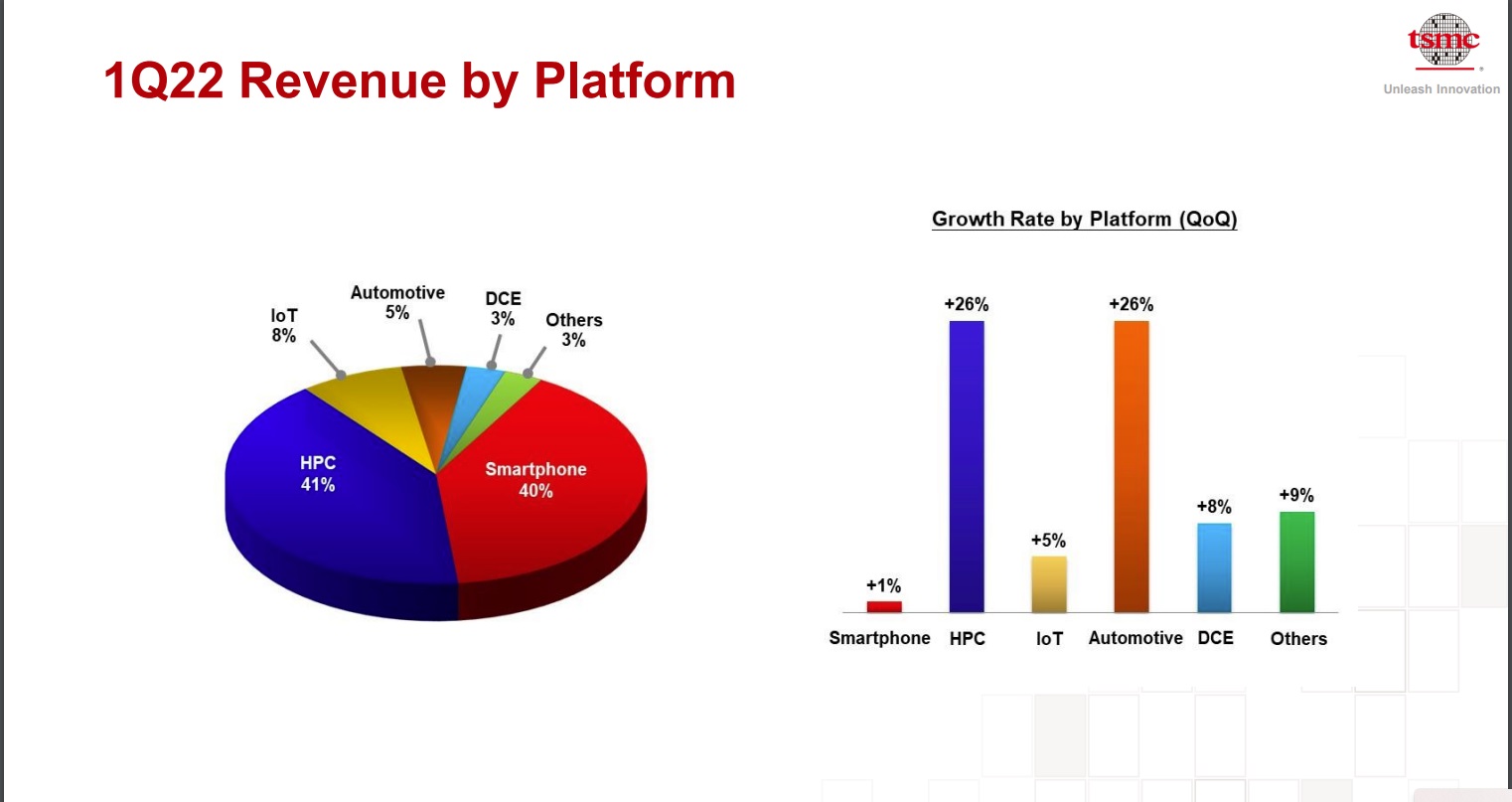

“Our first quarter business was supported by strong HPC and Automotive-related demand,” said Wendell Huang, VP and Chief Financial Officer of TSMC. “Moving into second quarter 2022, we expect our business to continue to be supported by HPC and Automotive-related demand, partially offset by smartphone seasonality.”

Based on the Company’s current business outlook, management expects the overall performance for second quarter 2022 to be as follows:

◼ Revenue to be between US$ 17.6 billion and US$ 18.2 billion

Based on our current business outlook, management expects: And, based on the exchange rate assumption of 1 US dollar to 28.8 NT dollars, management expects:

◼ Gross profit margin to be between 56% and 58%

◼ Operating profit margin to be between 45% and 47%

TSMC Reports First Quarter EPS of NT$7.82 HSINCHU, Taiwan, R.O.C., Apr. 14, 2022 -- TSMC (TWSE: 2330, NYSE: TSM) today announced consolidated revenue of NT$491.08 billion, net income of NT$202.73 billion, and diluted earnings per share of NT$7.82 (US$1.40 per ADR unit) for the first quarter ended March 31, 2022. Year-over-year, first quarter revenue increased 35.5% while net income and diluted EPS both increased 45.1%. Compared to fourth quarter 2021, first quarter results represented a 12.1% increase in revenue and a 22.0% increase in net income.

All figures were prepared in accordance with TIFRS on a consolidated basis. In US dollars, first quarter revenue was $17.57 billion, which increased 36.0% year-over-year and increased 11.6% from the previous quarter. Gross margin for the quarter was 55.6%, operating margin was 45.6%, and net profit margin was 41.3%. In the first quarter, shipments of 5-nanometer accounted for 20% of total wafer revenue; 7- nanometer accounted for 30%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 50% of total wafer revenue.

“Our first quarter business was supported by strong HPC and Automotive-related demand,” said Wendell Huang, VP and Chief Financial Officer of TSMC. “Moving into second quarter 2022, we expect our business to continue to be supported by HPC and Automotive-related demand, partially offset by smartphone seasonality.”

Based on the Company’s current business outlook, management expects the overall performance for second quarter 2022 to be as follows:

◼ Revenue to be between US$ 17.6 billion and US$ 18.2 billion

Based on our current business outlook, management expects: And, based on the exchange rate assumption of 1 US dollar to 28.8 NT dollars, management expects:

◼ Gross profit margin to be between 56% and 58%

◼ Operating profit margin to be between 45% and 47%